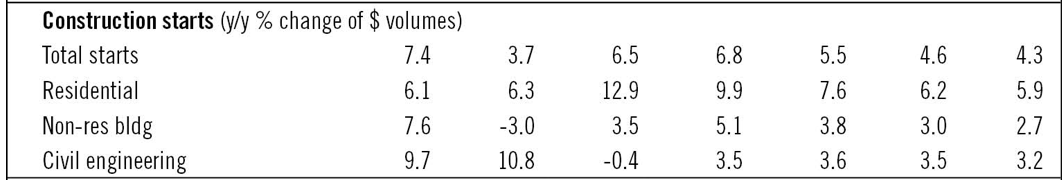

The value of construction starts will increase by 6.5% in 2016 to $562 billion, according to the latest projections from CMD Group and Oxford Economics. And the nonresidential building portion of that total is expected to rebound from its decline in 2015 and show single-digit growth this year.

CMD/Oxford estimates that the dollar volume of nonresidential building (which was off by 3% in 2015) will increase by 3.5% to $193 billion this year. That compares to the 12.9% gain, to $247 billion, that CMD/Oxford anticipates for residential building, and the 0.4% decline, to $122 billion, for engineering/civil construction.

The country’s GDP is expected to inch up by 2.4% this year.

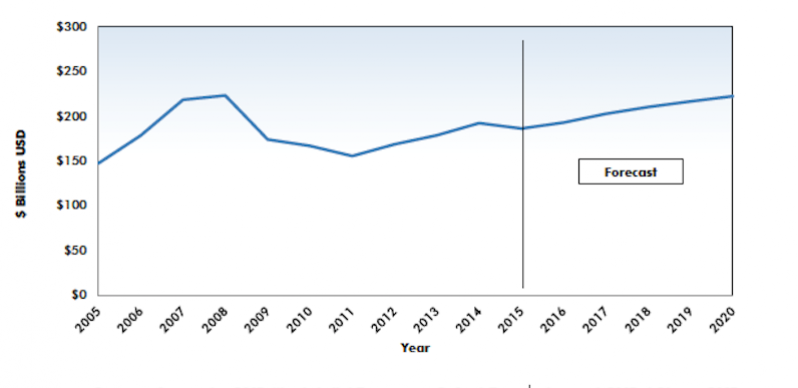

CMD/Oxford expects nonresidential building to rise to by 5.1% to $203 billion in 2017, and to hit $222.7 billion by 2020.

After a down year in 2015, nonresidential building is expected to ease upward this year, driven by low umemployment, borrowing costs, and output trends in relevant sectors. Chart: CMD Group

After a down year in 2015, nonresidential building is expected to ease upward this year, driven by low umemployment, borrowing costs, and output trends in relevant sectors. Chart: CMD Group

The short-term drivers of nonresidential building are expected to include the country’s unemployment rate, which CMD/Oxford forecasts will fall to 4.8% this year. Other variables that should contribute to the growth of nonres building are population trends (CMD/Oxford estimates another year of 0.8% growth), improvements in the outputs in certain sectors, and the still-low cost of borrowing money for construciton and investment.

Alex Carrick, CMD’s chief economist, notes that the depreciation of the U.S. dollar is likely to “blunt” industrial starts. On the other hand, increased state and federal spending on infrastructure projects and an improved investment outlook are expected to bolster the values of nonresidential building.

Broken down by sector, CMD/Oxford sees the value of construction for retail and offices easing upward from this year through 2020. Hotel/motel building will be essentially flat. Manufacturing could take a sharp dip this year, and then recover over the proceeding four years. Warehouse construction will be down slightly in 2016, but bounce back in the out years. Medical starts, which are expected to increase by 8.6% in 2016, will then settle around 5% annual growth from 2017 to 2020, as they ride the crest of an aging population.

CMD/Oxford also breaks down nonresidential building by that industry’s four largest states. Texas will be slightly down in 2016 and then flatten with modest increases over the next few years. After a decline in 2015, California’s nonres construction value will move upward, with a particularly strong rise expected for 2020. New York, which was also down in 2015, should see gains, whereas Florida should enjoy about a $1.5 billion jump in values in 2016, and then level off a bit.

Medical building should be one of the bright spots for nonresidential builidng, which is expected to stay positive over the next five years. Chart: CMD Group

Related Stories

Market Data | Sep 14, 2020

6 must reads for the AEC industry today: September 14, 2020

63% of New York's restaurants could be gone by 2021 and new weapons in the apartment amenities arms race.

Market Data | Sep 11, 2020

5 must reads for the AEC industry today: September 11, 2020

Des Moines University begins construction on new campus and the role of urgent care in easing the oncology journey.

Market Data | Sep 10, 2020

6 must reads for the AEC industry today: September 10, 2020

Taipei's new Performance Hall and Burger King's touchless restaurant designs.

Market Data | Sep 9, 2020

6 must reads for the AEC industry today: September 9, 2020

What will the 'new normal' look like and the AIA hands out its Twenty-five Year Award.

Market Data | Sep 8, 2020

‘New normal’: IAQ, touchless, and higher energy bills?

Not since 9/11 has a single event so severely rocked the foundation of the commercial building industry.

Market Data | Sep 8, 2020

7 must reads for the AEC industry today: September 8, 2020

Google proposes 40-acre redevelopment plan and office buildings should be an essential part of their communities.

Market Data | Sep 4, 2020

6 must reads for the AEC industry today: September 4, 2020

10 Design to redevelop Nanjing AIrport and TUrner Construction takes a stand against racism.

Market Data | Sep 4, 2020

Construction sector adds 16,000 workers in August but nonresidential jobs shrink

Association survey finds contractor pessimism is increasing.

Market Data | Sep 3, 2020

6 must reads for the AEC industry today: September 3, 2020

New affordable housing comes to the Bronx and California releases guide for state water policy.

Market Data | Sep 2, 2020

Coronavirus has caused significant construction project delays and cancellations

Yet demand for skilled labor is high, new survey finds.