All key construction measures for multifamily housing rose by double-digit percentages in 2015, and demand for rentals (which continue to account for the lion’s share of that construction) is expected to remain robust over the next decade, according to “The State of the Nation’s Housing Market 2016,” which the Joint Center for Housing Studies at Harvard University released today.

That’s good news and bad news for renters, as vacancy rates continue to fall and rents continue to rise.

Growth in multifamily starts topped 10% for the fifth consecutive year in 2015, reaching a 27-year high of 397,300 units. Multifamily accounted for more than 30% of all housing starts last year, and permits—the barometer of future construction—rose 18.2% to 486,600 units.

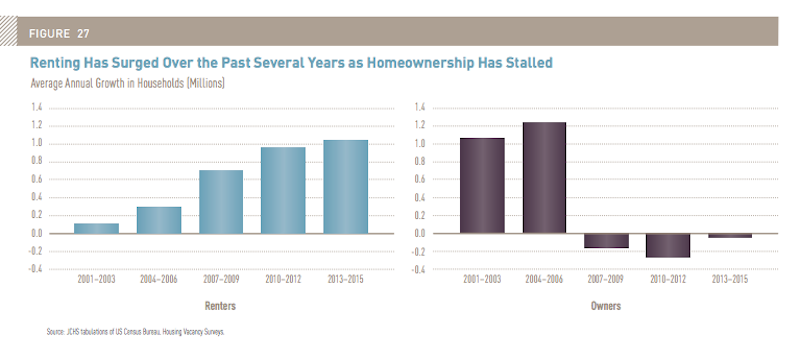

More than 36% of all U.S. households opted to rent last year, the largest share since the late 1960s. Over the past decade, in fact, the number of renters increased by over nine million, the largest 10-year gain on record, with palpable demand across all age groups, income levels, and household types.

The number of renters increased by 9 million in the past decade, the largest 10-year gain on record. Image: Joint Center for Housing Studies' “The State of the Nation's Housing Market”

Somewhat counter-intuitively, given all the press about Millennials not being able to afford to buy a house, Current Population Survey data indicate that much of the jump in rental demand is coming from middle-aged households. Renters in their 50s and 60s rose by 4.3 million between 2005 and 2015. Renters aged 70 or older increased by more than 600,000 during that decade. And even though their cohort’s population actually dipped a bit, households in their 30s and 40s accounted for three million net new renters.

Households under age 30, by comparison, made up only one million net new renters. “reflecting the steep falloff in headship rates among the Millennial generation following the Great Recession,” according to the Harvard report.

The micro-apartment trend for urban markets seems to be having a greater impact on what’s being built overall. The median size of multifamily units fell from nearly 1,200 sf at the 2007 peak to 1,074 sf in 2015, reflecting the shift in the focus of development from the owner to the rental market.

Many new multifamily units are in large structures, with nearly half of the units completed in 2014 in buildings with 50 or more apartments. And about 36 percent of all new multifamily units added between 2000 and 2014 were in high-density neighborhoods, and another 30 percent each in medium- and low-density sections of metro areas. Even so, growth in the multifamily housing stock during this period was even more rapid in rural areas (up 24 percent) than in urban areas (up 19 percent).

The Joint Center has long decried the scarcity of affordable housing in the U.S. A sizable percentage of the multifamily buildings under construction targets higher-end and luxury renters. In addition, the rental vacancy rate last year fell to a 30-year low of 7.1%, a telling indication that supply isn’t keeping up with demand, and that rent appreciation is likely to present challenges for renters at all income levels.

Still, the report postulates that expanding construction of market-rate multifamily product “should provide some slack to tight markets, as older units slowly filter down from higher to lower rents.” And if construction sates high-end demand, “developers in some areas may turn their attention to middle-market rentals,” the report speculates.

The report acknowledges, however, that high development costs make building new units of affordable or even moderate-income multifamily difficult without government subsidies. And absent of public subsidies, “the cost of a typical market-rate rental unit will remain out of reach for the nation’s lowest-income households.”

The Joint Center concludes that with housing assistance insufficient to help most of those in need, “the limited supply of low-cost units promises to keep the pressure on all renters at the lower end of the income scale.”

It’s still not certain how these dynamics will impact homeownership, even when buying is still more affordable than renting in 58% of U.S. markets, according to RealtyTrac’s 2016 Rental Affordability Analysis.

“Renters in 2016 will be caught between a bit of a rock and a hard place, with rents becoming less affordable as they rise faster than wages, but home prices rising even faster than rents,” said Daren Blomquist, Vice President at RealtyTrac. “In markets where home prices are still relatively affordable, 2016 may be a good time for some renters to take the plunge into homeownership before rising prices and possibly rising interest rates make it increasingly tougher to afford to buy a home.”

Related Stories

MFPRO+ News | Jun 20, 2024

National multifamily outlook: Summer 2024

The multifamily sector continues to be strong in 2024, even when a handful of challenges are present. That is according to the Matrix Multifamily National Report for Summer 2024.

Multifamily Housing | Jun 17, 2024

Elevating multifamily properties through quiet luxury

As the demands of urban living continue to evolve, the need for a tranquil and refined home environment has never been more pronounced.

Multifamily Housing | Jun 14, 2024

AEC inspections are the key to financially viable office to residential adaptive reuse projects

About a year ago our industry was abuzz with an idea that seemed like a one-shot miracle cure for both the shockingly high rate of office vacancies and the worsening housing shortage. The seemingly simple idea of converting empty office buildings to multifamily residential seemed like an easy and elegant solution. However, in the intervening months we’ve seen only a handful of these conversions, despite near universal enthusiasm for the concept.

Adaptive Reuse | Jun 13, 2024

4 ways to transform old buildings into modern assets

As cities grow, their office inventories remain largely stagnant. Yet despite changes to the market—including the impact of hybrid work—opportunities still exist. Enter: “Midlife Metamorphosis.”

Affordable Housing | Jun 12, 2024

Studio Libeskind designs 190 affordable housing apartments for seniors

In Brooklyn, New York, the recently opened Atrium at Sumner offers 132,418 sf of affordable housing for seniors. The $132 million project includes 190 apartments—132 of them available to senior households earning below or at 50% of the area median income and 57 units available to formerly homeless seniors.

MFPRO+ News | Jun 11, 2024

Rents rise in multifamily housing for May 2024

Multifamily rents rose for the fourth month in a row, according to the May 2024 National Multifamily Report. Up 0.6% year-over-year, the average U.S. asking rent increased by $6 in May, up to $1,733.

Apartments | Jun 4, 2024

Apartment sizes on the rise after decade-long shrinking trend

The average size of new apartments in the U.S. saw substantial growth in 2023, bouncing back to 916 sf after a steep decline the previous year. That is according to a recent RentCafe market insight report released this month.

Multifamily Housing | Jun 3, 2024

Grassroots groups becoming a force in housing advocacy

A growing movement of grassroots organizing to support new housing construction is having an impact in city halls across the country. Fed up with high housing costs and the commonly hostile reception to new housing proposals, advocacy groups have sprung up in many communities to attend public meetings to speak in support of developments.

MFPRO+ News | Jun 3, 2024

New York’s office to residential conversion program draws interest from 64 owners

New York City’s Office Conversion Accelerator Program has been contacted by the owners of 64 commercial buildings interested in converting their properties to residential use.

MFPRO+ News | Jun 3, 2024

Seattle mayor wants to scale back energy code to spur more housing construction

Seattle’s mayor recently proposed that the city scale back a scheduled revamping of its building energy code to help boost housing production. The proposal would halt an update to the city’s multifamily and commercial building energy code that is scheduled to take effect later this year.