Commercial real estate brokers are optimistic about their industry’s growth prospects for 2019, according to a poll of brokers that Transwestern released last month. They are buoyed by strong consumer and business confidence, steady employment growth, and the anticipation of available debt and equity liquidity.

The survey explored the sentiments of brokerage professionals about three sectors: offices, medical offices, and industrial.

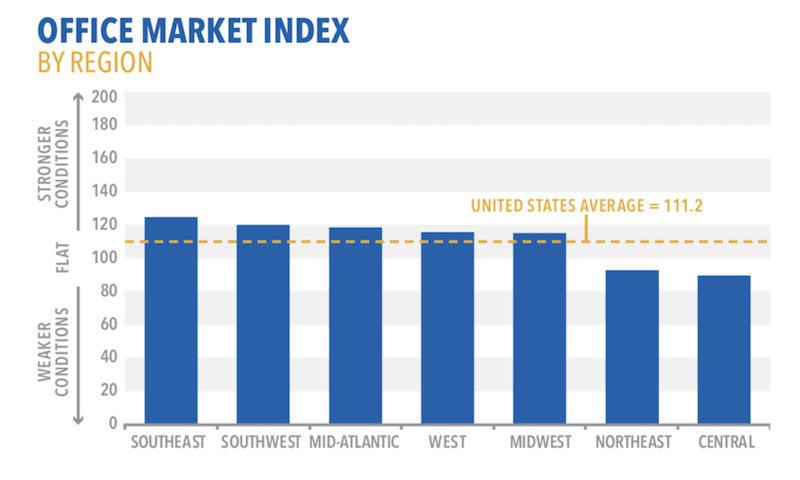

Over half of the 107 respondents, 52%, believe that leasing velocity, tenant walk throughs, and asking rents in the U.S. office market will be slightly to significantly higher in 2019. These factors will be driven primarily by continued economic expansion, lease expirations coming due, and rising interest rates.

Amenities continue to spur tenant interest, with access to transportation/parking and reliable WiFi service leading the “very important” list.

More than three quarters of respondents expect development levels to be flat or slightly higher in 2019, with select markets showing concern of oversupply and rising construction costs.

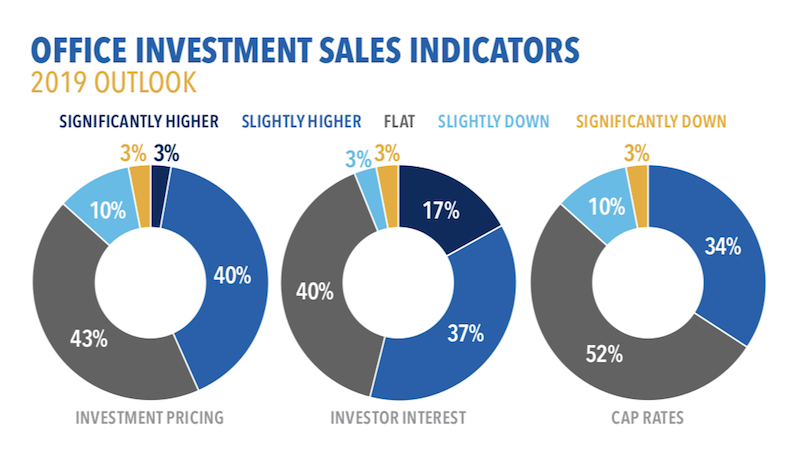

Most brokers foresee flat to modest growth for office pricing, investor interest and cap rates. Image: Transwestern

Nine of 10 respondents expect asking rents for medical offices to be slightly higher in 2019, driven by leasing activity. Demand is being driven by a growing and aging population. Cap rates in the medical office sector will be flat compared to 2018, predict 80% of respondents, with most also expecting investor interest to rise over the year.

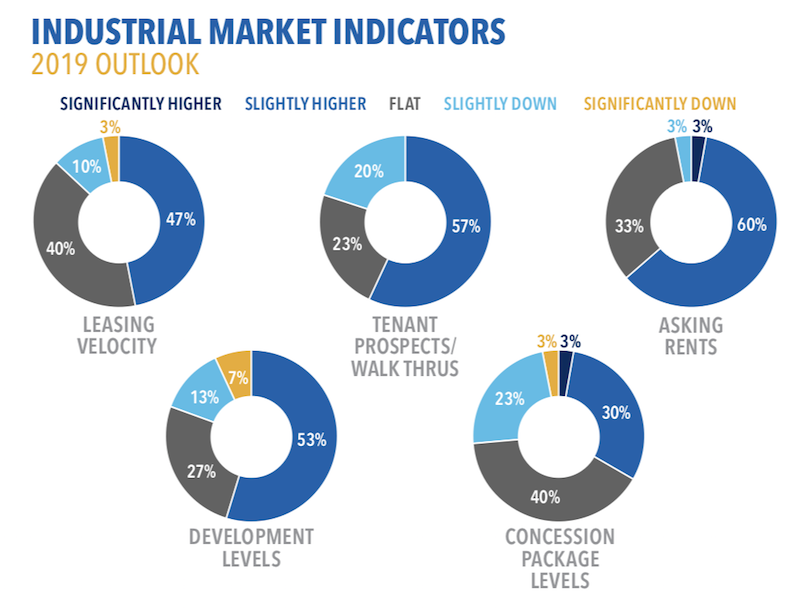

While the average index of 122.1 for the industrial sector’s prospects next year was down from 130.9 for last year’s outlook, respondents still expect tenant walk throughs, asking rents, and development to be higher for this sector, driven by ecommerce, a growing population demanding consumer goods, and better economic conditions.

Seventy-two percent of respondents expect higher investment interest in 2019, as the industrial market strengthens and select REITs shift focus away from office to industrial properties, especially in the Northeast and Mid-Atlantic regions.

Brokers expect an uptick next year, particularly in asking rents and tenant prospects, for the industrial sector. Image: Transwestern

Brokers expect an uptick next year, particularly in asking rents and tenant prospects, for the industrial sector. Image: Transwestern

Related Stories

Market Data | Oct 26, 2018

Nonresidential fixed investment returns to earth in Q3

Despite the broader economic growth, fixed investment inched 0.3% lower in the third quarter.

Market Data | Oct 24, 2018

Architecture firm billings slow but remain positive in September

Billings growth slows but is stable across sectors.

Market Data | Oct 19, 2018

New York’s five-year construction spending boom could be slowing over the next two years

Nonresidential building could still add more than 90 million sf through 2020.

Market Data | Oct 8, 2018

Global construction set to rise to US$12.9 trillion by 2022, driven by Asia Pacific, Africa and the Middle East

The pace of global construction growth is set to improve slightly to 3.7% between 2019 and 2020.

Market Data | Sep 25, 2018

Contractors remain upbeat in Q2, according to ABC’s latest Construction Confidence Index

More than three in four construction firms expect that sales will continue to rise over the next six months, while three in five expect higher profit margins.

Market Data | Sep 24, 2018

Hotel construction pipeline reaches record highs

There are 5,988 projects/1,133,017 rooms currently under construction worldwide.

Market Data | Sep 21, 2018

JLL fit out report portrays a hot but tenant-favorable office market

This year’s analysis draws from 2,800 projects.

Market Data | Sep 21, 2018

Mid-year forecast: No end in sight for growth cycle

The AIA Consensus Construction Forecast is projecting 4.7% growth in nonresidential construction spending in 2018.

Market Data | Sep 19, 2018

August architecture firm billings rebound as building investment spurt continues

Southern region, multifamily residential sector lead growth.

Market Data | Sep 18, 2018

Altus Group report reveals shifts in trade policy, technology, and financing are disrupting global real estate development industry

International trade uncertainty, widespread construction skills shortage creating perfect storm for escalating project costs; property development leaders split on potential impact of emerging technologies.