Commercial real estate brokers are optimistic about their industry’s growth prospects for 2019, according to a poll of brokers that Transwestern released last month. They are buoyed by strong consumer and business confidence, steady employment growth, and the anticipation of available debt and equity liquidity.

The survey explored the sentiments of brokerage professionals about three sectors: offices, medical offices, and industrial.

Over half of the 107 respondents, 52%, believe that leasing velocity, tenant walk throughs, and asking rents in the U.S. office market will be slightly to significantly higher in 2019. These factors will be driven primarily by continued economic expansion, lease expirations coming due, and rising interest rates.

Amenities continue to spur tenant interest, with access to transportation/parking and reliable WiFi service leading the “very important” list.

More than three quarters of respondents expect development levels to be flat or slightly higher in 2019, with select markets showing concern of oversupply and rising construction costs.

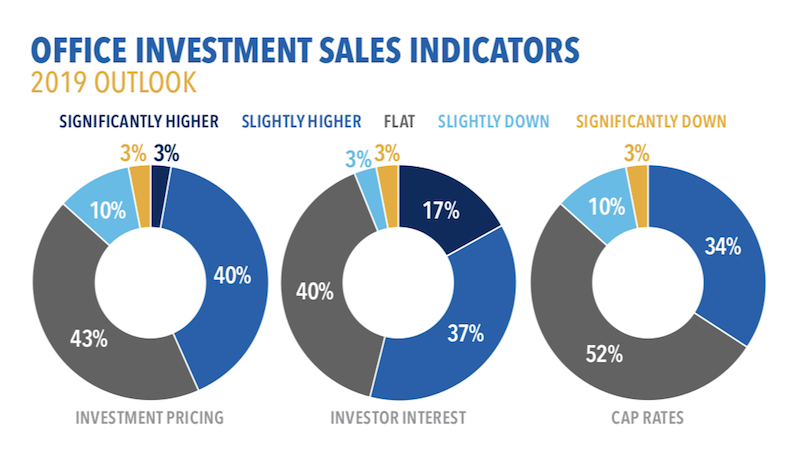

Most brokers foresee flat to modest growth for office pricing, investor interest and cap rates. Image: Transwestern

Nine of 10 respondents expect asking rents for medical offices to be slightly higher in 2019, driven by leasing activity. Demand is being driven by a growing and aging population. Cap rates in the medical office sector will be flat compared to 2018, predict 80% of respondents, with most also expecting investor interest to rise over the year.

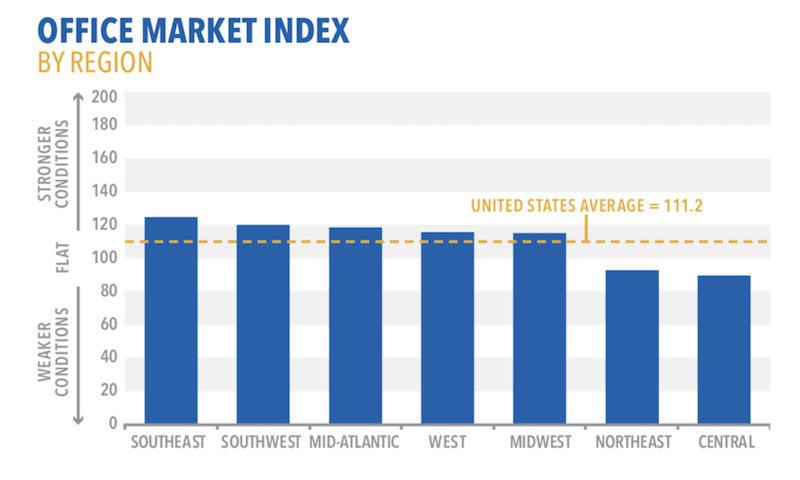

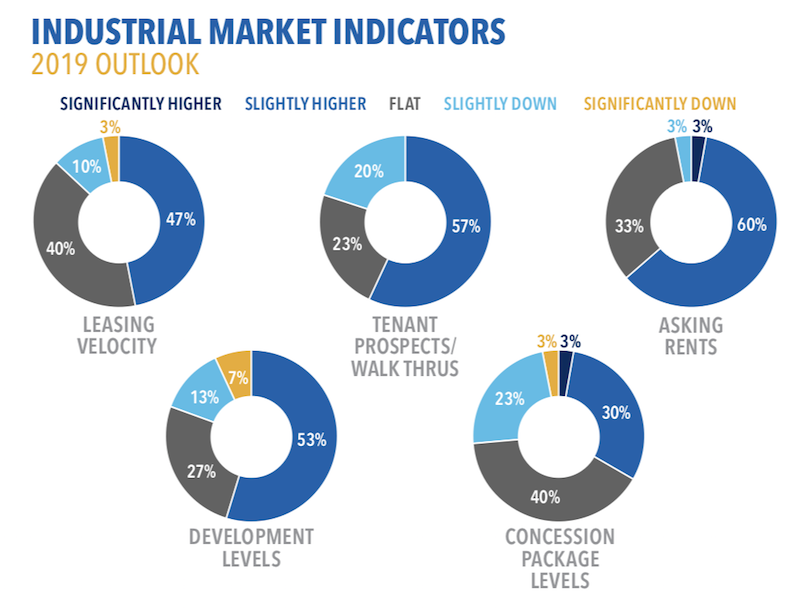

While the average index of 122.1 for the industrial sector’s prospects next year was down from 130.9 for last year’s outlook, respondents still expect tenant walk throughs, asking rents, and development to be higher for this sector, driven by ecommerce, a growing population demanding consumer goods, and better economic conditions.

Seventy-two percent of respondents expect higher investment interest in 2019, as the industrial market strengthens and select REITs shift focus away from office to industrial properties, especially in the Northeast and Mid-Atlantic regions.

Brokers expect an uptick next year, particularly in asking rents and tenant prospects, for the industrial sector. Image: Transwestern

Brokers expect an uptick next year, particularly in asking rents and tenant prospects, for the industrial sector. Image: Transwestern

Related Stories

Market Data | Sep 2, 2020

5 must reads for the AEC industry today: September 2, 2020

Precast concrete tower honors United AIrlines Flight 93 victims and public and private nonresidential construction spending slumps.

Market Data | Sep 2, 2020

Public and private nonresidential construction spending slumps in July

Industry employment declines from July 2019 in two-thirds of metros.

Market Data | Aug 31, 2020

5 must reads for the AEC industry today: August 31, 2020

The world's first LEED Platinum integrated campus and reopening campus performance arts centers.

Market Data | Aug 21, 2020

5 must reads for the AEC industry today: August 21, 2020

Student housing in the COVID-19 era and wariness of elevators may stymie office reopening.

Market Data | Aug 20, 2020

6 must reads for the AEC industry today: August 20, 2020

Japan takes on the public restroom and a look at the evolution of retail.

Market Data | Aug 19, 2020

6 must reads for the AEC industry today: August 19, 2020

July architectural billings remained stalled and Florida becomes third state to adopt concrete repair code.

Market Data | Aug 18, 2020

July architectural billings remained stalled

Clients showed reluctance to sign contracts for new design projects during July.

Market Data | Aug 18, 2020

Nonresidential construction industry won’t start growing again until next year’s third quarter

But labor and materials costs are already coming down, according to latest JLL report.

Market Data | Aug 18, 2020

6 must reads for the AEC industry today: August 18, 2020

The world's first AI-driven facade system and LA's Greek Theatre restoriation completes.

Market Data | Aug 17, 2020

5 must reads for the AEC industry today: August 17, 2020

5 strategies for creating safer hotel experiences and how to manage multifamily assets when residents no longer leave.