Commercial real estate brokers are optimistic about their industry’s growth prospects for 2019, according to a poll of brokers that Transwestern released last month. They are buoyed by strong consumer and business confidence, steady employment growth, and the anticipation of available debt and equity liquidity.

The survey explored the sentiments of brokerage professionals about three sectors: offices, medical offices, and industrial.

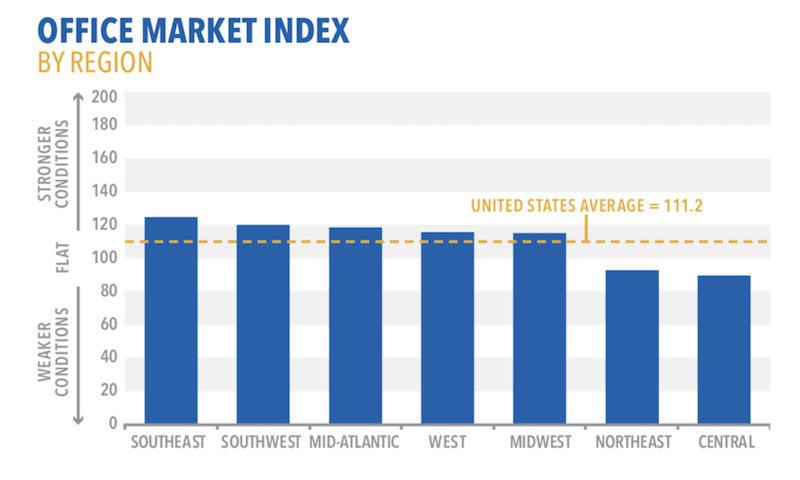

Over half of the 107 respondents, 52%, believe that leasing velocity, tenant walk throughs, and asking rents in the U.S. office market will be slightly to significantly higher in 2019. These factors will be driven primarily by continued economic expansion, lease expirations coming due, and rising interest rates.

Amenities continue to spur tenant interest, with access to transportation/parking and reliable WiFi service leading the “very important” list.

More than three quarters of respondents expect development levels to be flat or slightly higher in 2019, with select markets showing concern of oversupply and rising construction costs.

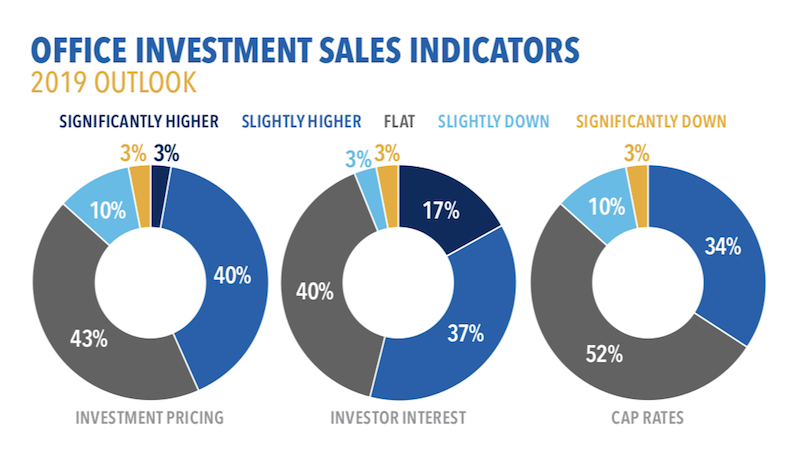

Most brokers foresee flat to modest growth for office pricing, investor interest and cap rates. Image: Transwestern

Nine of 10 respondents expect asking rents for medical offices to be slightly higher in 2019, driven by leasing activity. Demand is being driven by a growing and aging population. Cap rates in the medical office sector will be flat compared to 2018, predict 80% of respondents, with most also expecting investor interest to rise over the year.

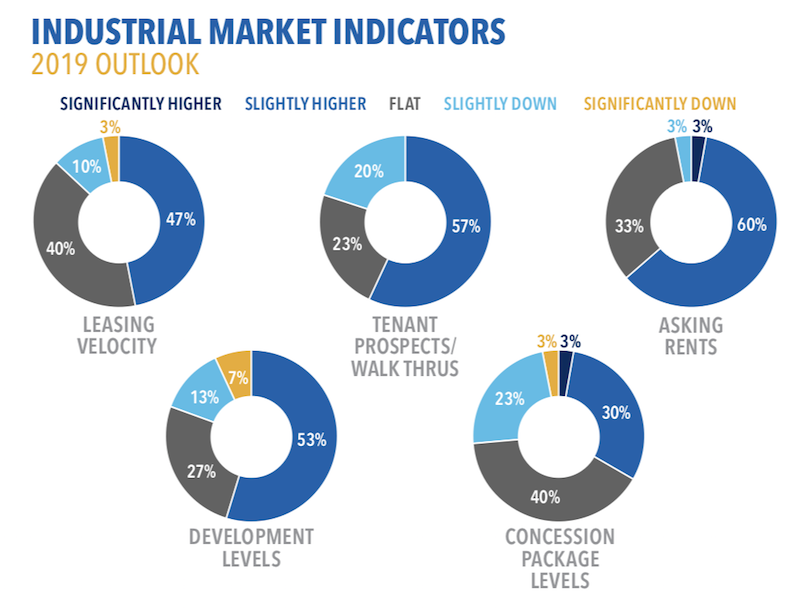

While the average index of 122.1 for the industrial sector’s prospects next year was down from 130.9 for last year’s outlook, respondents still expect tenant walk throughs, asking rents, and development to be higher for this sector, driven by ecommerce, a growing population demanding consumer goods, and better economic conditions.

Seventy-two percent of respondents expect higher investment interest in 2019, as the industrial market strengthens and select REITs shift focus away from office to industrial properties, especially in the Northeast and Mid-Atlantic regions.

Brokers expect an uptick next year, particularly in asking rents and tenant prospects, for the industrial sector. Image: Transwestern

Brokers expect an uptick next year, particularly in asking rents and tenant prospects, for the industrial sector. Image: Transwestern

Related Stories

Hotel Facilities | Oct 27, 2020

Hotel construction pipeline dips 7% in Q3 2020

Hospitality developers continue to closely monitor the impact the coronavirus will have on travel demand, according to Lodging Econometrics.

Market Data | Oct 22, 2020

Multifamily’s long-term outlook rebounds to pre-covid levels in Q3

Slump was a short one for multifamily market as 3rd quarter proposal activity soars.

Market Data | Oct 21, 2020

Architectural billings slowdown moderated in September

AIA’s ABI score for September was 47.0 compared to 40.0 in August.

Market Data | Oct 21, 2020

Only eight states top February peak construction employment despite gains in 32 states last month

California and Vermont post worst losses since February as Virginia and South Dakota add the most.

Market Data | Oct 20, 2020

AIA releases updated contracts for multi-family residential and prototype residential projects

New resources provide insights into mitigating and managing risk on complex residential design and construction projects.

Market Data | Oct 20, 2020

Construction officials call on Trump and Biden to establish a nationwide vaccine distribution plan to avoid confusion and delays

Officials say nationwide plan should set clear distribution priorities.

Market Data | Oct 19, 2020

5 must reads for the AEC industry today: October 19, 2020

Lower cost metros outperform pricey gateway markets and E-commerce fuels industrial's unstoppable engine.

Market Data | Oct 19, 2020

Lower-cost metros continue to outperform pricey gateway markets, Yardi Matrix reports

But year-over-year multifamily trendline remained negative at -0.3%, unchanged from July.

Market Data | Oct 16, 2020

5 must reads for the AEC industry today: October 16, 2020

Princeton's new museum and Miami's yacht-inspired luxury condos.

Market Data | Oct 15, 2020

6 must reads for the AEC industry today: October 15, 2020

Chicago's Bank of America Tower opens and altering facilities for a post-COVID-19 world.