In markets where labor continues to be in short supply, contractors that can attract and retain workers are capable of accepting projects that other manpower-deficient competitors might be turning away.

Labor availability is an important distinction in a construction market that “has stabilized at a comfortable level.” The backlog for the nation’s largest contractors stands at a record 12 months, according to the latest estimates from Associated Builders and Contractors (ABC), a national trade association representing 70 chapters with nearly 21,000 members.

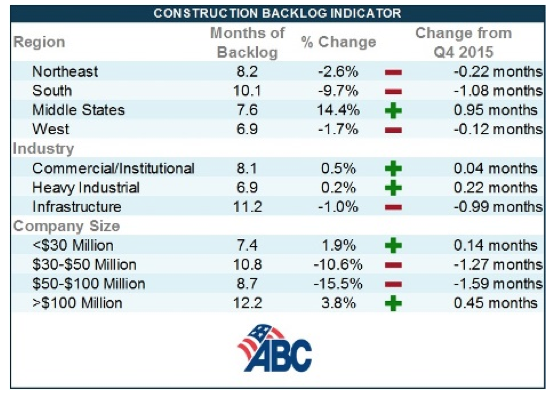

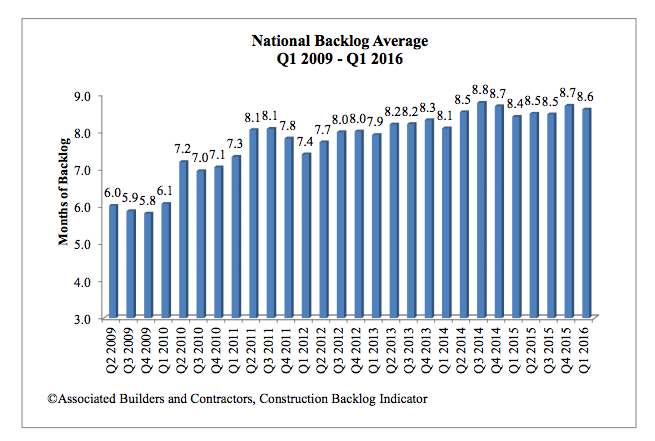

The group’s Construction Backlog Indicator, which has measured the national backlog average for every quarter since Q2 2009, stood at 8.6 months, compared to 8.7 months in Q4 2015 and 8.5 months for Q1 2015.

Where contractor backlogs in the Midwest increased by double digit percentages in the latest quarter measured, they fell in the Northeast, South, and West compared to the previous quarter.

ABC's latest Construction Backlog Index shows that contractors in the Midwest saw the biggest change in their backlogs during the first quarter of this year, as did companies whose revenues range from $50 million to $100 million. Image: Associated Builders and Contractors.

However, contractors in the South have reported average backlogs in excess of 10 months for three consecutive quarters, which is unprecedented in the history of ABC’s series. And while the Northeast isn’t expanding, the region “continues to experience a considerable volume of activity related to commercial development,” including ecommerce fulfillment centers, said ABC.

Backlogs for Commercial/Institutional (which have exceeded eight months for 3½ years), and heavy industrial were up in the most recent quarter tracked, where infrastructure backlogs, while outpacing other sectors at 11.2 months, were down slightly. “The passage of the FAST Act and growing focus among many state and local government policymakers should allow backlog in the infrastructure category to remain elevated,” ABC stated.

Companies with more than $100 million in revenue reported an average 12.25 months of backlog, representing a 3.8% gain over the previous quarter, which itself had set the previous record.

Apparently, the largest firms have recently been taking market share primarily from companies in the $30 million to $100 million range, which reported backlog declines. Companies under $30 million in revenue, on the other hand, enjoyed a modest backlog increase, and have collectively reported backlogs in excess of seven months for 11 consecutive quarters.

“Most contractors continue to express satisfaction regarding the amount of work they have under contract. This is of course truer in certain parts of the nation than others,” said Anirban Basu, ABC’s Chief Economist.

Indeed, backlogs in the West slipped in the latest quarter, even as technology generates “profound levels of activity” in markets like San Jose, Seattle, and San Diego.

ABC's data track a steady increase in national average backlogs dating back to the second quarter of 2009. Image: Associated Builders and Contractors.

Related Stories

| Jan 7, 2011

How Building Teams Choose Roofing Systems

A roofing survey emailed to a representative sample of BD+C’s subscriber list revealed such key findings as: Respondents named metal (56%) and EPDM (50%) as the roofing systems they (or their firms) employed most in projects. Also, new construction and retrofits were fairly evenly split among respondents’ roofing-related projects over the last couple of years.

| Jan 7, 2011

Total construction to rise 5.1% in 2011

Total U.S. construction spending will increase 5.1% in 2011. The gain from the end of 2010 to the end of 2011 will be 10%. The biggest annual gain in 2011 will be 10% for new residential construction, far above the 2-3% gains in all other construction sectors.

| Jan 7, 2011

Mixed-Use on Steroids

Mixed-use development has been one of the few bright spots in real estate in the last few years. Successful mixed-use projects are almost always located in dense urban or suburban areas, usually close to public transportation. It’s a sign of the times that the residential component tends to be rental rather than for-sale.

| Jan 4, 2011

Product of the Week: Zinc cladding helps border crossing blend in with surroundings

Zinc panels provide natural-looking, durable cladding for an administrative building and toll canopies at the newly expanded Queenstown Plaza U.S.-Canada border crossing at the Niagara Gorge. Toronto’s Moriyama & Teshima Architects chose the zinc alloy panels for their ability to blend with the structures’ scenic surroundings, as well as for their low maintenance and sustainable qualities. The structures incorporate 14,000 sf of Rheinzink’s branded Angled Standing Seam and Reveal Panels in graphite gray.

| Jan 4, 2011

6 green building trends to watch in 2011

According to a report by New York-based JWT Intelligence, there are six key green building trends to watch in 2011, including: 3D printing, biomimicry, and more transparent and accurate green claims.

| Jan 4, 2011

LEED 2012: 10 changes you should know about

The USGBC is beginning its review and planning for the next version of LEED—LEED 2012. The draft version of LEED 2012 is currently in the first of at least two public comment periods, and it’s important to take a look at proposed changes to see the direction USGBC is taking, the plans they have for LEED, and—most importantly—how they affect you.

| Jan 4, 2011

California buildings: now even more efficient

New buildings in California must now be more sustainable under the state’s Green Building Standards Code, which took effect with the new year. CALGreen, the first statewide green building code in the country, requires new buildings to be more energy efficient, use less water, and emit fewer pollutants, among many other requirements. And they have the potential to affect LEED ratings.

| Jan 4, 2011

New Years resolutions for architects, urban planners, and real estate developers

Roger K. Lewis, an architect and a professor emeritus of architecture at the University of Maryland, writes in the Washington Post about New Years resolutions he proposes for anyone involved in influencing buildings and cities. Among his proposals: recycle and reuse aging or obsolete buildings instead of demolishing them; amend or eliminate out-of-date, obstructive, and overly complex zoning ordinances; and make all city and suburban streets safe for cyclists and pedestrians.

| Jan 4, 2011

An official bargain, White House loses $79 million in property value

One of the most famous office buildings in the world—and the official the residence of the President of the United States—is now worth only $251.6 million. At the top of the housing boom, the 132-room complex was valued at $331.5 million (still sounds like a bargain), according to Zillow, the online real estate marketplace. That reflects a decline in property value of about 24%.