In markets where labor continues to be in short supply, contractors that can attract and retain workers are capable of accepting projects that other manpower-deficient competitors might be turning away.

Labor availability is an important distinction in a construction market that “has stabilized at a comfortable level.” The backlog for the nation’s largest contractors stands at a record 12 months, according to the latest estimates from Associated Builders and Contractors (ABC), a national trade association representing 70 chapters with nearly 21,000 members.

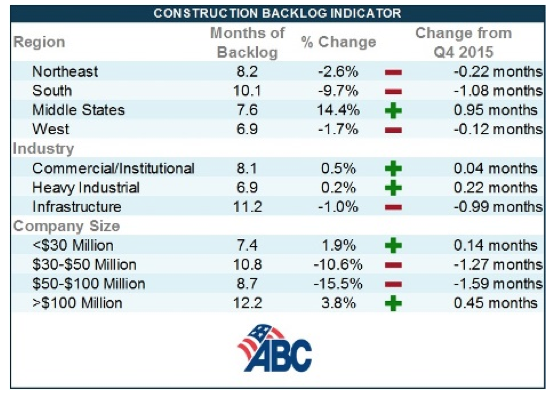

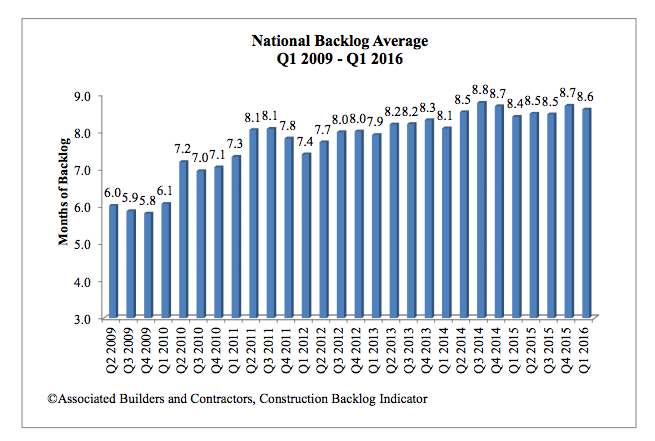

The group’s Construction Backlog Indicator, which has measured the national backlog average for every quarter since Q2 2009, stood at 8.6 months, compared to 8.7 months in Q4 2015 and 8.5 months for Q1 2015.

Where contractor backlogs in the Midwest increased by double digit percentages in the latest quarter measured, they fell in the Northeast, South, and West compared to the previous quarter.

ABC's latest Construction Backlog Index shows that contractors in the Midwest saw the biggest change in their backlogs during the first quarter of this year, as did companies whose revenues range from $50 million to $100 million. Image: Associated Builders and Contractors.

However, contractors in the South have reported average backlogs in excess of 10 months for three consecutive quarters, which is unprecedented in the history of ABC’s series. And while the Northeast isn’t expanding, the region “continues to experience a considerable volume of activity related to commercial development,” including ecommerce fulfillment centers, said ABC.

Backlogs for Commercial/Institutional (which have exceeded eight months for 3½ years), and heavy industrial were up in the most recent quarter tracked, where infrastructure backlogs, while outpacing other sectors at 11.2 months, were down slightly. “The passage of the FAST Act and growing focus among many state and local government policymakers should allow backlog in the infrastructure category to remain elevated,” ABC stated.

Companies with more than $100 million in revenue reported an average 12.25 months of backlog, representing a 3.8% gain over the previous quarter, which itself had set the previous record.

Apparently, the largest firms have recently been taking market share primarily from companies in the $30 million to $100 million range, which reported backlog declines. Companies under $30 million in revenue, on the other hand, enjoyed a modest backlog increase, and have collectively reported backlogs in excess of seven months for 11 consecutive quarters.

“Most contractors continue to express satisfaction regarding the amount of work they have under contract. This is of course truer in certain parts of the nation than others,” said Anirban Basu, ABC’s Chief Economist.

Indeed, backlogs in the West slipped in the latest quarter, even as technology generates “profound levels of activity” in markets like San Jose, Seattle, and San Diego.

ABC's data track a steady increase in national average backlogs dating back to the second quarter of 2009. Image: Associated Builders and Contractors.

Related Stories

| Feb 21, 2012

Skanska welcomes Morrison and Viviano to Atlanta office

Morrison will serve as a vice president and Viviano will serve as senior director of business development for Georgia.

| Feb 21, 2012

PV America West conference showcases solar growth market

Solar industry gathers March 19-21, 2012 in San Jose to discuss technology, market development and policy.

| Feb 21, 2012

SMPS announces Build Business 2012 keynote speakers

National conference set for July 11–13 in San Francisco.

| Feb 20, 2012

Comment period for update to USGBC's LEED Green Building Program now open

This third draft of LEED has been refined to address technical stringency and rigor, measurement and performance tools, and an enhanced user experience.

| Feb 20, 2012

Sto Corp. announces new technical director for Canada

Edgar will have full responsibility of specifications, details, website technical content, testing and approvals, and will support the Canada sales team.

| Feb 20, 2012

GAF introduces web portal for architects and specifiers

The new portal offers a clean look with minimal clutter to make it easier to find the technical information and product data that architects need.

| Feb 20, 2012

All Steel names Breagy director of metro New York

Breagy is responsible for overseeing this region’s sales team while strategically coordinating the sales efforts of Allsteel dealers and representatives in the tri-state area.

| Feb 17, 2012

Tremco Inc. headquarters achieves LEED Gold certification

Changes were so extensive that the certification is for new construction and not for renovation; officially, the building is LEED-NC.

| Feb 17, 2012

MacInnis joins Gilbane board of directors

MacInnis is the chairman and recently retired CEO of Connecticut-based EMCOR Group, Inc.