In markets where labor continues to be in short supply, contractors that can attract and retain workers are capable of accepting projects that other manpower-deficient competitors might be turning away.

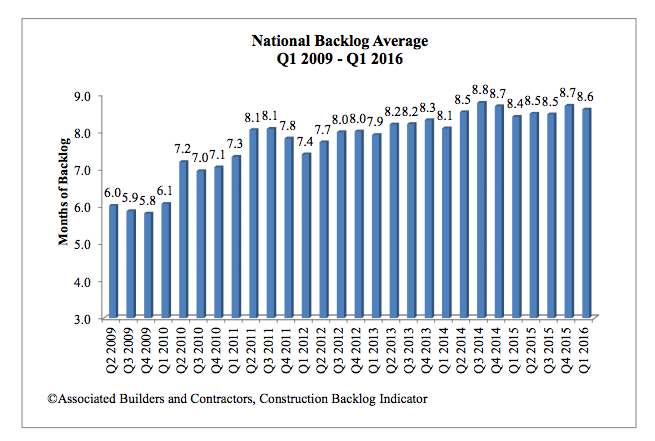

Labor availability is an important distinction in a construction market that “has stabilized at a comfortable level.” The backlog for the nation’s largest contractors stands at a record 12 months, according to the latest estimates from Associated Builders and Contractors (ABC), a national trade association representing 70 chapters with nearly 21,000 members.

The group’s Construction Backlog Indicator, which has measured the national backlog average for every quarter since Q2 2009, stood at 8.6 months, compared to 8.7 months in Q4 2015 and 8.5 months for Q1 2015.

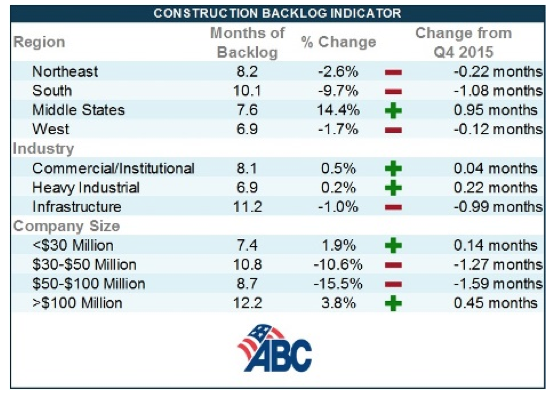

Where contractor backlogs in the Midwest increased by double digit percentages in the latest quarter measured, they fell in the Northeast, South, and West compared to the previous quarter.

ABC's latest Construction Backlog Index shows that contractors in the Midwest saw the biggest change in their backlogs during the first quarter of this year, as did companies whose revenues range from $50 million to $100 million. Image: Associated Builders and Contractors.

However, contractors in the South have reported average backlogs in excess of 10 months for three consecutive quarters, which is unprecedented in the history of ABC’s series. And while the Northeast isn’t expanding, the region “continues to experience a considerable volume of activity related to commercial development,” including ecommerce fulfillment centers, said ABC.

Backlogs for Commercial/Institutional (which have exceeded eight months for 3½ years), and heavy industrial were up in the most recent quarter tracked, where infrastructure backlogs, while outpacing other sectors at 11.2 months, were down slightly. “The passage of the FAST Act and growing focus among many state and local government policymakers should allow backlog in the infrastructure category to remain elevated,” ABC stated.

Companies with more than $100 million in revenue reported an average 12.25 months of backlog, representing a 3.8% gain over the previous quarter, which itself had set the previous record.

Apparently, the largest firms have recently been taking market share primarily from companies in the $30 million to $100 million range, which reported backlog declines. Companies under $30 million in revenue, on the other hand, enjoyed a modest backlog increase, and have collectively reported backlogs in excess of seven months for 11 consecutive quarters.

“Most contractors continue to express satisfaction regarding the amount of work they have under contract. This is of course truer in certain parts of the nation than others,” said Anirban Basu, ABC’s Chief Economist.

Indeed, backlogs in the West slipped in the latest quarter, even as technology generates “profound levels of activity” in markets like San Jose, Seattle, and San Diego.

ABC's data track a steady increase in national average backlogs dating back to the second quarter of 2009. Image: Associated Builders and Contractors.

Related Stories

| Oct 9, 2014

Regulations, demand will accelerate revenue from zero energy buildings, according to study

A new study by Navigant Research projects that public- and private-sector efforts to lower the carbon footprint of new and renovated commercial and residential structures will boost the annual revenue generated by commercial and residential zero energy buildings over the next 20 years by 122.5%, to $1.4 trillion.

| Oct 9, 2014

More recession-postponed design projects are being resurrected, says AIA

About three quarters of the estimated 700 firms that serve as panelists on AIA’s Architectural Billings Index (ABI) had delayed or canceled major design projects in response to recessionary pressures. Nearly one-third of those firms now say they have since restarted stalled projects.

| Oct 9, 2014

Steven Holl's 'intersecting spheres' scheme for Taipei necropolis gets green light

The schematic design has been approved for the 50 000-sm Arrival Hall and Oceanic Pavilion for the Taiwan ChinPaoSan Necropolis.

| Oct 9, 2014

Beyond the bench: Meet the modern laboratory facility

Like office workers escaping from the perceived confines of cubicles, today’s scientists have been freed from the trappings of the typical lab bench, writes Perkins+Will's Bill Harris.

| Oct 8, 2014

New tools for community feedback and action

Too often, members of a community are put into a reactive position, asked for their input only when a major project is proposed. But examples of proactive civic engagement are beginning to emerge, write James Miner and Jessie Bauters.

| Oct 8, 2014

Massive ‘healthcare village’ in Nevada touted as world’s largest healthcare project

The $1.2 billion Union Village project is expected to create 12,000 permanent jobs when completed by 2024.

| Oct 8, 2014

First look: Woods Bagot unveils plans for new Christchurch Convention Center

The locally-inspired building is meant to serve as a symbol of the city's recovery from the earthquake of 2011.

| Oct 8, 2014

Denver transit project wins design-build Project of the Year honor

The Denver Union Station Transit Improvement Project is among 25 projects honored by the Design Build Institute of America for excellence in design-build project delivery.

| Oct 7, 2014

Analysis: Student loans will cost housing industry $83 billion in 2014

More than 410,000 single- and multifamily home sales will be lost in 2014 due to student loan debt, according to analysis by John Burns Real Estate Consulting.

| Oct 7, 2014

Economic gains are rallying rents in Raleigh, N.C.

The greater Raleigh, N.C., market appears to be getting back on its feet again, which is good news for rental property owners.