In markets where labor continues to be in short supply, contractors that can attract and retain workers are capable of accepting projects that other manpower-deficient competitors might be turning away.

Labor availability is an important distinction in a construction market that “has stabilized at a comfortable level.” The backlog for the nation’s largest contractors stands at a record 12 months, according to the latest estimates from Associated Builders and Contractors (ABC), a national trade association representing 70 chapters with nearly 21,000 members.

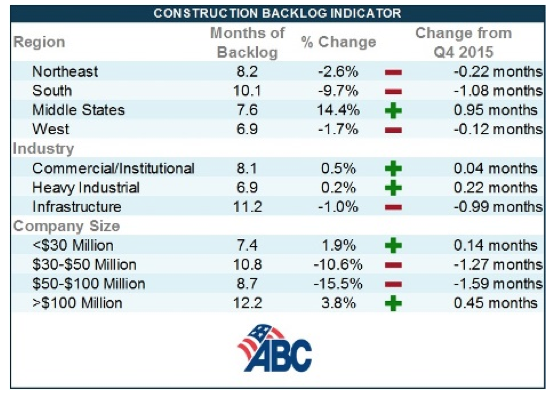

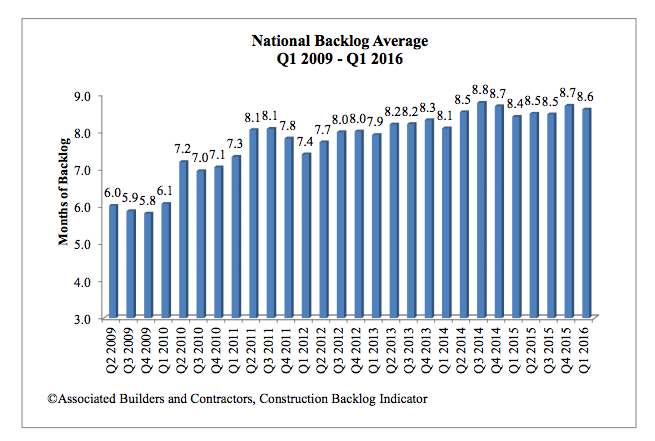

The group’s Construction Backlog Indicator, which has measured the national backlog average for every quarter since Q2 2009, stood at 8.6 months, compared to 8.7 months in Q4 2015 and 8.5 months for Q1 2015.

Where contractor backlogs in the Midwest increased by double digit percentages in the latest quarter measured, they fell in the Northeast, South, and West compared to the previous quarter.

ABC's latest Construction Backlog Index shows that contractors in the Midwest saw the biggest change in their backlogs during the first quarter of this year, as did companies whose revenues range from $50 million to $100 million. Image: Associated Builders and Contractors.

However, contractors in the South have reported average backlogs in excess of 10 months for three consecutive quarters, which is unprecedented in the history of ABC’s series. And while the Northeast isn’t expanding, the region “continues to experience a considerable volume of activity related to commercial development,” including ecommerce fulfillment centers, said ABC.

Backlogs for Commercial/Institutional (which have exceeded eight months for 3½ years), and heavy industrial were up in the most recent quarter tracked, where infrastructure backlogs, while outpacing other sectors at 11.2 months, were down slightly. “The passage of the FAST Act and growing focus among many state and local government policymakers should allow backlog in the infrastructure category to remain elevated,” ABC stated.

Companies with more than $100 million in revenue reported an average 12.25 months of backlog, representing a 3.8% gain over the previous quarter, which itself had set the previous record.

Apparently, the largest firms have recently been taking market share primarily from companies in the $30 million to $100 million range, which reported backlog declines. Companies under $30 million in revenue, on the other hand, enjoyed a modest backlog increase, and have collectively reported backlogs in excess of seven months for 11 consecutive quarters.

“Most contractors continue to express satisfaction regarding the amount of work they have under contract. This is of course truer in certain parts of the nation than others,” said Anirban Basu, ABC’s Chief Economist.

Indeed, backlogs in the West slipped in the latest quarter, even as technology generates “profound levels of activity” in markets like San Jose, Seattle, and San Diego.

ABC's data track a steady increase in national average backlogs dating back to the second quarter of 2009. Image: Associated Builders and Contractors.

Related Stories

Contractors | Jun 8, 2015

ABC: 49 states report decline in construction unemployment rate

Five Plain States reported the lowest unemployment rates for construction workers in April.

Contractors | Jun 5, 2015

FMI's quarterly survey finds contractors mostly optimistic about their growth

The overall economy, as well as the economy in which they do business, might be down, but contractor panelists who provided these insights still see nonresidential construction on the upswing, according to FMI’s latest report.

Contractors | Jun 2, 2015

Weather to blame for decline in Construction Backlog Indicator

Following an intense winter season, the Associated Builders and Contractors' Construction Backlog Indicator (CBI) revealed a 3.2% decline during the first quarter of 2015.

Contractors | Jun 1, 2015

Nonresidential construction spending surges in April

Nonresidential construction is up by a solid 8.8% over the past year, consistent with ABC's forecast of high single-digit growth.

Multifamily Housing | Jun 1, 2015

Sacramento moves forward on multifamily project with new modular supplier

Guerdon Modular Buildings will provide modules for 118 apartments.

BIM and Information Technology | May 27, 2015

4 projects honored with AIA TAP Innovation Awards for excellence in BIM and project delivery

Morphosis Architects' Emerson College building in Los Angeles and the University of Delaware’s ISE Lab are among the projects honored by AIA for their use of BIM/VDC tools.

Healthcare Facilities | May 27, 2015

Rochester, Minn., looks to escape Twin Cities’ shadow with $6.5 billion biotech development

The 20-year plan would also be a boon to Mayo Clinic, this city’s best-known address.

BIM and Information Technology | May 21, 2015

How AEC firms should approach BIM training

CASE Founding Partner Steve Sanderson talks about the current state of software training in the AEC industry and common pitfalls in AEC training.

Architects | May 20, 2015

Architecture billings remain stuck in winter slowdown

Regional business conditions continue to thrive in the South and West

University Buildings | May 19, 2015

Special Report: How your firm can help struggling colleges and universities meet their building project goals

Building Teams that want to succeed in the higher education market have to help their clients find new funding sources, control costs, and provide the maximum value for every dollar.