In markets where labor continues to be in short supply, contractors that can attract and retain workers are capable of accepting projects that other manpower-deficient competitors might be turning away.

Labor availability is an important distinction in a construction market that “has stabilized at a comfortable level.” The backlog for the nation’s largest contractors stands at a record 12 months, according to the latest estimates from Associated Builders and Contractors (ABC), a national trade association representing 70 chapters with nearly 21,000 members.

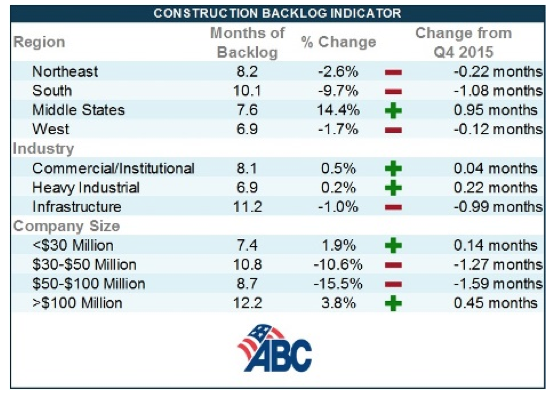

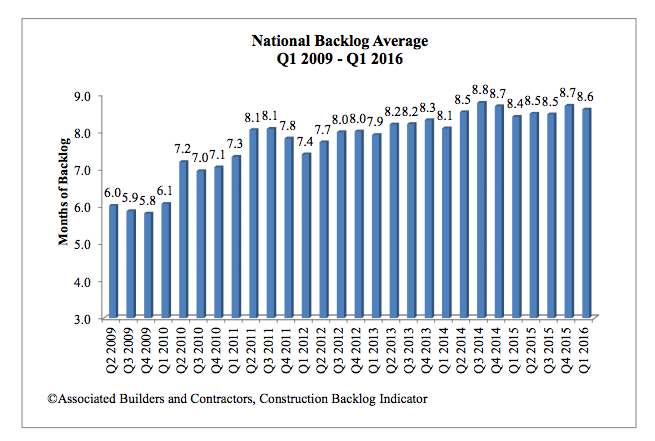

The group’s Construction Backlog Indicator, which has measured the national backlog average for every quarter since Q2 2009, stood at 8.6 months, compared to 8.7 months in Q4 2015 and 8.5 months for Q1 2015.

Where contractor backlogs in the Midwest increased by double digit percentages in the latest quarter measured, they fell in the Northeast, South, and West compared to the previous quarter.

ABC's latest Construction Backlog Index shows that contractors in the Midwest saw the biggest change in their backlogs during the first quarter of this year, as did companies whose revenues range from $50 million to $100 million. Image: Associated Builders and Contractors.

However, contractors in the South have reported average backlogs in excess of 10 months for three consecutive quarters, which is unprecedented in the history of ABC’s series. And while the Northeast isn’t expanding, the region “continues to experience a considerable volume of activity related to commercial development,” including ecommerce fulfillment centers, said ABC.

Backlogs for Commercial/Institutional (which have exceeded eight months for 3½ years), and heavy industrial were up in the most recent quarter tracked, where infrastructure backlogs, while outpacing other sectors at 11.2 months, were down slightly. “The passage of the FAST Act and growing focus among many state and local government policymakers should allow backlog in the infrastructure category to remain elevated,” ABC stated.

Companies with more than $100 million in revenue reported an average 12.25 months of backlog, representing a 3.8% gain over the previous quarter, which itself had set the previous record.

Apparently, the largest firms have recently been taking market share primarily from companies in the $30 million to $100 million range, which reported backlog declines. Companies under $30 million in revenue, on the other hand, enjoyed a modest backlog increase, and have collectively reported backlogs in excess of seven months for 11 consecutive quarters.

“Most contractors continue to express satisfaction regarding the amount of work they have under contract. This is of course truer in certain parts of the nation than others,” said Anirban Basu, ABC’s Chief Economist.

Indeed, backlogs in the West slipped in the latest quarter, even as technology generates “profound levels of activity” in markets like San Jose, Seattle, and San Diego.

ABC's data track a steady increase in national average backlogs dating back to the second quarter of 2009. Image: Associated Builders and Contractors.

Related Stories

Wood | May 14, 2021

What's next for mass timber design?

An architect who has worked on some of the nation's largest and most significant mass timber construction projects shares his thoughts on the latest design trends and innovations in mass timber.

Healthcare Facilities | Apr 30, 2021

Registration and waiting: Weak points and an enduring strength

Changing how patients register and wait for appointments will enhance the healthcare industry’s ability to respond to crises.

University Buildings | Apr 29, 2021

The Weekly Show, April 29, 2021: COVID-19's impact on campus planning, and bird management strategies

This week on The Weekly show, BD+C Senior Editor John Caulfield interviews a duo of industry experts on 1) how campus planning has changed during the pandemic and 2) managing bird infestations on construction sites and completed buildings.

Multifamily Housing | Apr 22, 2021

The Weekly Show, Apr 22, 2021: COVID-19's impact on multifamily amenities

This week on The Weekly show, BD+C's Robert Cassidy speaks with three multifamily design experts about the impact of COVID-19 on apartment and condo amenities, based on the 2021 Multifamily Amenities Survey.

Market Data | Apr 20, 2021

The pandemic moves subs and vendors closer to technology

Consigli’s latest market outlook identifies building products that are high risk for future price increases.

Adaptive Reuse | Apr 15, 2021

The Weekly Show, Apr 15, 2021: The ins and outs of adaptive reuse, and sensors for real-time construction monitoring

This week on The Weekly show, BD+C editors speak with AEC industry leaders from PBDW Architects and Wohlsen Construction about what makes adaptive reuse projects successful, and sensors for real-time monitoring of concrete construction.

Contractors | Apr 9, 2021

Construction bidding activity ticks up in February

The Blue Book Network's Velocity Index measures month-to-month changes in bidding activity among construction firms across five building sectors and in all 50 states.

Industry Research | Apr 9, 2021

BD+C exclusive research: What building owners want from AEC firms

BD+C’s first-ever owners’ survey finds them focused on improving buildings’ performance for higher investment returns.