Last May, Germany based Thyssenkrupp decided to divide itself into two separate companies as part of a major restructuring effort. That strategy called for spinning off its profitable Elevator Technology business unit via an Initial Public Offering or by putting that unit up for sale.

Elevator Technology, in the fiscal year ended Sept. 30, 2019, generated 907 million Euro (US$1 billion) in cash flow from 7.96 billion Euro in net sales, both up around 5% from the previous year. Thyssenkrupp’s total revenue, just under 42 billion Euro, was up only 1%, and the company reported a 260 million Euro net loss on top of a 12 million Euro loss the previous fiscal year.

Thyssenkrupp, as a corporation, is also groaning under 8.5 billion Euro in pension obligations and 5.1 billion Euro in net debt.

The Elevator Technology unit—which made waves a few years ago with MULTI, the industry’s first sideways-moving elevator transport system—has since drawn interest from at least four investor groups, including one that includes Finnish engineering firm Kone Oyj and CVC Capital Partners, which last week reportedly made a non-binding offer of 17 billion Euro. Bloomberg reports that Kone gave Thyssenkrupp the option of receiving all cash or a combination of cash and stock for the elevator business. And to mollify regulators over any antitrust issues, Kone said it would hand the Elevator Technology operations in Europe to CVC.

Last year, regulators scotched Thyssenkrupp’s attempt to forge a joint venture between its Steel Europe business unit and Tata Steel Ltd.

Last November, Reuters reported that Kone proposed paying Thyssenkrupp a multibillion-euro breakup fee (reportedly the equivalent of US$3.3 billion) to improve its position in the company’s auction of its elevator unit.

The other investor groups vying to acquire Thyssenkrupp’s Elevator Technology unit reportedly include a consortium of Blackstone Group, Carlyle Group, and Canada Pension Plan Investment Board. Advent International, Cinven and the Abu Dhabi Investment Authority form another investor group. And Brookfield Asset Management partnered with Temasek Holdings Pte to bid. These offers reportedly were all under 16 billion Euro, but suitors will have the opportunity to adjust their bids next month.

Thyssenkrupp has also disclosed that it plans to put its plant-building unit—which makes chemicals, cement, and fertilizer plants—on the auction block, possibly selling the division in parts.

Related Stories

| Jan 13, 2014

AEC professionals weigh in on school security

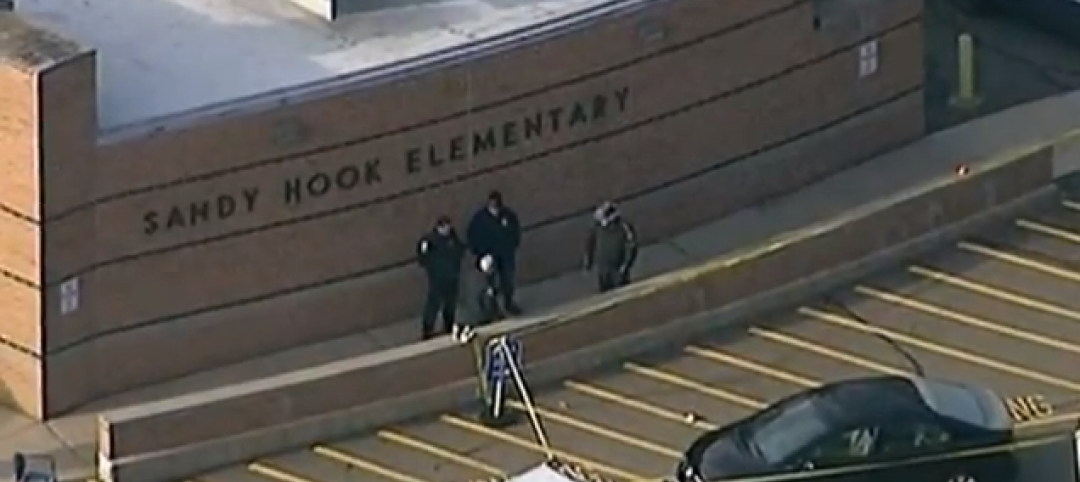

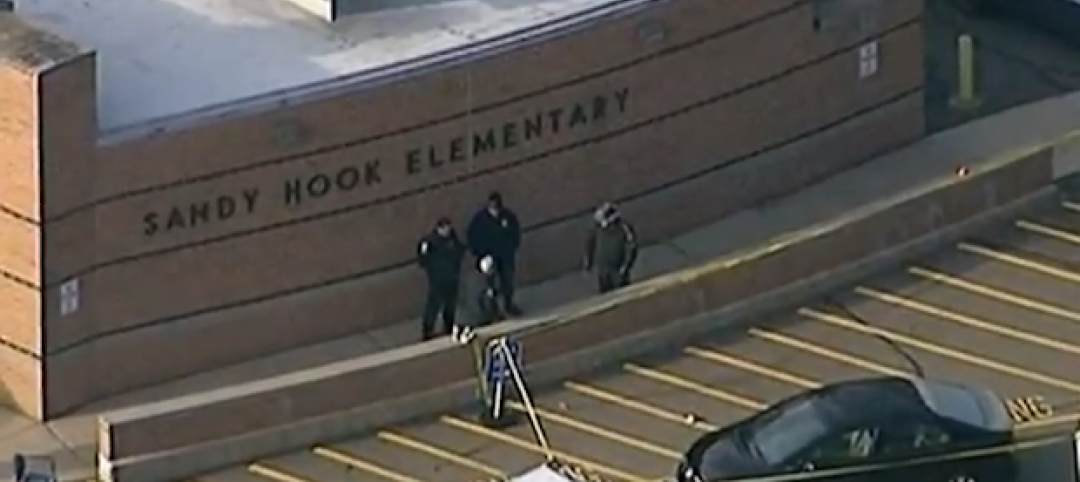

An exclusive survey reveals that Building Teams are doing their part to make the nation’s schools safer in the aftermath of the Sandy Hook tragedy.

| Jan 10, 2014

Special Report: K-12 school security in the wake of Sandy Hook

BD+C's exclusive five-part report on K-12 school security offers proven design advice, technology recommendations, and thoughtful commentary on how Building Teams can help school districts prevent, or at least mitigate, a Sandy Hook on their turf.

| Jan 9, 2014

How security in schools applies to other building types

Many of the principles and concepts described in our Special Report on K-12 security also apply to other building types and markets.

| Jan 9, 2014

16 recommendations on security technology to take to your K-12 clients

From facial recognition cameras to IP-based door hardware, here are key technology-related considerations you should discuss with your school district clients.

| Jan 6, 2014

What is value engineering?

If you had to define value engineering in a single word, you might boil it down to "efficiency." That would be one word, but it wouldn’t be accurate.

| Dec 23, 2013

MBI commends start of module setting at B2, world's tallest modular building

The first modules have been set at B2 residential tower at Atlantic Yards in New York, set to become the tallest modular building in the world.

| Dec 13, 2013

Safe and sound: 10 solutions for fire and life safety

From a dual fire-CO detector to an aspiration-sensing fire alarm, BD+C editors present a roundup of new fire and life safety products and technologies.

| Dec 10, 2013

16 great solutions for architects, engineers, and contractors

From a crowd-funded smart shovel to a why-didn’t-someone-do-this-sooner scheme for managing traffic in public restrooms, these ideas are noteworthy for creative problem-solving. Here are some of the most intriguing innovations the BD+C community has brought to our attention this year.

| Dec 6, 2013

French concert hall includes integrated musical elements [VIDEO]

La Métaphone, a concert hall in Ognies, France, is a 1,980-sm facility with the unique characteristic of being a structural musical instrument. The solar-powered building incorporates musical elements in its walls, which can be played by musicians inside or outside the facility.

| Dec 5, 2013

Exclusive BD+C survey shows reaction to Sandy Hook tragedy

More than 60% of AEC professionals surveyed by BD+C said their firms experienced heightened interest in security measures from school districts they worked with.