Construction backlog for large contractors reached a new peak of 14.06 months during the second quarter of 2016 according to the Associated Builders and Contractors (ABC) Construction Backlog Indicator (CBI) released today. The new high for companies with annual revenue above $100 million shattered the previous high of 12.25 months for any revenue segment, which was recorded in the first quarter of 2016 and second quarter of 2013.

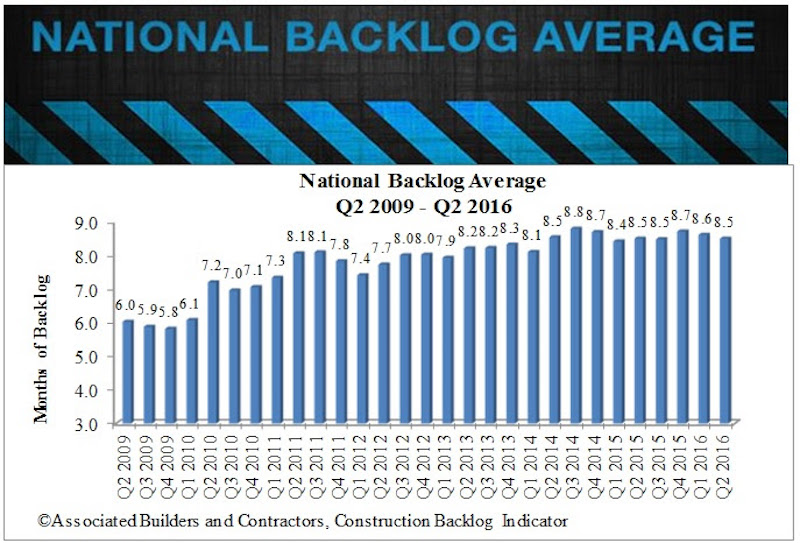

Nationally, average backlog fell to 8.5 months during the second quarter, down 1.6 percent from the prior quarter. CBI remained virtually unchanged on a year-over-year basis, signaling that growth in the nation’s nonresidential construction industry is slowing.

“There are a number of potential explanatory factors regarding the lack of growth in backlog, the most obvious of which is the continued slow growth of the economy,” says ABC Chief Economist Anirban Basu. “Financial regulators have begun to express growing concern regarding possible bubbles forming in certain real estate segments in certain cities, which may have rendered the developer financing environment somewhat more challenging. A slowdown in business investment, including in energy-related sectors, has undoubtedly also played a role.”

Regional Highlights

- Contractors in the South have reported average backlog in excess of 10 months for fourth consecutive quarters. Backlog in the South has never been higher than it has been over the past year, with significant activity reported in several South Carolina, Georgia and Florida markets.

- Backlog in the West expanded during the second quarter, with contractors in Seattle, Portland, Boise and in a number of California markets reporting still expanding backlog. Many contractors report both more private and public contracting as local governments scramble to accommodate rapidly expanding populations.

- Backlog in the Middle States hit the eight-month threshold, the highest level recorded in the history of the series. The expansion of the U.S. auto sector appears to be disproportionately responsible.

Sector Highlights

- Average backlog in the heavy industrial category rose to 7.4 months during the second quarter, the highest level on record. The U.S. auto industry appears to be largely responsible, with contractors in Mississippi, Tennessee, Indiana and other significant auto supply markets reported stable to rising backlog levels.

- Backlog in the infrastructure category declined for a second consecutive quarter during the second quarter, but remains well above 10 months. Only on two occasions have infrastructure contractors reported higher backlog. However, the impact of the passage of a federal highway bill last year has been generally less than anticipated.

Highlights by Company Size

- Backlog for firms with revenue less than $30 million—the smallest delineation—declined by 0.1 months in the second quarter and has now fallen during five of the previous seven quarters. These firms are among the most likely to be limited by skilled labor shortfalls, which prevent them from effectively bidding on larger projects, thereby setting the stage for gradual declines in backlog.

- A softening of backlog in the northeast helps to explain the year-over-year decline in backlog among firms in the $30-$100 million annual revenue category.

- Large industrial projects represent a primarily explanatory factor behind the surge in backlog among the largest construction firms. Large-scale industrial projects have been reported in Texas, Louisiana and other markets, setting the stage for stable to rising construction investment in those markets. Over the past two years, construction volumes have been falling in a number of Texas and Louisiana markets, likely attributable to diminished oil and natural gas prices.

Related Stories

Market Data | Jul 29, 2020

62% of metros shed construction jobs from June 2019 to June 2020 as Association calls for new infrastructure funding, other relief steps

New York City and Brockton-Bridgewater-Easton, Mass. have worst 12-month losses, while Austin and Walla Walla, Wash. top job gainers.

Market Data | Jul 29, 2020

6 must reads for the AEC industry today: July 29, 2020

The world's first net-zero airport and California utility adopts climate emergency declaration.

Market Data | Jul 28, 2020

For the fourth consecutive quarter, Los Angeles leads the U.S. hotel construction pipeline at the close of Q2’ 20

New York City continues to have the greatest number of projects under construction, with 106 projects/18,354 rooms.

Market Data | Jul 28, 2020

6 must reads for the AEC industry today: July 28, 2020

St. Petersburg Pier reconstruction completes and post-pandemic workplace design will not be the same for all.

Market Data | Jul 28, 2020

Senate Republicans' coronavirus relief measure includes provisions that will help hard-hit construction firms recover

The HEALS Act includes essential liability, workforce, financial & unemployment reforms, but association will work to get needed infrastructure investments included in final relief measure.

Market Data | Jul 27, 2020

6 must reads for the AEC industry today: July 27, 2020

Customized labs give universities a recruiting edge and the U.S. construction pipeline remains robust through the first half of 2020.

Market Data | Jul 27, 2020

The U.S. construction pipeline remains robust through the first half of 2020, despite pandemic

Projects currently under construction stand at 1,771 projects/235,467 rooms, up 3% and 1% respectively, YOY.

Market Data | Jul 24, 2020

5 must reads for the AEC industry today: July 24, 2020

North Carolina will stop relying on FEMA flood mapping and Cal Poly Pomona's newest project.

Market Data | Jul 23, 2020

New LEED guidance from USGBC helps cities and communities expand resilience efforts in response to the COVID-19 pandemic

Credits integrate public health and social equity with sustainability planning.

Market Data | Jul 23, 2020

6 must reads for the AEC industry today: July 23, 2020

Skanska selects Pickard Chilton to design new ofice tower and days grow long at nursing homes as virus lockdowns drag on.