Construction backlog for large contractors reached a new peak of 14.06 months during the second quarter of 2016 according to the Associated Builders and Contractors (ABC) Construction Backlog Indicator (CBI) released today. The new high for companies with annual revenue above $100 million shattered the previous high of 12.25 months for any revenue segment, which was recorded in the first quarter of 2016 and second quarter of 2013.

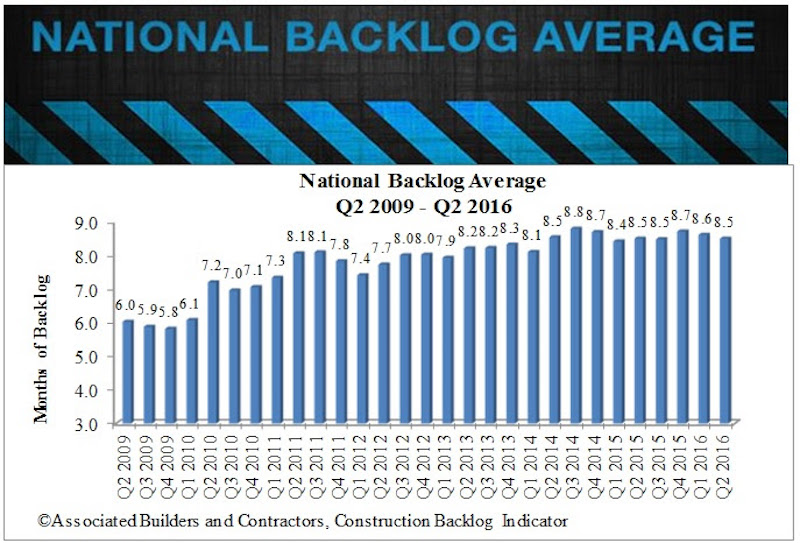

Nationally, average backlog fell to 8.5 months during the second quarter, down 1.6 percent from the prior quarter. CBI remained virtually unchanged on a year-over-year basis, signaling that growth in the nation’s nonresidential construction industry is slowing.

“There are a number of potential explanatory factors regarding the lack of growth in backlog, the most obvious of which is the continued slow growth of the economy,” says ABC Chief Economist Anirban Basu. “Financial regulators have begun to express growing concern regarding possible bubbles forming in certain real estate segments in certain cities, which may have rendered the developer financing environment somewhat more challenging. A slowdown in business investment, including in energy-related sectors, has undoubtedly also played a role.”

Regional Highlights

- Contractors in the South have reported average backlog in excess of 10 months for fourth consecutive quarters. Backlog in the South has never been higher than it has been over the past year, with significant activity reported in several South Carolina, Georgia and Florida markets.

- Backlog in the West expanded during the second quarter, with contractors in Seattle, Portland, Boise and in a number of California markets reporting still expanding backlog. Many contractors report both more private and public contracting as local governments scramble to accommodate rapidly expanding populations.

- Backlog in the Middle States hit the eight-month threshold, the highest level recorded in the history of the series. The expansion of the U.S. auto sector appears to be disproportionately responsible.

Sector Highlights

- Average backlog in the heavy industrial category rose to 7.4 months during the second quarter, the highest level on record. The U.S. auto industry appears to be largely responsible, with contractors in Mississippi, Tennessee, Indiana and other significant auto supply markets reported stable to rising backlog levels.

- Backlog in the infrastructure category declined for a second consecutive quarter during the second quarter, but remains well above 10 months. Only on two occasions have infrastructure contractors reported higher backlog. However, the impact of the passage of a federal highway bill last year has been generally less than anticipated.

Highlights by Company Size

- Backlog for firms with revenue less than $30 million—the smallest delineation—declined by 0.1 months in the second quarter and has now fallen during five of the previous seven quarters. These firms are among the most likely to be limited by skilled labor shortfalls, which prevent them from effectively bidding on larger projects, thereby setting the stage for gradual declines in backlog.

- A softening of backlog in the northeast helps to explain the year-over-year decline in backlog among firms in the $30-$100 million annual revenue category.

- Large industrial projects represent a primarily explanatory factor behind the surge in backlog among the largest construction firms. Large-scale industrial projects have been reported in Texas, Louisiana and other markets, setting the stage for stable to rising construction investment in those markets. Over the past two years, construction volumes have been falling in a number of Texas and Louisiana markets, likely attributable to diminished oil and natural gas prices.

Related Stories

Market Data | Oct 22, 2020

Multifamily’s long-term outlook rebounds to pre-covid levels in Q3

Slump was a short one for multifamily market as 3rd quarter proposal activity soars.

Market Data | Oct 21, 2020

Architectural billings slowdown moderated in September

AIA’s ABI score for September was 47.0 compared to 40.0 in August.

Market Data | Oct 21, 2020

Only eight states top February peak construction employment despite gains in 32 states last month

California and Vermont post worst losses since February as Virginia and South Dakota add the most.

Market Data | Oct 20, 2020

AIA releases updated contracts for multi-family residential and prototype residential projects

New resources provide insights into mitigating and managing risk on complex residential design and construction projects.

Market Data | Oct 20, 2020

Construction officials call on Trump and Biden to establish a nationwide vaccine distribution plan to avoid confusion and delays

Officials say nationwide plan should set clear distribution priorities.

Market Data | Oct 19, 2020

5 must reads for the AEC industry today: October 19, 2020

Lower cost metros outperform pricey gateway markets and E-commerce fuels industrial's unstoppable engine.

Market Data | Oct 19, 2020

Lower-cost metros continue to outperform pricey gateway markets, Yardi Matrix reports

But year-over-year multifamily trendline remained negative at -0.3%, unchanged from July.

Market Data | Oct 16, 2020

5 must reads for the AEC industry today: October 16, 2020

Princeton's new museum and Miami's yacht-inspired luxury condos.

Market Data | Oct 15, 2020

6 must reads for the AEC industry today: October 15, 2020

Chicago's Bank of America Tower opens and altering facilities for a post-COVID-19 world.

Market Data | Oct 14, 2020

6 must reads for the AEC industry today: October 14, 2020

Thailand's new Elephant Museum and the Art Gallery of New South Wales receives an expansion.