In its latest report, the Census Bureau estimates that annualized starts of structures with five or more units stood at 445,000 in October, up 28.2% over the same month a year earlier. However, multifamily permits were only 5.8% higher.

Could the long-predicted slowdown in the multifamily boom finally be happening? The market researcher Axiometrics looked at its identified supply data and concludes that multifamily deliveries could peak by mid-year 2017.

Over the next three quarters, though, this market sector should continue to thrive. Axiometrics expects deliveries to growth by more than 10%, to 91,957, in the fourth quarter of 2016, and then recede a bit to 91,721 in the first quarter of 2017 (which would still be nearly 49% more than 1Q 2016), and then jump again to 102,617 deliveries in the second quarter of 2017, which would be 48.5% more than 2Q 2016.

Axiometrics estimates that a total of 343,582 new apartment units will come onto the market in 2017, 55.7% of which in the first half of the year.

Axiometrics estimates that 343,582 apartment units will come onto the market next year, more than half in the first six months. Image: Axiometrics

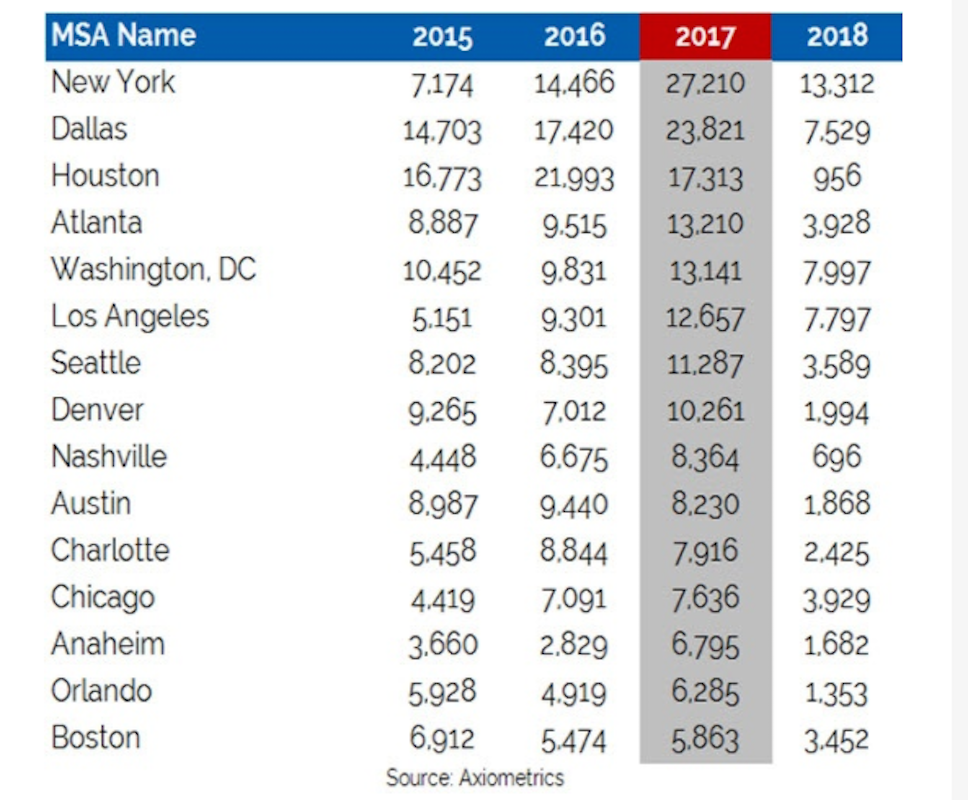

New York is expected to lead the nation in new apartment deliveries next year, with 27,210, representing an 88% leap over 2016 deliveries. (Three of New York’s boroughs—Brooklyn, Queens, and Midtown Manhattan—are among the top 10 submarkets for projected deliveries in 2017.)

Axiometrics points out, though, that New York’s delivery schedule “is a telling example of how construction delays have affected the apartment market.” Those delays are, in part, the result of an ongoing construction labor shortage that other data have shown is expected to continue for at least the next year.

Indeed, New York’s apartment deliveries are expected to fall precipitously in 2018, to 13,312.

Following New York in projected apartment deliveries next year are Dallas (up 36% to 23,821), Houston (which will actually be down 21.2% to 17,313), Atlanta (up 38.8% to 13,210) and Washington D.C. (up 33.7% to 13.141).

All of these metros are expected to see deliveries plummet in 2018, which Houston expected to deliver only 956 new apartment units that year.

The leading metros for multifamily deliveries are all expected to see significant falloffs by 2018. Image: Axiometrics

Axiometrics states that most of new apartments that come onto the market will be absorbed because “the U.S. economy remains in growth mode.” However, by this time next year, apartment deliveries should scale back to more historically normal quarterly levels, in the mid 60,000 units range.

Related Stories

Codes and Standards | Oct 17, 2022

Ambitious state EV adoption goals put pressure on multifamily owners to provide chargers

California’s recently announced ban on the sale of new gas-powered vehicles starting in 2035—and New York’s recent decision to follow suit—are putting pressure on multifamily property owners to install charging stations for tenants.

Multifamily Housing | Oct 7, 2022

Design for new Ft. Lauderdale mixed-use tower features sequence of stepped rounded volumes

The newly revealed design for 633 SE 3rd Ave., a 47-story, mixed-use tower in Ft. Lauderdale, features a sequence of stepped rounded volumes that ease the massing of the tower as it rises.

Multifamily Housing | Oct 5, 2022

Co-living spaces, wellness-minded designs among innovations in multifamily housing

The booming multifamily sector shows no signs of a significant slowdown heading into 2023. Here is a round up of Giants 400 firms that are driving innovation in this sector.

Fire and Life Safety | Oct 4, 2022

Fire safety considerations for cantilevered buildings

Bold cantilevered designs are prevalent today, as developers and architects strive to maximize space, views, and natural light in buildings. Cantilevered structures, however, present a host of challenges for building teams, according to José R. Rivera, PE, Associate Principal and Director of Plumbing and Fire Protection with Lilker.

| Oct 4, 2022

Rental property owners want access to utility usage data for whole properties

As pressure from investors for ESG reporting mounts, owners of multifamily properties increasingly look to collect whole-building utility usage data.

Resiliency | Sep 30, 2022

Designing buildings for wildfire defensibility

Wold Architects and Engineers' Senior Planner Ryan Downs, AIA, talks about how to make structures and communities more fire-resistant.

Sponsored | Multifamily Housing | Sep 16, 2022

In-Stock Sheathing System Saves Multifamily Project Timeline

Multifamily Housing | Sep 15, 2022

Toronto’s B-Line Condominiums completed using prefabricated panels

B-Line Condos, Toronto, completed using Sto Panel Technology.

Multifamily Housing | Sep 15, 2022

Heat Pumps in Multifamily Projects

RMI's Lacey Tan gives the basics of heat pumps and how they can reduce energy costs and carbon emissions in apartment projects.