In its latest report, the Census Bureau estimates that annualized starts of structures with five or more units stood at 445,000 in October, up 28.2% over the same month a year earlier. However, multifamily permits were only 5.8% higher.

Could the long-predicted slowdown in the multifamily boom finally be happening? The market researcher Axiometrics looked at its identified supply data and concludes that multifamily deliveries could peak by mid-year 2017.

Over the next three quarters, though, this market sector should continue to thrive. Axiometrics expects deliveries to growth by more than 10%, to 91,957, in the fourth quarter of 2016, and then recede a bit to 91,721 in the first quarter of 2017 (which would still be nearly 49% more than 1Q 2016), and then jump again to 102,617 deliveries in the second quarter of 2017, which would be 48.5% more than 2Q 2016.

Axiometrics estimates that a total of 343,582 new apartment units will come onto the market in 2017, 55.7% of which in the first half of the year.

Axiometrics estimates that 343,582 apartment units will come onto the market next year, more than half in the first six months. Image: Axiometrics

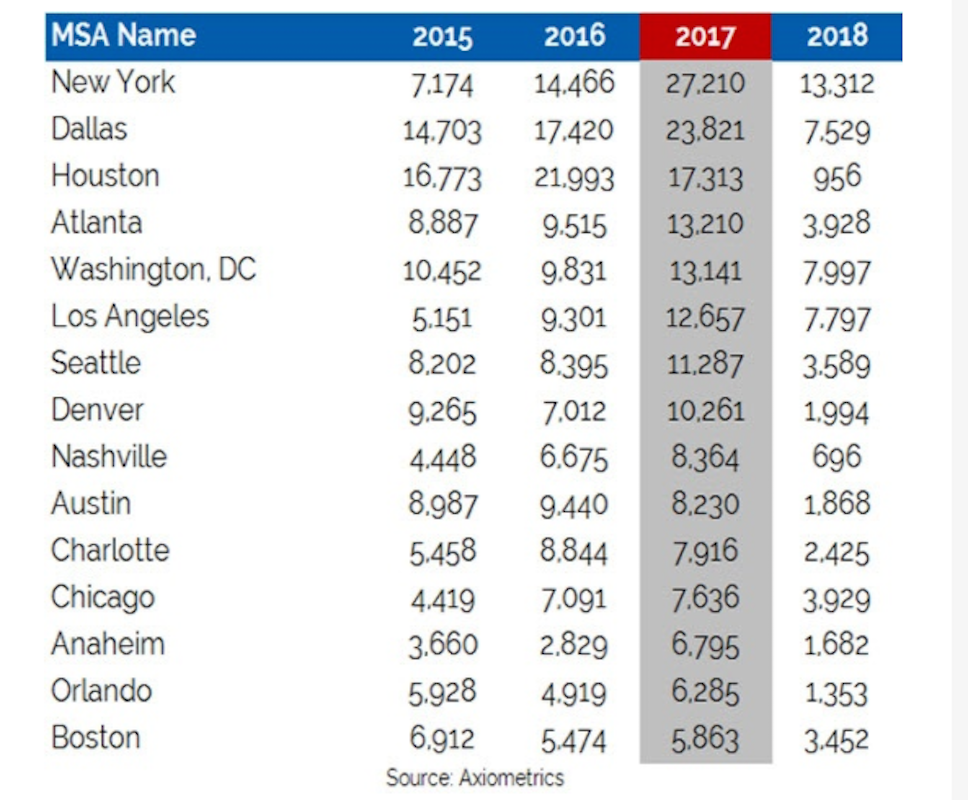

New York is expected to lead the nation in new apartment deliveries next year, with 27,210, representing an 88% leap over 2016 deliveries. (Three of New York’s boroughs—Brooklyn, Queens, and Midtown Manhattan—are among the top 10 submarkets for projected deliveries in 2017.)

Axiometrics points out, though, that New York’s delivery schedule “is a telling example of how construction delays have affected the apartment market.” Those delays are, in part, the result of an ongoing construction labor shortage that other data have shown is expected to continue for at least the next year.

Indeed, New York’s apartment deliveries are expected to fall precipitously in 2018, to 13,312.

Following New York in projected apartment deliveries next year are Dallas (up 36% to 23,821), Houston (which will actually be down 21.2% to 17,313), Atlanta (up 38.8% to 13,210) and Washington D.C. (up 33.7% to 13.141).

All of these metros are expected to see deliveries plummet in 2018, which Houston expected to deliver only 956 new apartment units that year.

The leading metros for multifamily deliveries are all expected to see significant falloffs by 2018. Image: Axiometrics

Axiometrics states that most of new apartments that come onto the market will be absorbed because “the U.S. economy remains in growth mode.” However, by this time next year, apartment deliveries should scale back to more historically normal quarterly levels, in the mid 60,000 units range.

Related Stories

Multifamily Housing | Jun 15, 2023

Alliance of Pittsburgh building owners slashes carbon emissions by 45%

The Pittsburgh 2030 District, an alliance of property owners in the Pittsburgh area, says that it has reduced carbon emissions by 44.8% below baseline. Begun in 2012 under the guidance of the Green Building Alliance (GBA), the Pittsburgh 2030 District encompasses more than 86 million sf of space within 556 buildings.

Industry Research | Jun 15, 2023

Exurbs and emerging suburbs having fastest population growth, says Cushman & Wakefield

Recently released county and metro-level population growth data by the U.S. Census Bureau shows that the fastest growing areas are found in exurbs and emerging suburbs.

Engineers | Jun 14, 2023

The high cost of low maintenance

Walter P Moore’s Javier Balma, PhD, PE, SE, and Webb Wright, PE, identify the primary causes of engineering failures, define proactive versus reactive maintenance, recognize the reasons for deferred maintenance, and identify the financial and safety risks related to deferred maintenance.

Mixed-Use | Jun 12, 2023

Goettsch Partners completes its largest China project to date: a mixed-used, five-tower complex

Chicago-based global architecture firm Goettsch Partners (GP) recently announced the completion of its largest project in China to date: the China Resources Qianhai Center, a mixed-use complex in the Qianhai district of Shenzhen. Developed by CR Land, the project includes five towers totaling almost 472,000 square meters (4.6 million sf).

Mixed-Use | Jun 6, 2023

Public-private partnerships crucial to central business district revitalization

Central Business Districts are under pressure to keep themselves relevant as they face competition from new, vibrant mixed-use neighborhoods emerging across the world’s largest cities.

Multifamily Housing | Jun 6, 2023

Minnesota expected to adopt building code that would cut energy use by 80%

Minnesota Gov. Tim Walz is expected to soon sign a bill that would change the state’s commercial building code so that new structures would use 80% less energy when compared to a 2004 baseline standard. The legislation aims for full implementation of the new code by 2036.

Student Housing | Jun 5, 2023

The power of student engagement: How on-campus student housing can increase enrollment

Studies have confirmed that students are more likely to graduate when they live on campus, particularly when the on-campus experience encourages student learning and engagement, writes Design Collaborative's Nathan Woods, AIA.

Multifamily Housing | Jun 1, 2023

Income-based electric bills spark debate on whether they would harm or hurt EV and heat pump adoption

Starting in 2024, the electric bills of most Californians could be based not only on how much power they use, but also on how much money they make. Those who have higher incomes would pay more; those with lower incomes would see their electric bills decline - a concept known as income-based electric bills.

Multifamily Housing | May 30, 2023

Boston’s new stretch code requires new multifamily structures to meet Passive House building requirements

Phius certifications are expected to become more common as states and cities boost green building standards. The City of Boston recently adopted Massachusetts’s so-called opt-in building code, a set of sustainability standards that goes beyond the standard state code.

Multifamily Housing | May 30, 2023

Milhaus, Gershman Partners, and Citimark close on $70 million multifamily development in Indy

Versa will bring 233 studio and one- and two-bedroom apartments to Indianapolis's $271 million, Class-A Broad Ripple Village development enterprise.