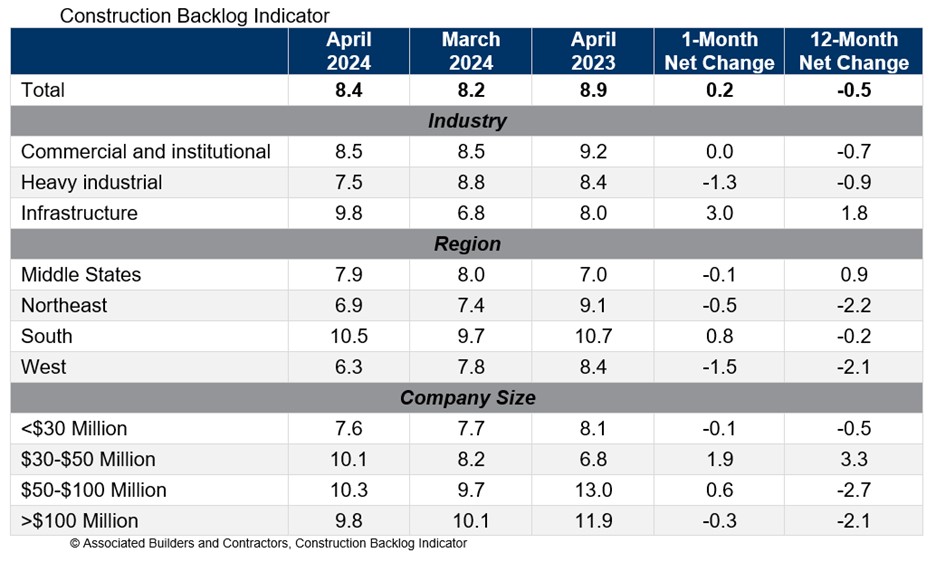

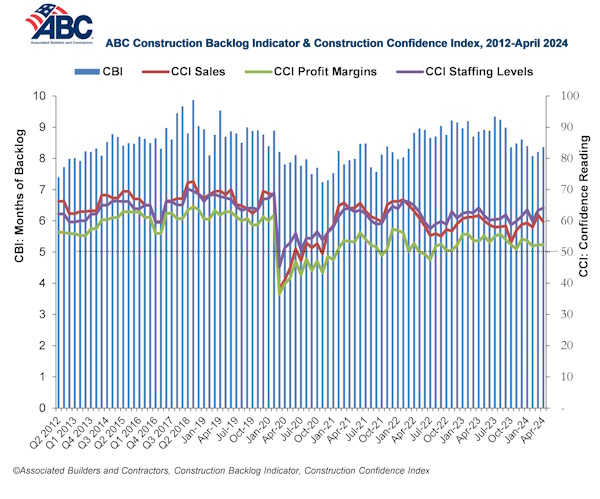

Associated Builders and Contractors reported that its Construction Backlog Indicator increased to 8.4 months in April, according to an ABC member survey conducted April 22 to May 6. The reading is down 0.5 months from April 2023, but expanded 0.2 months from the prior month.

Backlog declined on a monthly basis for the largest and smallest contractors by revenue and grew for those with $30-$50 million and $50-$100 million in annual revenues. On an annual basis, only contractors with $30-$50 million in annual revenues have experienced an increase in backlog.

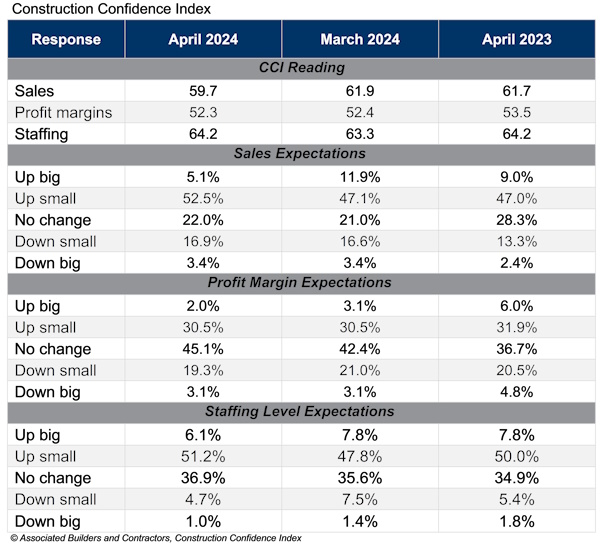

ABC’s Construction Confidence Index readings for sales and profit margins fell slightly in April, while the reading for staffing levels improved. All three readings remain above the threshold of 50, indicating expectations for growth over the next six months.

“The Federal Reserve began ratcheting up interest rates more than two years ago but one would not know it based on construction confidence and backlog,” said ABC Chief Economist Anirban Basu. “ABC measurements reflect ongoing momentum in the nation’s nonresidential construction sector. While there are occasional hints of softness in certain segments and over certain periods, the average contractor continues to report solid backlog and a belief that sales, employment and profit margins will expand over the next six months.

“Time will tell whether this optimism is justified,” said Basu. “Coming into the year, many expected that interest rates would fall markedly in 2024. Given stubbornly elevated inflation, that will not occur. Project financing costs are poised to remain higher for longer. Project cancellations and postponements have been on the rise. Moreover, a new set of supply chain issues has emerged, driving up materials costs and prospectively weakening industry margins. Workers also are becoming more expensive, in part because the construction wage premium has shrunk over the past several years due to rapidly rising compensation levels in competing segments like logistics and retail. The implication is that construction compensation levels will need to rise for the industry to be able to staff up more fully."

Related Stories

| Aug 6, 2013

California construction firm C.W. Driver acquires Good & Roberts

C.W. Driver, a premier builder serving California since 1919, announced today that it has acquired Good & Roberts (G&R), a 34-year-old San Diego based construction company. G&R will operate as a subsidiary, allowing C.W. Driver to expand into new markets and broaden its current San Diego market share

| Aug 5, 2013

Top Retail Architecture Firms [2013 Giants 300 Report]

Callison, Stantec, Gensler top Building Design+Construction's 2013 ranking of the largest retail architecture and architecture/engineering firms in the United States.

| Aug 5, 2013

Top Retail Engineering Firms [2013 Giants 300 Report]

Jacobs, AECOM, Henderson Engineers top Building Design+Construction's 2013 ranking of the largest retail engineering and engineering/architecture firms in the United States.

| Aug 5, 2013

Retail market shows signs of life [2013 Giants 300 Report]

Retail rentals and occupancy are finally on the rise after a long stretch in the doldrums.

| Aug 5, 2013

Top Retail Construction Firms [2013 Giants 300 Report]

Shawmut, Whiting-Turner, PCL top Building Design+Construction's 2013 ranking of the largest retail contractor and construction management firms in the United States.

| Aug 2, 2013

Michael Baker Corp. agrees to be acquired by Integrated Mission Solutions

Michael Baker Corporation (“Baker”) (NYSE MKT:BKR) announced today that it has entered into a definitive merger agreement to be acquired by Integrated Mission Solutions, LLC (“IMS”), an affiliate of DC Capital Partners, LLC (“DC Capital”).

| Jul 31, 2013

Suffolk Construction hires ex-Google exec Woods for business development role

Suffolk Construction, one of the most successful, privately held building contractors in the country, announced it has hired innovative, former Google executive Christopher Woods as its new Executive Vice President of National Business Development. Woods will be responsible for auditing Suffolk’s existing sales approaches and developing new strategies.

| Jul 31, 2013

Hotel, retail sectors bright spots of sluggish nonresidential construction market

A disappointing recovery of the U.S. economy is limiting need for new nonresidential building activity, said AIA Chief Economist, Kermit Baker in the AIA's semi-annual Consensus Construction Forecast, released today. As a result, AIA reduced its projections for 2013 spending to 2.3%.

| Jul 30, 2013

Better planning and delivery sought for VA healthcare facilities

Making Veterans Administration healthcare projects “better planned, better delivered” is the new goal of the VA’s Office of Construction and Facilities Management.

| Jul 30, 2013

Healthcare designers get an earful about controlling medical costs

At the current pace, in 2020 the U.S. will spend $4.2 trillion a year on healthcare; unchecked, waste would hit $1.2 trillion. Yet “waste” is keeping a lot of poorly performing hospitals in business, said healthcare facility experts at the recent American College of Healthcare Architects/AIA Academy of Architecture for Health Summer Leadership Summit in Chicago.