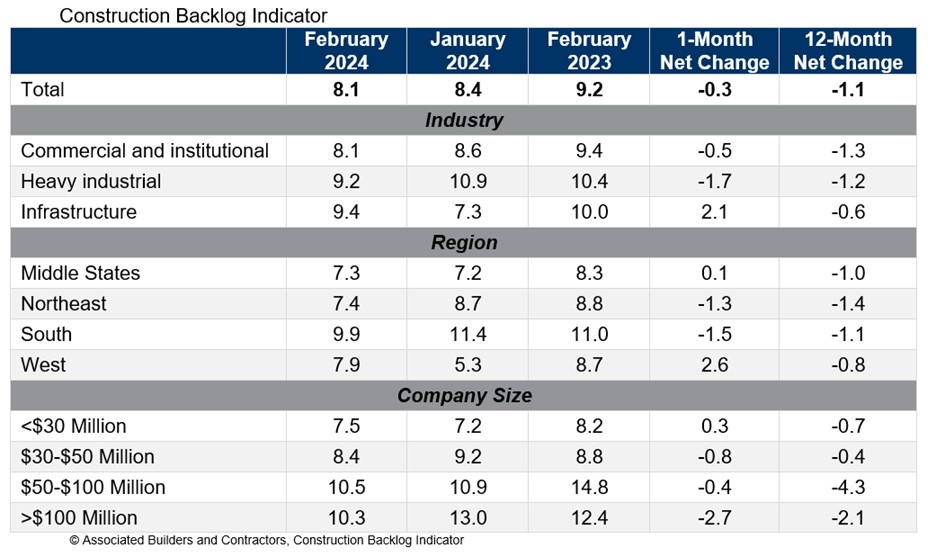

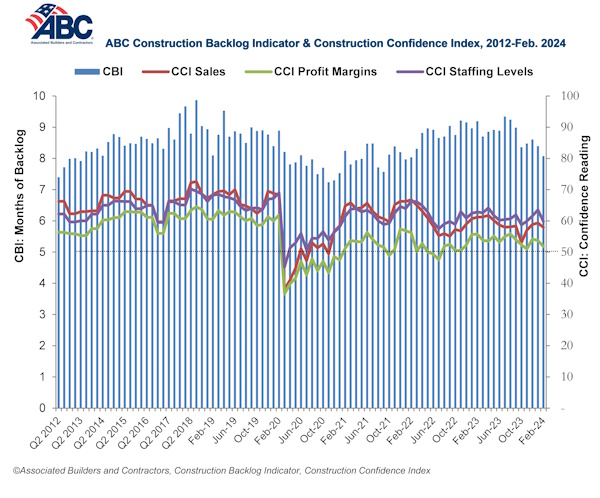

Associated Builders and Contractors reported that its Construction Backlog Indicator declined to 8.1 months in February, according to an ABC member survey conducted Feb. 20 to March 5. The reading is down 1.1 months from February 2023.

Backlog fell for every size of contractor except for those with under $30 million in annual revenues in February. Over the past year, however, the largest contractors—those with greater than $50 million in revenues—have experienced the greatest decline in backlog.

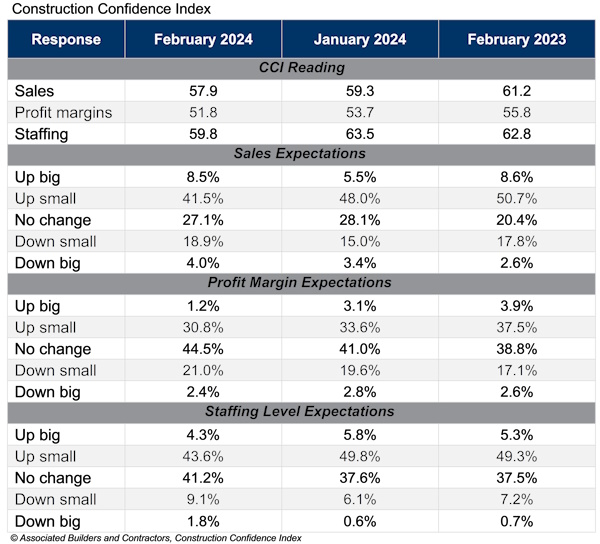

ABC’s Construction Confidence Index readings for sales, profit margins and staffing levels also decreased in February. However, all three readings remain above the threshold of 50, indicating expectations for growth over the next six months.

“Backlog is declining and confidence began to fade modestly in February,” said ABC Chief Economist Anirban Basu. “While it is far too early to predict an industrywide downturn given that confidence readings continue to signal growth along sales, employment and profit margin dimensions, it appears that a rising tide of project cancellations and postponements has begun to make its mark.

“With excess inflation remaining stubbornly durable, at least according to certain measures, interest rates are poised to remain higher for longer,” said Basu. “That gives higher borrowing costs more time to upset the economic momentum that has so surprised economists over the past two years and has provided support for various nonresidential construction activities. With so much federal money still entering the economy, there will continue to be support for growth in certain construction segments, including public works and manufacturing-related megaprojects, but industry weakness is more apparent in segments that rely more purely on private financing.”

Related Stories

| Jul 19, 2013

Reconstruction Sector Engineering Firms [2013 Giants 300 Report]

URS, STV, Wiss Janney Elstner top Building Design+Construction's 2013 ranking of the largest reconstruction engineering and engineering/architecture firms in the U.S.

| Jul 19, 2013

Reconstruction Sector Architecture Firms [2013 Giants 300 Report]

Stantec, HOK, HDR top Building Design+Construction's 2013 ranking of the largest reconstruction architecture and architecture/engineering firms in the U.S.

| Jul 19, 2013

Best in brick: 7 stunning building façades made with brick [slideshow]

The Brick Industry Association named the winners of its 2013 Brick in Architecture Awards. Here are seven winning projects that caught our eye.

| Jul 19, 2013

Construction lags other sectors, but momentum is building: JLL report

Although the construction recovery continues to lag other sectors as well as the overall U.S. economy, the industry is finally seeing a rebound. Commercial real estate giant Jones Lang LaSalle recently released its Summer 2013 Construction Highlights report, which found that there are some sectors (such as energy and high-tech) driving demand for construction, while a few major cities are starting to record increased levels of speculative office building developments.

| Jul 19, 2013

Must see: 220 years of development on Capitol Hill in one snazzy 3D flyover video

The Architect of the Capitol this week released a dramatic video timeline of 220 years of building development on Capitol Hill.

| Jul 18, 2013

Top Local Government Sector Construction Firms [2013 Giants 300 Report]

Turner, Clark Group, PCL top Building Design+Construction's 2013 ranking of the largest local government sector contractor and construction management firms in the U.S.

| Jul 18, 2013

Top Local Government Sector Engineering Firms [2013 Giants 300 Report]

STV, URS, AECOM top Building Design+Construction's 2013 ranking of the largest local government sector engineering and engineering/architecture firms in the U.S.

| Jul 18, 2013

Top Local Government Sector Architecture Firms [2013 Giants 300 Report]

Stantec, HOK, IBI Group top Building Design+Construction's 2013 ranking of the largest local government sector architecture and architecture/engineering firms in the U.S.

| Jul 18, 2013

Top State Government Sector Construction Firms [2013 Giants 300 Report]

PCL, Clark Group, Turner top Building Design+Construction's 2013 ranking of the largest state government sector contractor and construction management firms in the U.S.

| Jul 18, 2013

Top State Government Sector Engineering Firms [2013 Giants 300 Report]

Jacobs, AECOM, URS top Building Design+Construction's 2013 ranking of the largest state government sector engineering and engineering/architecture firms in the U.S.