The Southeast and Texas offer the most favorable conditions for commercial construction, claiming seven of the top 10 markets in CBRE’s inaugural Development Opportunity Index. CBRE’s Index analyzes a spectrum of variables in the 50 largest U.S. markets to determine rate the highest for development opportunities across various asset classes.

U.S. construction activity is expected to bounce back in 2021, after a slowdown in 2020 due to challenges brought by COVID-19, including temporary work stoppages and difficulty sourcing various materials from abroad. Since the start of the pandemic, momentum has varied across commercial real estate sectors – development largely progressed in the multifamily and industrial & logistics sectors, but activity slowed—and in some cases stalled—for retail, hotels and speculative office development.

“We expect to see an uptick tenant fit-out projects in 2021 as employers redesign and reconfigure spaces to accommodate new standards in health, wellness and safety,” said Jim Dobleske, CBRE Global President of Project Management. “Costs, however, aren’t likely to change much; markets with high costs of land and labor won’t get much cheaper, if at all.”

CBRE’s Development Opportunity Index ranks markets based on development conditions including property performance across each of the major commercial real estate asset classes, construction costs, strength of supply, prior and forecast performance.

“Southern states continue to rate highly for development and construction conditions, though investors looking for development opportunities can find them in every market,” said James Millon, a Vice Chairman in CBRE’s Debt & Structured Finance practice. “Southern states often have job growth, in-migration and cost advantages that drive high volumes of construction activity.”

An overall top-10 ranking doesn’t necessarily mean that market is among the best for every asset class.

For example, CBRE’s analysts ranked San Jose as the best positioned market for office construction due to its supply growth and strong absorption. Phoenix – reflecting its shrinking vacancy and strong absorption -- and San Francisco – with strong rent growth – also are attractive office markets for development.

For industrial & logistics construction, Atlanta ranks highest due to its balance of strong inventory growth and net absorption. Also ranking well are Phoenix because of its affordable land and labor, and Dallas due to its relatively low costs and strong population growth.

Houston tops the index of ideal markets for retail construction due to that market’s strong consumer spending and sustained absorption of retail space. Next are Dallas and Atlanta, which both offer stable costs and good absorption of retail space.

For multifamily construction, the top markets are Orlando, Phoenix and Denver. Each offers strong population growth, job gains and relatively low costs.

To download the report, click here.

Related Stories

Market Data | Jan 13, 2020

Construction employment increases by 20,000 in December and 151,000 in 2019

Survey finds optimism about 2020 along with even tighter labor supply as construction unemployment sets record December low.

Market Data | Jan 10, 2020

North America’s office market should enjoy continued expansion in 2020

Brokers and analysts at two major CRE firms observe that tenants are taking longer to make lease decisions.

Market Data | Dec 17, 2019

Architecture Billings Index continues to show modest growth

AIA’s Architecture Billings Index (ABI) score of 51.9 for November reflects an increase in design services provided by U.S. architecture firms.

Market Data | Dec 12, 2019

2019 sets new record for supertall building completion

Overall, the number of completed buildings of at least 200 meters in 2019 declined by 13.7%.

Market Data | Dec 4, 2019

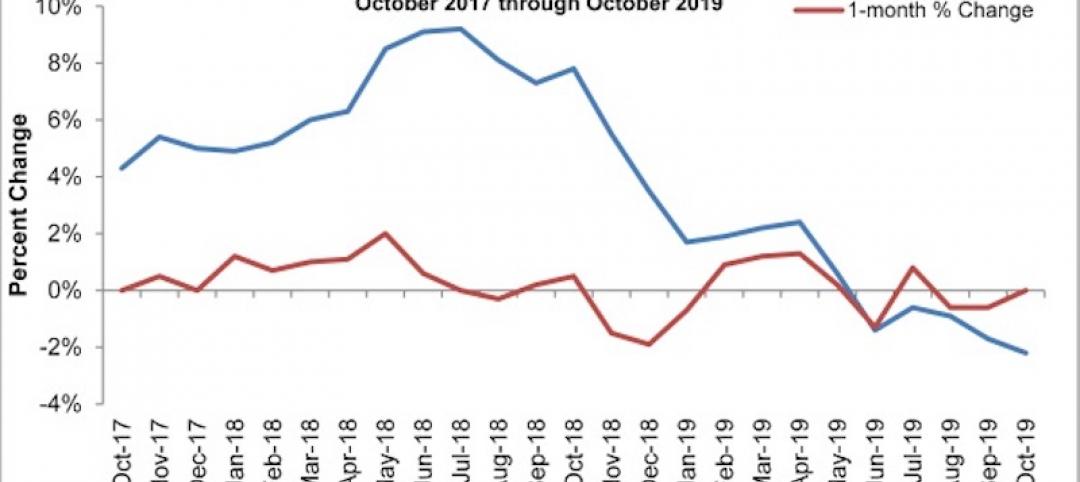

Nonresidential construction spending falls in October

Private nonresidential spending fell 1.2% on a monthly basis and is down 4.3% from October 2018.

Market Data | Nov 25, 2019

Office construction lifts U.S. asking rental rate, but slowing absorption in Q3 raises concerns

12-month net absorption decelerates by one-third from 2018 total.

Market Data | Nov 22, 2019

Architecture Billings Index rebounds after two down months

The Architecture Billings Index (ABI) score in October is 52.0.

Market Data | Nov 14, 2019

Construction input prices unchanged in October

Nonresidential construction input prices fell 0.1% for the month and are down 2.0% compared to the same time last year.

Multifamily Housing | Nov 7, 2019

Multifamily construction market remains strong heading into 2020

Fewer than one in 10 AEC firms doing multifamily work reported a decrease in proposal activity in Q3 2019, according to a PSMJ report.

Market Data | Nov 5, 2019

Construction and real estate industry deals in September 2019 total $21.7bn globally

In terms of number of deals, the sector saw a drop of 4.4% over the last 12-month average.