December 3, 2017 - The American Institute of Architects (AIA) will lobby aggressively in coming days against significant inequities in both the House and Senate versions of the Tax Cuts and Jobs Act, just as the legislation heads into conference.

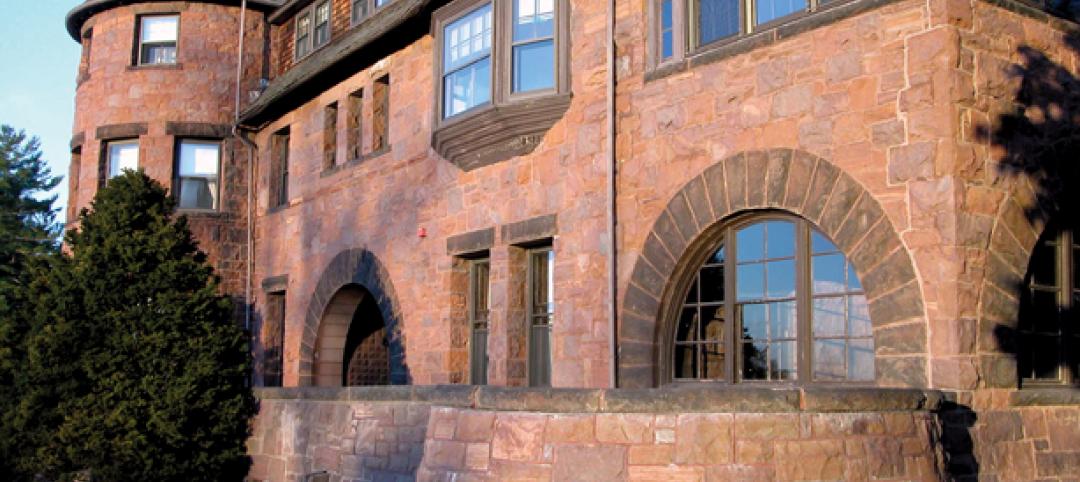

The House legislation abolishes the Historic Tax Credit (HTC), vital to the revitalization of America’s city centers and widely hailed as an economic engine since the Reagan Administration put them into place more than three decades ago. The Senate bill eliminates the current 10 percent credit for pre-1936 structures, and significantly dilutes the current 20 percent credit for certified historic structures by spreading it over a five-year period.

The Senate's tax reform bill allows small businesses that are organized as “pass through” companies (i.e. partnerships, sole proprietorships and S-Corporations) to reduce income through a 23 percent deduction. But, like the House-passed bill, the Senate bill totally excludes certain professional services companies - including all but the smallest architecture firms - from tax relief.

AIA 2017 President Thomas Vonier, FAIA, says:

"By weakening the Historic Tax Credits, Congress and the Administration will hurt historic rehabilitation projects all across the country - something to which architects have been committed for decades. Since 1976, the HTCs have generated some $132 billion in private investment, involving nearly 43,000 projects. The Historic Tax Credit is fundamental to maintaining America's architectural heritage.

"Unfortunately, both bills for some reason continue to exclude architects and other small business service professions by name from lower tax rates. There's no public policy reason to do this. Design and construction firms do much more than provide a service; they produce a major component of the nation's gross domestic product and are a major catalyst for job growth.

"Our members across the country are already mobilized to make sure their Congressional delegations know these views. In the coming days, we will spare no effort to make sure members of the House-Senate conference committee know the views of the AIA's more than 90,000 members on the inequities in both pieces of legislation

"We say this again: tax reforms must achieve three basic goals to ensure the vitality of small business and the health, safety and welfare of our communities:

· Preserve tax policies that support and strengthen small businesses.

· Support innovative, economically vibrant, sustainable and resilient buildings and communities.

· Ensure fairness.

"So far, this legislation still falls well short of these goals. If passed, Congress would be making a terrible mistake."

Related Stories

| Nov 11, 2011

By the Numbers

What do ‘46.9,’ ‘886.2,’ and ‘171,271’ mean to you? Check here for the answer.

| Nov 11, 2011

Streamline Design-build with BIM

How construction manager Barton Malow utilized BIM and design-build to deliver a quick turnaround for Georgia Tech’s new practice facility.

| Nov 11, 2011

AIA: Engineered Brick + Masonry for Commercial Buildings

Earn 1.0 AIA/CES learning units by studying this article and successfully completing the online exam.

| Nov 11, 2011

How Your Firm Can Win Federal + Military Projects

The civilian and military branches of the federal government are looking for innovative, smart-thinking AEC firms to design and construct their capital projects. Our sources give you the inside story.

| Nov 10, 2011

BD+C's 28th Annual Reconstruction Awards

A total of 13 projects recognized as part of BD+C's 28th Annual Reconstruction Awards.

| Nov 10, 2011

Grousbeck Center for Students & Technology opens doors

New Perkins School for the Blind Building is dedicated to innovation, interaction, and independence for students.

| Nov 10, 2011

Skanska Moss to expand and renovate Greenville-Spartanburg International Airport

The multi-phase terminal improvement program consists of an overall expansion to the airport’s footprint and major renovations to the existing airport terminal.

| Nov 10, 2011

Suffolk Construction awarded MBTA transit facility and streetscape project

The 21,000-sf project will feature construction of a cable-stayed pedestrian bridge over Ocean Avenue, an elevated plaza deck above Wonderland MBTA Station, a central plaza, and an at-grade pedestrian crossing over Revere Beach Boulevard

| Nov 10, 2011

Thornton Tomasetti’s Joseph and Choi to co-chair the Council on Tall Buildings and Urban Habitat’s Outrigger Design Working Group

Design guide will describe in detail the application of outriggers within the lateral load resisting systems of tall buildings, effects on building behavior and recommendations for design.