For the second consecutive year, the leading cause of construction contract disputes in North America was errors and/or omissions in contract documents. And while the value of disputes fell by nearly 14% in 2014, the time it took to resolve them lengthened substantially last year.

These are some of the key findings in the “Global Construction Disputes Report 2015,” the fifth such annual report produced by Arcadis, a leading global natural and built asset design and consultancy firm. Its data are based on contract disputes handled by Arcadis’ Construction Claims Consulting teams in North America, Europe, the UK, the Middle East, and Asia.

(Arcadis could not provide statistics on the total value of disputes. But last year it served as a claims consultant on approximately 40 disputes with values up to $100 million last year.)

Globally, the report found an increase in the value and length of disputes, with the most common cause being a failure to properly administer the contract. “This is both a revealing and concerning statistic,” observes Mike Allen, Arcadis’ Global Leader of Contract Solutions. “It raises myriad questions as to how projects and programs are briefed, scoped, [and] structured,” as well as questions about resourcing, training, and contracting environment itself.

The transportation sector accounted for 31% of global contract disputes. And despite the presumed advantages of joint ventures, one in three still ends up in a contract dispute, although that number dips to less than one in five (19.8%) in North America.

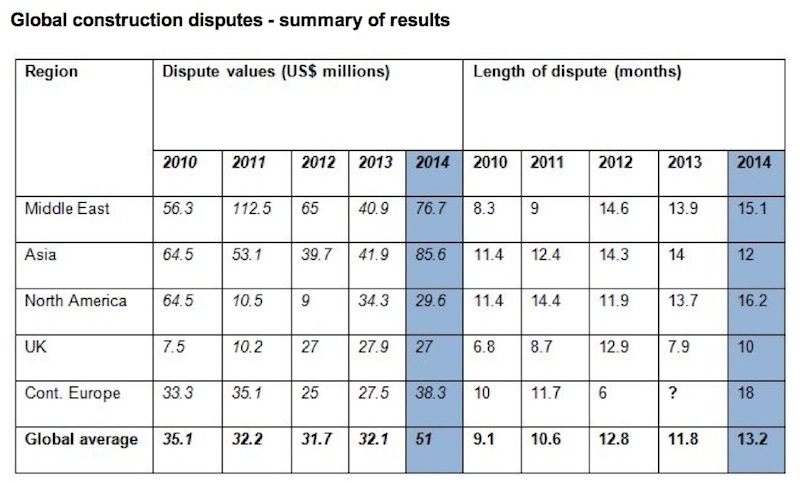

Worldwide, the average value of disputes increased last year to $51 million, from $32.1 million in 2013. The highest average was in Asia, where dispute values more than doubled to $85.6 million. Arcadis attributed the jump primarily to the region’s growth, the complexity of its construction projects, and the rise in joint ventures.

Dispute values in the Middle East rose to $76.7 million, from $40.9 million in 2013. In the UK, dispute values dipped slightly to $27 million.

The average time taken to resolve disputes globally rose to 13.2 months, up from just under 12 months in 2013. All areas of the world saw their resolution processes extend, with the exception of Asia where the average dispute length took two months less than it did the year before.

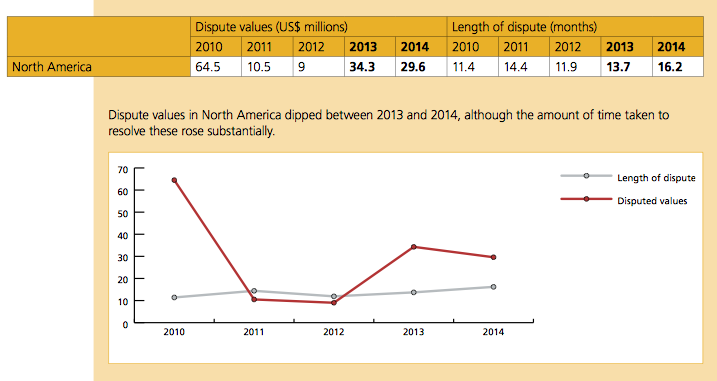

In North America, the length of disputes last year increased by more than 18% to 16.2 months. On the other hand, dispute values dipped by nearly 14% to $29.6 million, and there was evident willingness on behalf of contractual parties “to try and try again to arrive at a settlement” and avoid the inevitably escalating costs associated with formal litigation and negative publicity, said Roy Cooper, Arcadis’ Vice President and Head of Contract Solutions in North America.

For the second year running, the most common cause of disputes in North America during 2014 was errors and/or omissions in the contract documents. Differing site conditions came in second, while a failure to understand or comply with contractual obligations on the part of an employer, contractor or subcontractor was the third most commonly cited reason for a dispute.

With North America’s crumbling infrastructure system in need of a significant overhaul, Cooper sees the construction industry moving towards a program of interconnected projects, rather than discrete projects. But big programs can come with bigger risks, so “failure and high visibility disputes are not an option,” he said. “Owners have turned to alternate project delivery, increased project controls and early intervention to mitigate disputes to help manage that risk.”

The three most common methods of Alternate Dispute Resolution in the U.S. were party-to-party negotiation, mediation, and arbitration.

Still, Arcadis predicts that the number of projects going into dispute would to rise this year globally, with projects accepted for lower margins during economic downturns and labor shortages in some markets likely to prove the catalysts for disputes.

Related Stories

Giants 400 | Jan 29, 2024

Top 140 Office Core and Shell Architecture Firms for 2023

Gensler, Stantec, Page Southerland Page, Perkins&Will, and NBBJ top BD+C's ranking of the nation's largest office core and shell architecture and architecture engineering (AE) firms for 2023, as reported in the 2023 Giants 400 Report.

Giants 400 | Jan 29, 2024

Top 80 Workplace Interior Construction Firms for 2023

STO Building Group, HITT Contracting, Clune Construction, Hensel Phelps, and JRM Construction Management top BD+C's ranking of the nation's largest workplace interior and interior fitout general contractors and construction management (CM) firms for 2023, as reported in the 2023 Giants 400 Report.

Giants 400 | Jan 29, 2024

Top 100 Office Core and Shell Construction Firms for 2023

Turner Construction, AECOM, DPR Construction, Clark Group, and Clayco top BD+C's ranking of the nation's largest office core and shell general contractors and construction management (CM) firms for 2023, as reported in the 2023 Giants 400 Report.

Mixed-Use | Jan 29, 2024

12 U.S. markets where entertainment districts are under consideration or construction

The Pomp, a 223-acre district located 10 miles north of Fort Lauderdale, Fla., and The Armory, a 225,000-sf dining and entertainment venue on six acres in St Louis, are among the top entertainment districts in the works across the U.S.

Industrial Facilities | Jan 29, 2024

How big-ticket, government-funded investments in industrial developments are affecting private construction companies

Large sums of money remain in bank accounts for government-funded programs like the CHIPS Act, the Infrastructure Investment and Jobs Act, and the Inflation Reduction Act. But with opportunities come challenges.

Senior Living Design | Jan 24, 2024

Former Walgreens becomes affordable senior living community

Evergreen Real Estate Group has announced the completion of Bellwood Senior Apartments. The 80-unit senior living community at 542 25th Ave. in Bellwood, Ill., provides independent living options for low-income seniors.

AEC Tech | Jan 24, 2024

4 ways AEC firms can benefit from digital transformation

While going digital might seem like a playground solely for industry giants, the truth is that any company can benefit from the power of technology.

Giants 400 | Jan 23, 2024

Top 55 Parking Structure Construction Firms for 2023

PCL Construction Enterprises, Swinerton, Bomel Construction, McCarthy Holdings, and Alberici-Flintco top BD+C's ranking of the nation's largest parking structure general contractors and construction management (CM) firms for 2023, as reported in the 2023 Giants 400 Report.

Industry Research | Jan 23, 2024

Leading economists forecast 4% growth in construction spending for nonresidential buildings in 2024

Spending on nonresidential buildings will see a modest 4% increase in 2024, after increasing by more than 20% last year according to The American Institute of Architects’ latest Consensus Construction Forecast. The pace will slow to just over 1% growth in 2025, a marked difference from the strong performance in 2023.

Giants 400 | Jan 23, 2024

Top 70 Medical Office Building Construction Firms for 2023

PCL Construction Enterprises, Swinerton, Skanska USA, Clark Group, and Hensel Phelps top BD+C's ranking of the nation's largest medical office building general contractors and construction management (CM) firms for 2023, as reported in the 2023 Giants 400 Report.