Eight percent fewer homes will transact in 2014 than normal, purely due to student loan debt, according to analysis by Rick Palacios, Jr., and Ali Wolf of John Burns Real Estate Consulting.

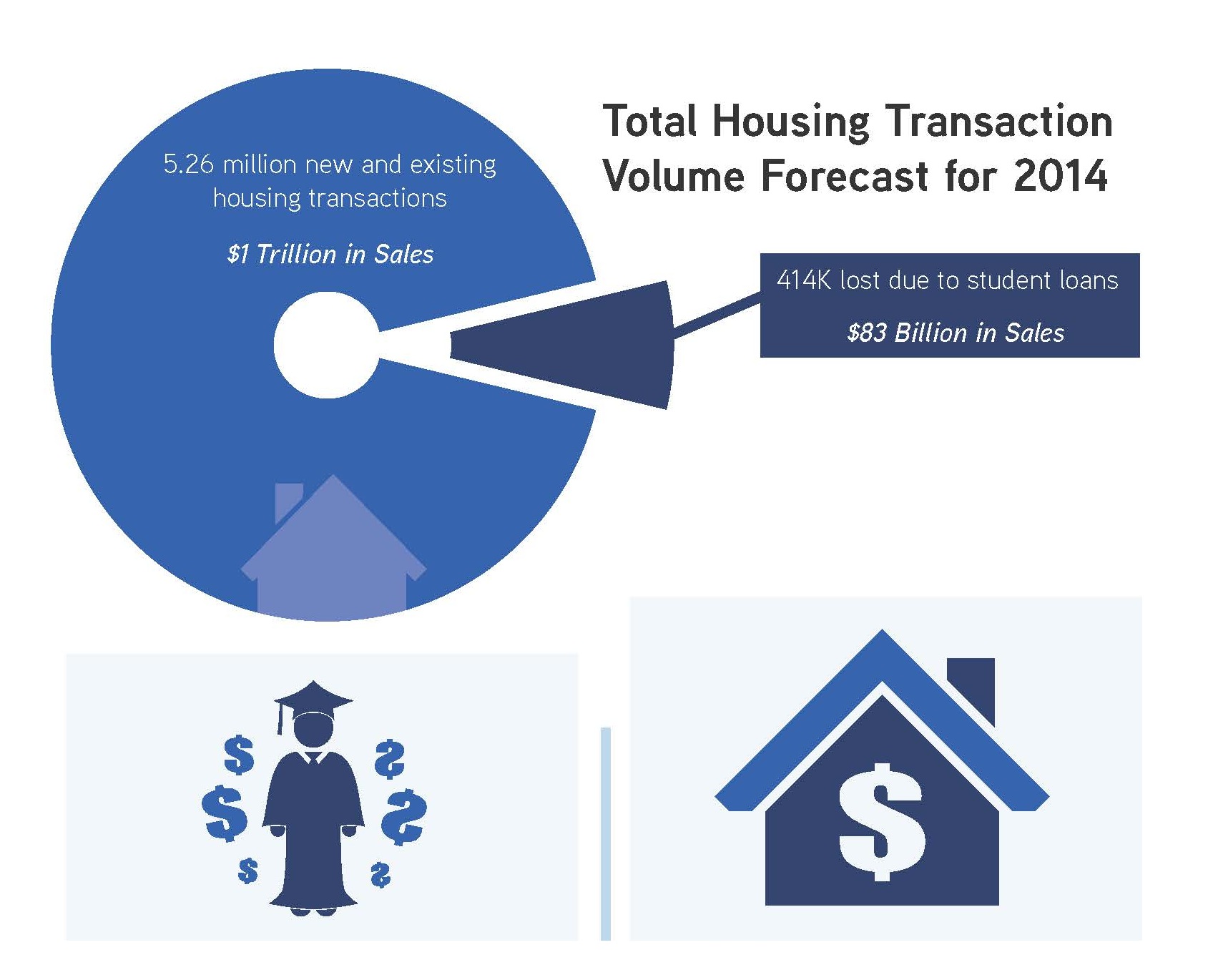

In a new 30-page paper, the firm assesses the impact of student loans on home buying for households under the age of 40. Its conclusion: 414,000 transactions will be lost in 2014 due to student debt. At a typical price of $200,000, that equals $83 billion in lost volume.

Palacios and Wolf explain their methodology and findings:

The analysis was quite complicated and involved a few assumptions, but we believe it is conservative, primarily because we looked only at those under the age of 40 with student debt.

At a high level, the math is as follows:

• Student debt has ballooned from $241 billion to $1.1 trillion in just 11 years.

• 29 million of the 86 million people aged 20-39 have some student debt.

• Those 29 million individuals translate to 16.8 million households.

• Of the 16.8 million households, 5.9 million (or 35%) pay more than $250 per month in student loans, which inhibits at least $44,000 per year in mortgage capability for each of them.

• About 8% of the 20-39 age cohort usually buys a home each year, which would be 1.35 million transactions per year.

• Using previous academic literature as a benchmark for our own complicated calculation, we then estimated that today's purchase rate is reduced from the normal 8% depending on the level of student debt--ranging from 6.9% for those paying less than $100 per month in student loans to less than 1% for those paying over $1,300 per month. Other factors contribute to even less entry-level buying today.

While we applaud the increasing education, we need to realize that it comes with a cost known as student debt. We raised the red flag on student debt back in 2011 and continue to believe that this debt will delay homeownership for many, or at least require that they buy a less expensive home.

Related Stories

Education Facilities | May 22, 2017

Educational design taking lessons from tech firms

Recently, in educational design, we have seen a trend toward more flexible learning spaces.

Architects | May 16, 2017

Architecture that helps children fall in love with the environment

The coming decades present a major ecological challenge... so let’s encourage the next generation to do something about it!

AEC Tech | May 11, 2017

Accelerate Live!: Social media reactions from BD+C's AEC innovation conference

BD+C's inaugural Accelerate Live! innovation conference took place May 11, in Chicago.

Multifamily Housing | May 10, 2017

Triple Treat: Developer transforms mid-rise into unique live-work lofts

Novus Residences’ revolutionary e-lofts concept offers tenants a tempting trio of options—‘live,’ ‘live-work,’ or ‘work’—all on the same floor.

Architects | May 9, 2017

Spiezle Architectural Group looks to the future

Now in its seventh decade, the firm expands its portfolio and moves into a larger HQs.

Architects | May 9, 2017

Movers + Shapers: The social connector

Studio Gang gains fans with buildings that unite people and embrace the outside world.

Architects | May 5, 2017

An acquisition extends Eppstein Uhen Architects’ national footprint

Has architects in 35 states after acquiring Burkettdesign in Denver.

Great Solutions | May 5, 2017

No nails necessary: Framing system comes together with steel zip ties and screws

Clemson University’s School of Architecture develops a patent-pending construction method that is gaining attention for its potential use in rapid, low-tech sustainable housing.

Multifamily Housing | May 3, 2017

Silicon Valley’s high-tech oasis

An award-winning rental complex takes its design cues from its historic location in Silicon Valley.

Architects | May 3, 2017

Avoiding trouble in paradise: Tips on building successfully in the Caribbean

The island setting itself is at the root of several of these disruptive assumptions.