Altus Group Limited (“Altus Group”) (TSX: AIF), a provider of software, data solutions and independent advisory services to the global commercial real estate industry, recently released the Altus Group Real Estate Development Trends Report, which provides an outlook of a global property development industry being hit by rapid change from disruptive market forces that did not exist a few years ago or have evolved substantially.

According to the report, which is based on a global survey of more than 400 property development executives, 68% said cost escalation is the biggest business challenge they are facing over the next five years. Several related factors account for this, which in combination are creating a ‘domino effect’ for developers:

- 34% of developers view cross-border trade policy as having a negative impact on the industry as uncertainty continues about future implications stemming from international tariffs and trade agreements

- 65% of developers are facing challenges with labour shortages, which are exacerbated by government policy and booming demand

- 60% of developers are concerned about the development approval process which is often complex and protracted

“It’s clear from the report that the global development sector is facing an increasingly complex set of challenges and rapid change, from escalating construction costs through to a sea-change in the development financing environment,” said Bob Courteau, Chief Executive Officer, Altus Group. “However, development leaders clearly see significant opportunities to manage risk and take advantage of changing conditions through a number of future-ready strategies including investments in technology and performance management along with consideration of new ways of managing and financing projects.”

When asked about the impact of emerging technologies on the property development industry, many respondents expressed a significant degree of uncertainty around some technologies that are experiencing successful application and adoption in other industries. Only a minority of respondents recognized a potential for major disruptive change with certain technologies:

- 3D printing – 65% see little to no impact / 16% anticipate major disruptive change

- Process automation – 56% see little to no impact / 22% anticipate major disruptive change

- Augmented reality/Virtual reality – 45% see little to no impact / 20% anticipate major disruptive change

Development industry leaders seem to have significant reservations about the potential impact of 3D printing, a rapidly evolving technology which is already being applied successfully to smaller scale development projects in countries such as China, Netherlands and USA.

Respondents, however, appeared to acknowledge the potential of more established technologies. Smart building technologies were regarded as the most disruptive, with 49% expecting major disruptive changes, and 42% anticipating a significant impact on efficiencies and how development is conducted.

Finally, the report also indicated a decade-on shift since the financial crisis in financing patterns, away from traditional and institutional lending, with 82% of respondents reporting they were utilizing at least one source of alternative financing while 46% are using traditional or institutional financing. Further, over 45% indicated they were considering, planning or utilizing some form of alternative financing exclusively.

This shift has coincided with a rapidly expanding range of financial options and sources coupled with a substantial increase in global capital inflow into real estate in recent years. Many alternative lenders and private funds have actively positioned themselves toward the space of traditional lenders, with investors increasingly seeing real estate as an income source as well as an opportunity for premium returns on the equity and joint venture structure side. In addition, there has been an increase and acceleration in the adoption and utilization of real estate joint ventures with 62% of development executives indicating they are considering entering into partnerships or joint ventures.

Related Stories

Market Data | May 18, 2020

5 must reads for the AEC industry today: May 18, 2020

California's grid can support all-electric buildings and you'll miss your office when it's gone.

Market Data | May 15, 2020

6 must reads for the AEC industry today: May 15, 2020

Nonresidential construction employment sees record loss and Twitter will keep all of its office space.

Market Data | May 15, 2020

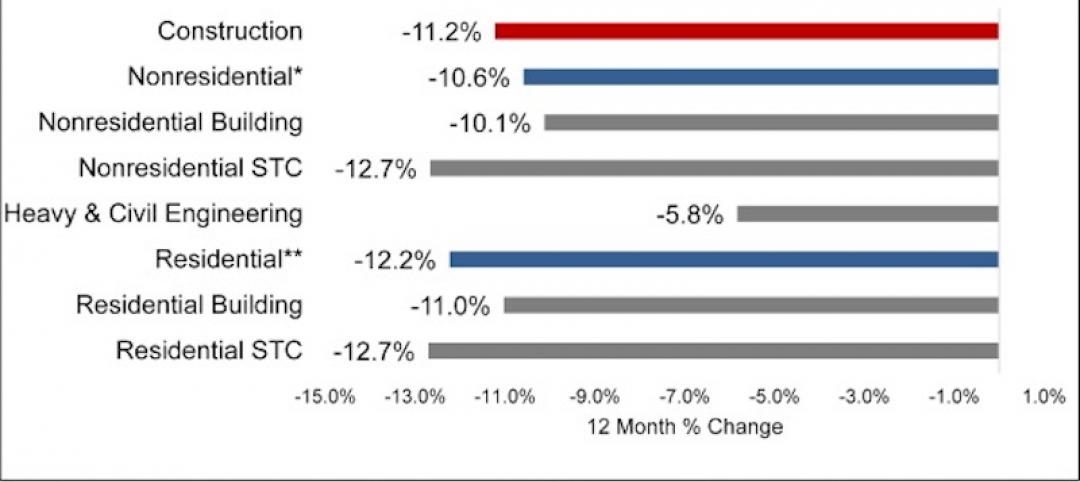

Nonresidential construction employment sees record loss in April

The construction unemployment rate was 16.6% in April, up 11.9 percentage points from the same time last year.

Market Data | May 14, 2020

5 must reads for the AEC industry today: May 14, 2020

The good news about rent might not be so good and some hotel developers consider whether to abandon projects.

Market Data | May 13, 2020

House democrats' coronavirus measure provides some relief for contractors, but lacks other steps needed to help construction

Construction official says new highway funding, employee retention credits and pension relief will help, but lack of safe harbor measure, Eextension of unemployment bonus will undermine recovery.

Market Data | May 13, 2020

5 must reads for the AEC industry today: May 13, 2020

How to design resilient libraries in a post-covid world and vacation real-estate markets are 'toast.'

Market Data | May 12, 2020

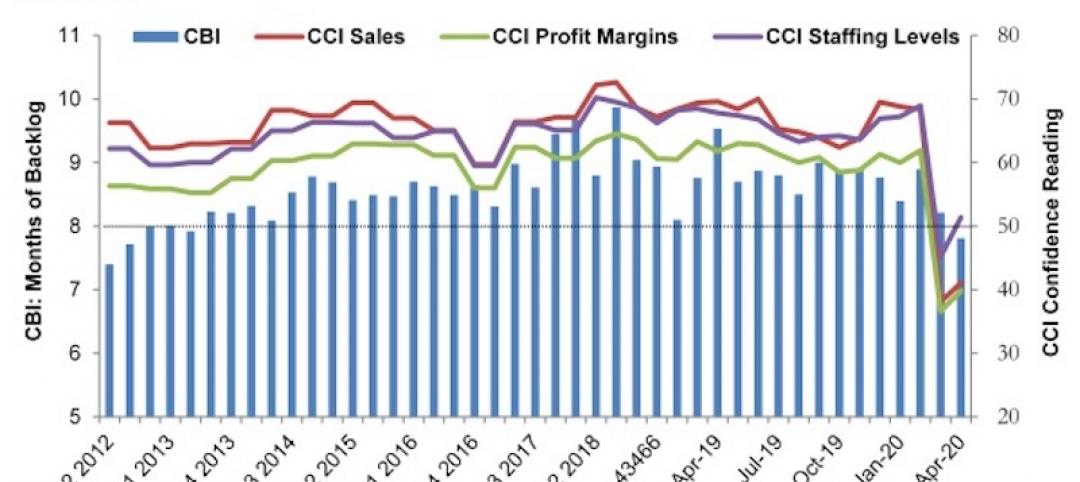

ABC’s Construction Backlog Indicator falls in April; Contractor Confidence rebounds from historic lows

Nonresidential construction backlog is down 0.4 months compared to the March 2020 ABC survey and 1.7 months from April 2019.

Market Data | May 12, 2020

6 must reads for the AEC industry today: May 12, 2020

A 13-point plan to reduce coronavirus deaths in nursing homes and Bjarke Ingels discusses building on Mars.

Market Data | May 11, 2020

Interest in eSports is booming amid COVID-19

The industry has proved largely immune to the COVID-19 pandemic due to its prompt transition into online formats and sudden spike in interest from traditional sports organizations.

Market Data | May 11, 2020

6 must reads for the AEC industry today: May 11, 2020

Nashville residential tower will rise 416 feet and the construction industry loses 975,000 jobs.