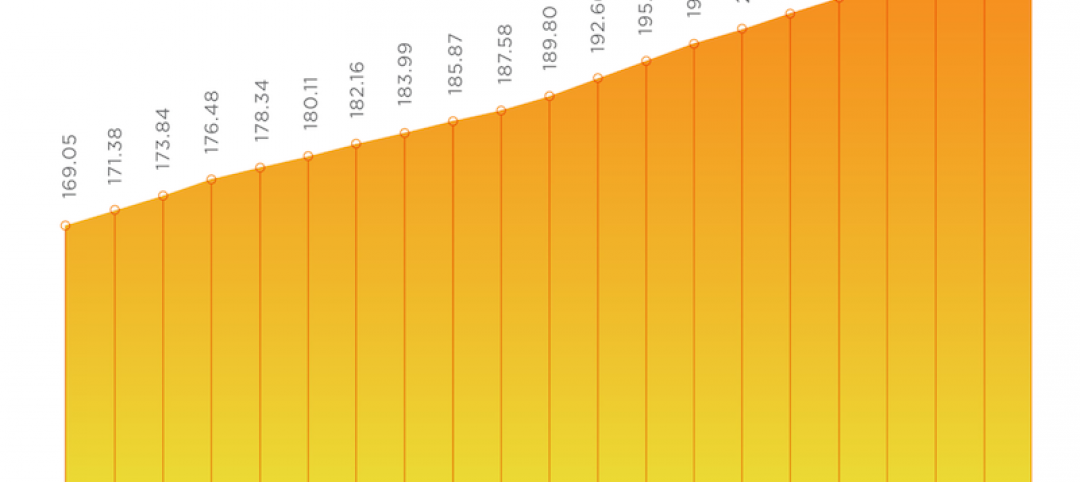

Based on data from over *11,000 tracked large-scale country wide construction projects, GlobalData, a leading data and analytics company, finds that 10 major US states account for nearly 60% of the total US construction project pipeline value (US$3.7 trillion).

GlobalData’s latest report: ‘Project Insight - Construction in Key US States’ reveals that, California, Texas and New York are among the states with the highest value of construction projects in the pipeline. With a total of 1,302 projects worth US$524.6bn, California, for example, has both the largest number and value of projects in the US construction project pipeline, with infrastructure projects and mixed-use developments, representing a combined 56% of California’s total pipeline value.

Dariana Tani, Economist at GlobalData explains: “The construction of mixed-use developments is booming across many US states, with the building of American city centers and suburbs coming to resemble one another due to changing demands from consumers and homebuyers. This is particularly the case for states such as Florida, California and New York. In Florida, the construction of mixed-use properties is growing faster than any other US state, with five of the top 10 largest construction projects in Florida being mixed-use construction projects, according to GlobalData.”

The desire to live, work, shop and play within walkable distances is not only unique to millennials and baby boomers, but also older generations who want to live in well-connected urban communities.

Tani adds: “The tech industry is also creating new demand to build more residential and commercial buildings, as well as transport infrastructure to accommodate the influx of workers. Big tech companies such as Google, Apple, Facebook, Microsoft and Amazon are encouraging significant investment. Among the most notable projects in the pipeline are Facebook’s US$850m Willow Campus Mixed-Use Development in San Francisco, Google’s US$800m Residential Development in Mountain View and Microsoft’s US$1bn Redmond Headquarters Redevelopment.”

*These projects are at all stages of development from announcement to execution.

Related Stories

Market Data | Jan 19, 2021

Architecture Billings continue to lose ground

The pace of decline during December accelerated from November.

Market Data | Jan 19, 2021

2021 construction forecast: Nonresidential building spending will drop 5.7%, bounce back in 2022

Healthcare and public safety are the only nonresidential construction sectors that will see growth in spending in 2021, according to AIA's 2021 Consensus Construction Forecast.

Market Data | Jan 13, 2021

Atlanta, Dallas seen as most favorable U.S. markets for commercial development in 2021, CBRE analysis finds

U.S. construction activity is expected to bounce back in 2021, after a slowdown in 2020 due to challenges brought by COVID-19.

Market Data | Jan 13, 2021

Nonres construction could be in for a long recovery period

Rider Levett Bucknall’s latest cost report singles out unemployment and infrastructure spending as barometers.

Market Data | Jan 13, 2021

Contractor optimism improves as ABC’s Construction Backlog inches up in December

ABC’s Construction Confidence Index readings for sales, profit margins, and staffing levels increased in December.

Market Data | Jan 11, 2021

Turner Construction Company launches SourceBlue Brand

SourceBlue draws upon 20 years of supply chain management experience in the construction industry.

Market Data | Jan 8, 2021

Construction sector adds 51,000 jobs in December

Gains are likely temporary as new industry survey finds widespread pessimism for 2021.

Market Data | Jan 7, 2021

Few construction firms will add workers in 2021 as industry struggles with declining demand, growing number of project delays and cancellations

New industry outlook finds most contractors expect demand for many categories of construction to decline.

Market Data | Jan 5, 2021

Barely one-third of metros add construction jobs in latest 12 months

Dwindling list of project starts forces contractors to lay off workers.

Market Data | Jan 4, 2021

Nonresidential construction spending shrinks further in November

Many commercial projects languish, even while homebuilding soars.