Despite what it describes as a “chaotic” year saddled with labor shortages and interest-rate creep, the American Institute of Architects (AIA) estimates that spending for nonresidential construction increased by nearly 8% in 2016. That growth is expected to continue for “another couple of years,” albeit somewhat more modestly.

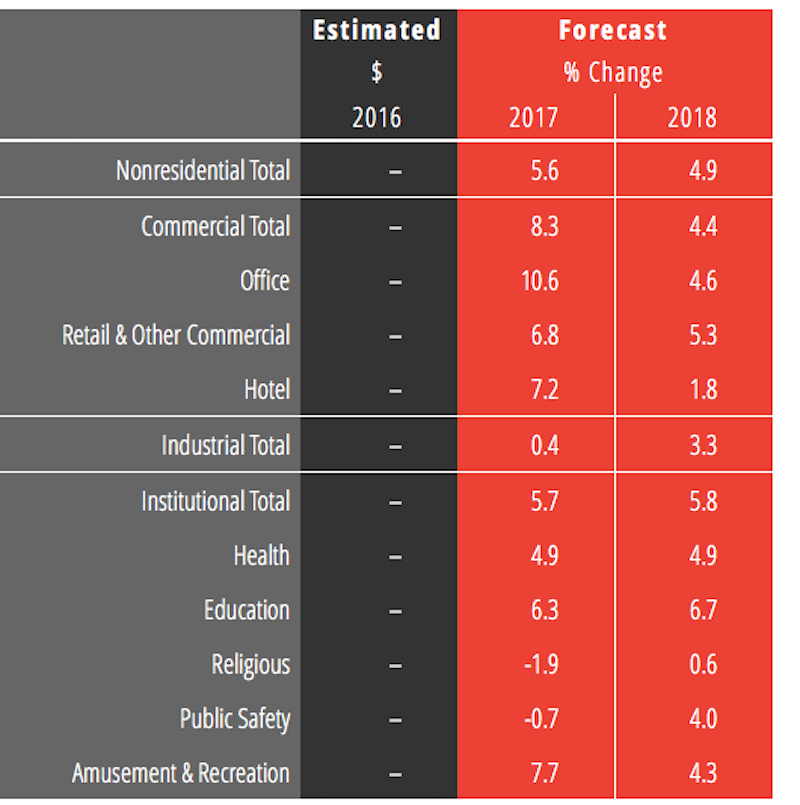

The AIA Consensus Forecast projects a 5.6% increase in nonres construction spending this year, and 4.8% in 2018, with commercial and industrial sectors growing at slower rates. (AIA did not include dollar amounts with its forecast.) And certain sectors, such as offices and hotels, are expected to cool considerably.

Offices, which increased by more than 20% in 2016, will grow 10.6% this year and by 4.6% in 2018, by AIA’s reckoning. Hotel spending, up 25% last year, should rise by 7.2% in 2017, but only by 1.8% the following year, according to AIA projections. Spending on healthcare building is expected to stay at nearly 5% growth this year and next.

Office construction spending is expected to stay relatively strong this year, with some fading in 2018. But hotel construction is expected to experience a significant decline. Image: AIA Consensus Construction Forecast.

AIA’s forecast is in line with other industry watchers, with the notable exception of a rosier portrait painted by Dodge Data and Analytics, which estimates that nonres spending, at $406.9 billion last year, will increase by 8.2% this year and by 7.3% in 2018. Dodge is far more bullish than AIA on office construction. But it also sees negative growth in the hotel sector in 2018.

On the flip side, FMI expects growth this year to be only 4.4%, and 4.1% in 2018, and foresees a weaker industrial sector than some of the other prognosticators.

Kermit Baker, Hon. AIA, AIA’s chief economist, addressed several issues affecting construction spending that could be impacted by the new Trump administration. For example, infrastructure spending, which is currently at about $1.2 trillion a year, could get a big boost if proposals to spend another $1 trillion over the next decade are realized.

The proposed repeal of the Affordable Care Act, and what would replace it are serious concerns for a construction industry where healthcare accounts for about 10% of total spending.

Trump has also promised “massive” regulatory rollbacks, especially on the environment front. Baker cites an NAHB study posted last May that attributes 24.3% of the price of a single-family home to government regulations. (Three-fifths of this is due to higher finished lot costs resulting from regulations.)

Baker also touches immigration restrictions that could “exacerbate an already serious labor problem” in a construction industry that is “most reliant on immigration for its workforce.”

On the whole, though, AIA is “quite positive” about the prospects for the construction sector, which it expects to outperform the broader economy over the next two years. However, AIA also see an industry “on the down side of this construction cycle.” The commercial sector is expected to show signs of slowing first, and AIA foresees its growth rate dropping from 17% in 2017, to 8% this year and just over 4% in 2018.

“Being this late in the cycle, the industry is more vulnerable to external disruptions, and the list of possibilities in this category is very long at present,” Baker writes.

Related Stories

Market Data | May 2, 2018

Nonresidential Construction down in March, private sector falters, public sector unchanged

February’s spending estimate was revised roughly $10 billion higher.

Market Data | Apr 30, 2018

Outlook mixed for renewable energy installations in Middle East and Africa region

Several major MEA countries are actively supporting the growth of renewable energy.

Market Data | Apr 12, 2018

Construction costs climb in March as wide range of input costs jump

Association officials urge Trump administration, congress to fund infrastructure adequately as better way to stimulate demand than tariffs that impose steep costs on contractors and project owners.

Market Data | Apr 9, 2018

Construction employers add 228,000 jobs over the year despite dip in March

Average hourly earnings increase to $29.43 in construction, topping private sector by nearly 10%; Association officials urge updating and better funding programs to train workers for construction jobs.

Market Data | Apr 4, 2018

Construction employment increases in 257 metro areas between February 2017 & 2018 as construction firms continue to expand amid strong demand

Riverside-San Bernardino-Ontario, Calif. and Merced, Calif. experience largest year-over-year gains; Baton Rouge, La. and Auburn-Opelika, Ala. have biggest annual declines in construction employment.

Market Data | Apr 2, 2018

Construction spending in February inches up from January

Association officials urge federal, state and local officials to work quickly to put recently enacted funding increases to work to improve aging and over-burdened infrastructure, offset public-sector spending drops.

Market Data | Mar 29, 2018

AIA and the University of Minnesota partner to develop Guides for Equitable Practice

The Guides for Equitable Practice will be developed and implemented in three phase.

Market Data | Mar 22, 2018

Architecture billings continue to hold positive in 2018

Billings particularly strong at firms in the West and Midwest regions.

Market Data | Mar 21, 2018

Construction employment increases in 248 metro areas as new metal tariffs threaten future sector job gains

Riverside-San Bernardino-Ontario, Calif., and Merced, Calif., experience largest year-over-year gains; Baton Rouge, La., and Auburn-Opelika, Ala., have biggest annual declines in construction employment.

Market Data | Mar 19, 2018

ABC's Construction Backlog Indicator hits a new high: 2018 poised to be a very strong year for construction spending

CBI is up by 1.36 months, or 16.3%, on a year-over-year basis.