Despite what it describes as a “chaotic” year saddled with labor shortages and interest-rate creep, the American Institute of Architects (AIA) estimates that spending for nonresidential construction increased by nearly 8% in 2016. That growth is expected to continue for “another couple of years,” albeit somewhat more modestly.

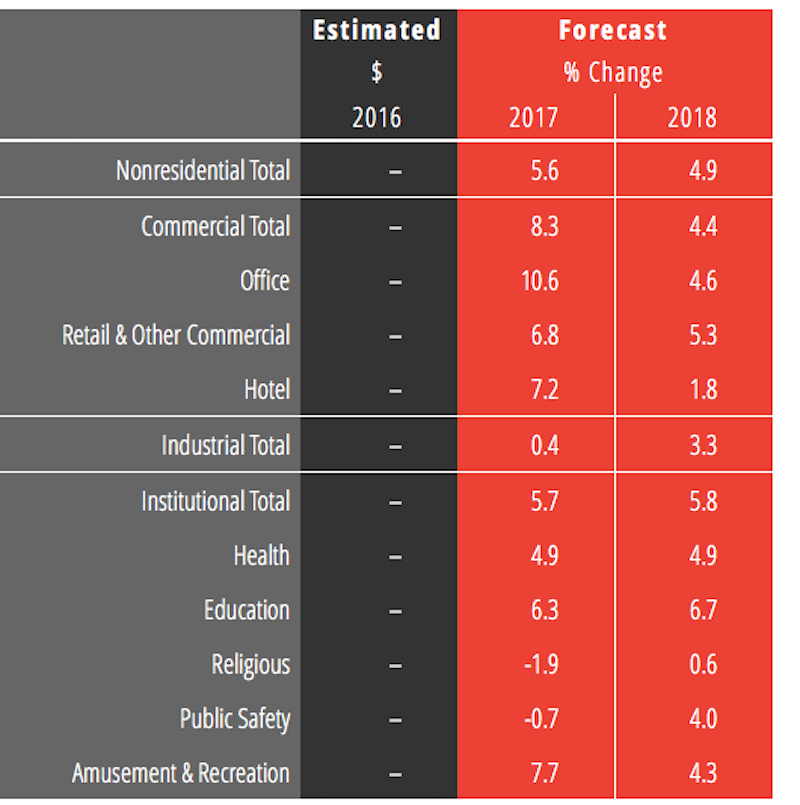

The AIA Consensus Forecast projects a 5.6% increase in nonres construction spending this year, and 4.8% in 2018, with commercial and industrial sectors growing at slower rates. (AIA did not include dollar amounts with its forecast.) And certain sectors, such as offices and hotels, are expected to cool considerably.

Offices, which increased by more than 20% in 2016, will grow 10.6% this year and by 4.6% in 2018, by AIA’s reckoning. Hotel spending, up 25% last year, should rise by 7.2% in 2017, but only by 1.8% the following year, according to AIA projections. Spending on healthcare building is expected to stay at nearly 5% growth this year and next.

Office construction spending is expected to stay relatively strong this year, with some fading in 2018. But hotel construction is expected to experience a significant decline. Image: AIA Consensus Construction Forecast.

AIA’s forecast is in line with other industry watchers, with the notable exception of a rosier portrait painted by Dodge Data and Analytics, which estimates that nonres spending, at $406.9 billion last year, will increase by 8.2% this year and by 7.3% in 2018. Dodge is far more bullish than AIA on office construction. But it also sees negative growth in the hotel sector in 2018.

On the flip side, FMI expects growth this year to be only 4.4%, and 4.1% in 2018, and foresees a weaker industrial sector than some of the other prognosticators.

Kermit Baker, Hon. AIA, AIA’s chief economist, addressed several issues affecting construction spending that could be impacted by the new Trump administration. For example, infrastructure spending, which is currently at about $1.2 trillion a year, could get a big boost if proposals to spend another $1 trillion over the next decade are realized.

The proposed repeal of the Affordable Care Act, and what would replace it are serious concerns for a construction industry where healthcare accounts for about 10% of total spending.

Trump has also promised “massive” regulatory rollbacks, especially on the environment front. Baker cites an NAHB study posted last May that attributes 24.3% of the price of a single-family home to government regulations. (Three-fifths of this is due to higher finished lot costs resulting from regulations.)

Baker also touches immigration restrictions that could “exacerbate an already serious labor problem” in a construction industry that is “most reliant on immigration for its workforce.”

On the whole, though, AIA is “quite positive” about the prospects for the construction sector, which it expects to outperform the broader economy over the next two years. However, AIA also see an industry “on the down side of this construction cycle.” The commercial sector is expected to show signs of slowing first, and AIA foresees its growth rate dropping from 17% in 2017, to 8% this year and just over 4% in 2018.

“Being this late in the cycle, the industry is more vulnerable to external disruptions, and the list of possibilities in this category is very long at present,” Baker writes.

Related Stories

Market Data | Nov 9, 2021

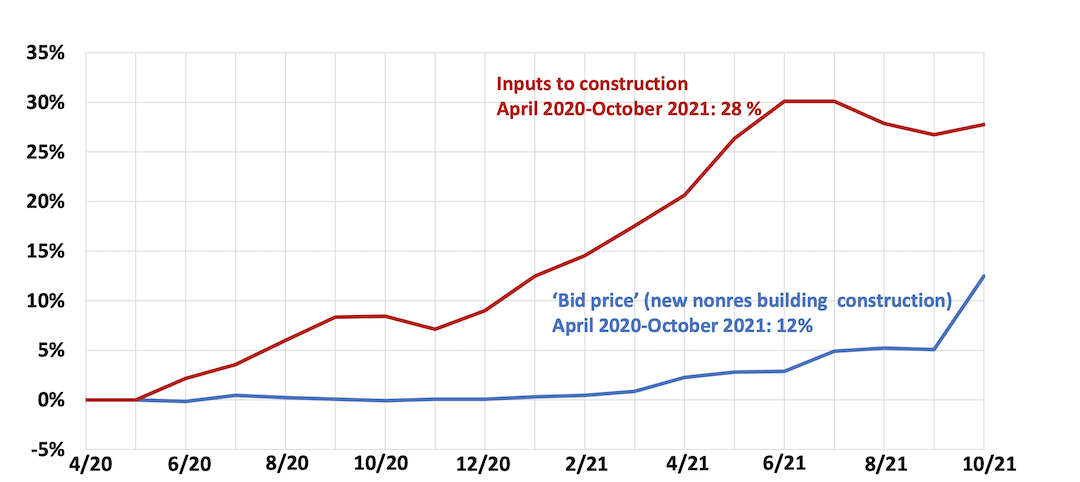

Continued increases in construction materials prices starting to drive up price of construction projects

Supply chain and labor woes continue.

Market Data | Nov 5, 2021

Construction firms add 44,000 jobs in October

Gain occurs even as firms struggle with supply chain challenges.

Market Data | Nov 3, 2021

One-fifth of metro areas lost construction jobs between September 2020 and 2021

Beaumont-Port Arthur, Texas and Sacramento--Roseville--Arden-Arcade Calif. top lists of gainers.

Market Data | Nov 2, 2021

Construction spending slumps in September

A drop in residential work projects adds to ongoing downturn in private and public nonresidential.

Hotel Facilities | Oct 28, 2021

Marriott leads with the largest U.S. hotel construction pipeline at Q3 2021 close

In the third quarter alone, Marriott opened 60 new hotels/7,882 rooms accounting for 30% of all new hotel rooms that opened in the U.S.

Hotel Facilities | Oct 28, 2021

At the end of Q3 2021, Dallas tops the U.S. hotel construction pipeline

The top 25 U.S. markets account for 33% of all pipeline projects and 37% of all rooms in the U.S. hotel construction pipeline.

Market Data | Oct 27, 2021

Only 14 states and D.C. added construction jobs since the pandemic began

Supply problems, lack of infrastructure bill undermine recovery.

Market Data | Oct 26, 2021

U.S. construction pipeline experiences highs and lows in the third quarter

Renovation and conversion pipeline activity remains steady at the end of Q3 ‘21, with conversion projects hitting a cyclical peak, and ending the quarter at 752 projects/79,024 rooms.

Market Data | Oct 19, 2021

Demand for design services continues to increase

The Architecture Billings Index (ABI) score for September was 56.6.

Market Data | Oct 14, 2021

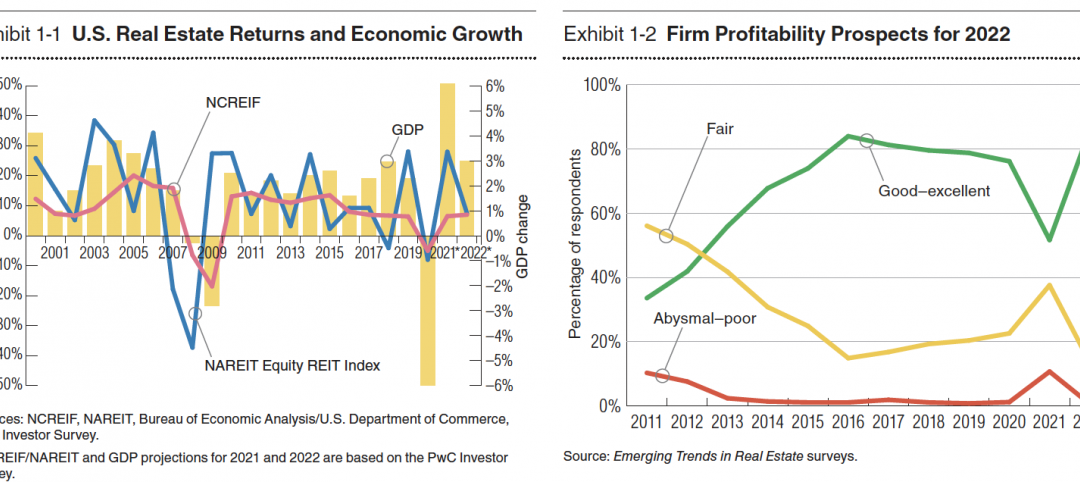

Climate-related risk could be a major headwind for real estate investment

A new trends report from PwC and ULI picks Nashville as the top metro for CRE prospects.