Artificial intelligence (AI) is the next big step for retail and FMCG companies following the implementation of advanced big data and analytics (BDA) solutions, which can unlock huge data volumes in an automated way in real-time and ultimately lead to maximum profitability, according to data and analytics company GlobalData.

The company’s Disruptor Database revealed that although retailers have grown to their current size by capitalizing on profitable bits of digitalization, they are often challenged in understanding what their customers need at scale. There is a colossal amount of customer data with enterprises, but only a handful are able to generate value deemed from low conversion rates of below 5% overall.

This broadens the scope for retailers and consumer goods companies to use predictive analytics to enhance decisions related to supply chain management, customer behavior, staff allocation and the likelihood of goods being damaged, lost or returned.

Rena Bhattacharyya, Technology Research Director at GlobalData, says: “While most analysis related to understanding market trends, achieving greater customer personalization, and improving operational efficiency can be performed with BDA methods, AI in many cases is less cost intensive and faster - at times even instant.. Intelligent machine learning systems can replace expensive armies of data scientists and provide solutions or product recommendations in an automated way. The timing of the analytics is crucial, since opportunities for cost savings or additional sales are frequently limited to minutes or even seconds.”

What made their way through the experimental phase of AI in FMCG and retail are the use cases related to predictive analytics. For example, thanks to the integration of machine learning, eBay is now able to help sellers on its platform with solutions ranging from delivery time to fraud detection. It can also discover gaps in inventory of a particular product and alert related sellers to stock up on that item, as well as make price recommendations based on trending events automatically.

Procter & Gamble used deep learning technology to create a skin advisor service for its Olay brand. After screening millions of selfies and spotting key age characteristics, Olay’s service can provide women with personalized product recommendations based on skin analysis.

Leading retailers including Amazon, Alibaba, Lowe’s and Tesco are developing their own AI solutions for automation, analytics and robotics use cases. At the same time, many retailers have not implemented any AI solutions yet and are likely to fall behind their competitors.

“AI is the path to maximum profitability. It will be the technology platform that reaps the biggest rewards. Retail and FMCG companies looking to launch AI-based solutions should start by understanding the needs of their target customer base, focus on providing an omnichannel experience, and strive to achieve cost savings through greater efficiency,” concludes Bhattacharyya.

Related Stories

Market Data | Sep 28, 2021

Design-Build projects should continue to take bigger shares of construction spending pie over next five years

FMI’s new study finds collaboration and creativity are major reasons why owners and AEC firms prefer this delivery method.

Market Data | Sep 22, 2021

Architecture billings continue to increase

The ABI score for August was 55.6, up from July’s score of 54.6.

Market Data | Sep 20, 2021

August construction employment lags pre-pandemic peak in 39 states

The coronavirus delta variant and supply problems hold back recovery.

Market Data | Sep 15, 2021

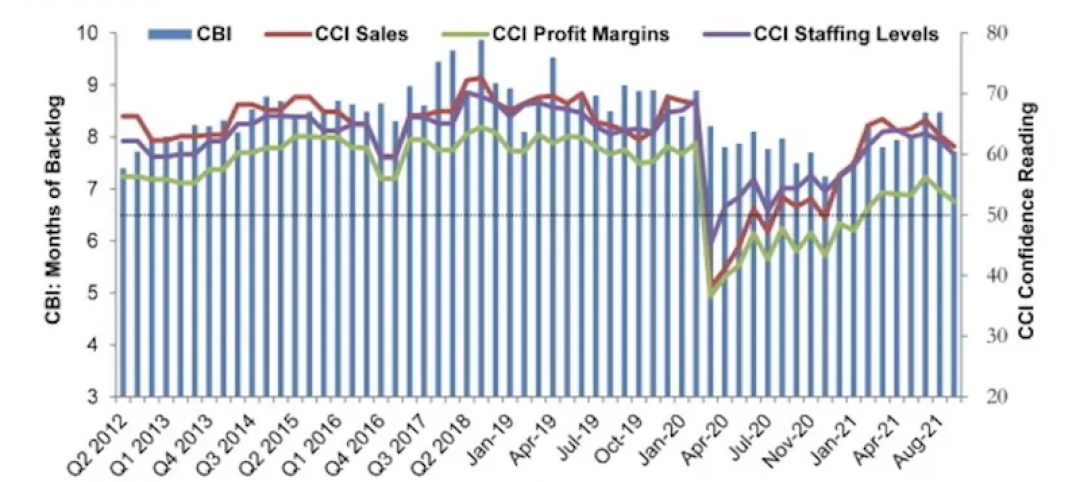

ABC’s Construction Backlog Indicator plummets in August; Contractor Confidence down

ABC’s Construction Confidence Index readings for sales, profit margins and staffing levels all fell modestly in August.

Market Data | Sep 7, 2021

Construction sheds 3,000 jobs in August

Gains are limited to homebuilding as other contractors struggle to fill both craft and salaried positions.

Market Data | Sep 3, 2021

Construction workforce shortages reach pre-pandemic levels

Coronavirus continues to impact projects and disrupt supply chains.

Multifamily Housing | Sep 1, 2021

Top 10 outdoor amenities at multifamily housing developments for 2021

Fire pits, lounge areas, and covered parking are the most common outdoor amenities at multifamily housing developments, according to new research from Multifamily Design+Construction.

Market Data | Sep 1, 2021

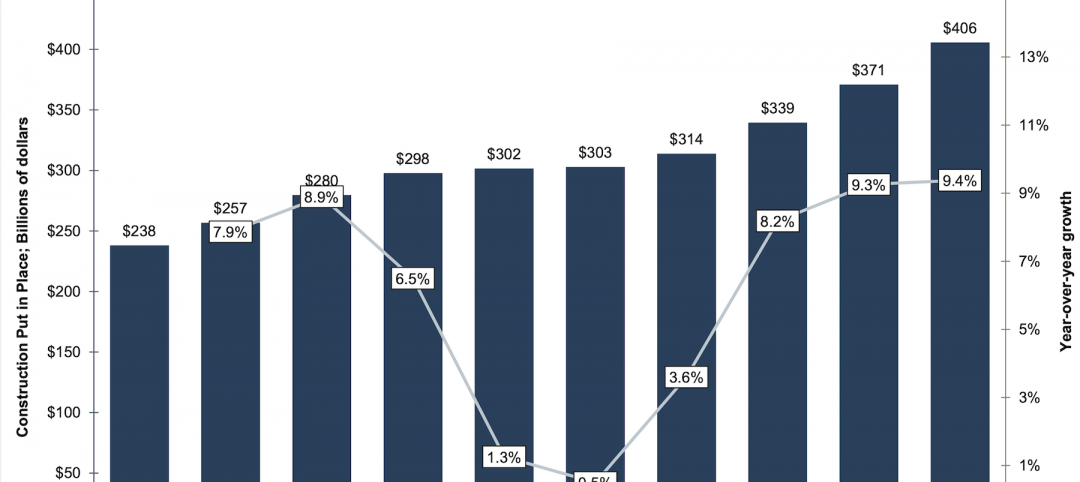

Construction spending posts small increase in July

Coronavirus, soaring costs, and supply disruptions threaten to erase further gains.

Market Data | Sep 1, 2021

Bradley Corp. survey finds office workers taking coronavirus precautions

Due to the rise in new strains of the virus, 70% of office workers have implemented a more rigorous handwashing regimen versus 59% of the general population.

Market Data | Aug 31, 2021

Three out of four metro areas add construction jobs from July 2020 to July 2021

COVID, rising costs, and supply chain woes may stall gains.