Construction costs escalated in February, driven by price increases for a wide range of building materials including steel and aluminum, according to an analysis by the Associated General Contractors of America of Labor Department data released today. Association officials warned that newly imposed tariffs on those metals will create steeper increases that will squeeze budgets for infrastructure, school districts and commercial projects.

"Price increases have accelerated for many construction materials in the last two years, with additional increases already announced, and others on the way as soon as tariffs on steel and aluminum take effect," said the association's chief economist, Ken Simonson. "Contractors will be forced to pass these cost increases along in bid prices, but that will mean fewer projects get built. And contractors that are already working on projects for which they have not bought some materials are at risk of absorbing large losses."

The producer price index for inputs to construction industries—a measure of all goods and services used in construction projects including items consumed by contractors, such as diesel fuel—rose 0.6% in February alone and 4.4% over 12 months. The index increased by 4.2% in 2017 and just 0.9% in 2016, the economist noted.

"Many materials contributed to the latest round of increases," Simonson observed. "Moreover, today's report only reflects prices charged as of mid-February. Since then, producers of steel and concrete have implemented or announced substantial additional increases, and the huge tariffs the President has imposed will make steel, aluminum and many products that incorporate those metals even more expensive."

From February 2016 to February 2017, the producer price index rose 11.6% for aluminum mill shapes, 4.8% for steel mill products and 10.0% for copper and brass mill shapes. Metal products that are used in construction include steel bars (rebar) to reinforce building and highway concrete; piles and beams (structural steel) in buildings; steel studs to support wallboard in houses and buildings; steel and copper pipe; and aluminum window frames, siding and architectural elements. Several other products that are important to construction also had large price increases over the past 12 months: diesel fuel, 38.5%; lumber and plywood, 13.2%; gypsum products, 8.0%; and plastic construction products, 4.9%.

Construction officials said the new tariffs will raise costs for firms, many of which are locked into fixed-price contracts with little ability to charge more for their services. They said funding the President's infrastructure plans would be a better way to foster demand for domestic steel and aluminum without harming contractors

"Tariffs may help a few producers but they harm contractors and anyone with a limited budget for construction," said Stephen E. Sandherr, the association's chief executive officer. "The best way to help the U.S. steel and aluminum sector is to continue pushing measures, like regulatory reform and new infrastructure funding, that will boost demand for their products as the economy expands."

Related Stories

Market Data | Oct 27, 2021

Only 14 states and D.C. added construction jobs since the pandemic began

Supply problems, lack of infrastructure bill undermine recovery.

Market Data | Oct 26, 2021

U.S. construction pipeline experiences highs and lows in the third quarter

Renovation and conversion pipeline activity remains steady at the end of Q3 ‘21, with conversion projects hitting a cyclical peak, and ending the quarter at 752 projects/79,024 rooms.

Market Data | Oct 19, 2021

Demand for design services continues to increase

The Architecture Billings Index (ABI) score for September was 56.6.

Market Data | Oct 14, 2021

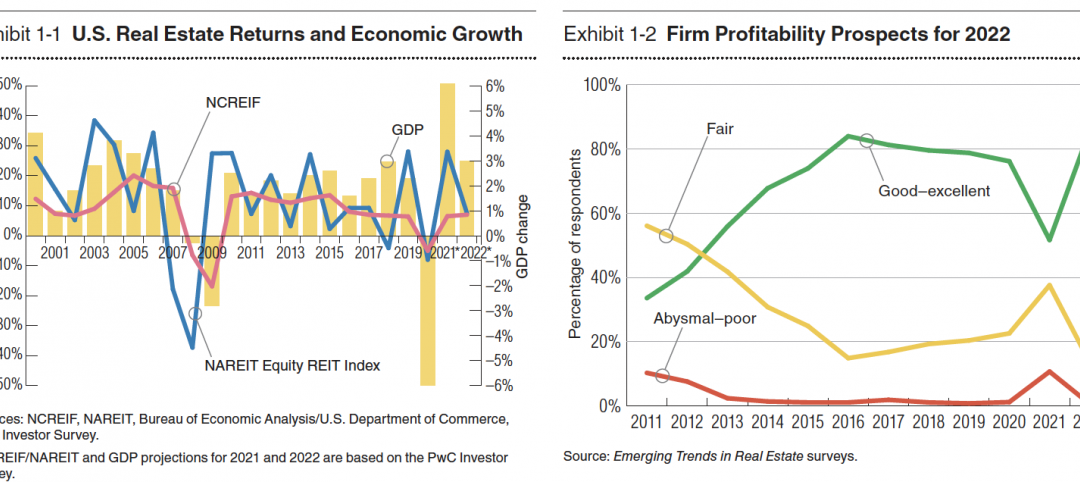

Climate-related risk could be a major headwind for real estate investment

A new trends report from PwC and ULI picks Nashville as the top metro for CRE prospects.

Market Data | Oct 14, 2021

Prices for construction materials continue to outstrip bid prices over 12 months

Construction officials renew push for immediate removal of tariffs on key construction materials.

Market Data | Oct 11, 2021

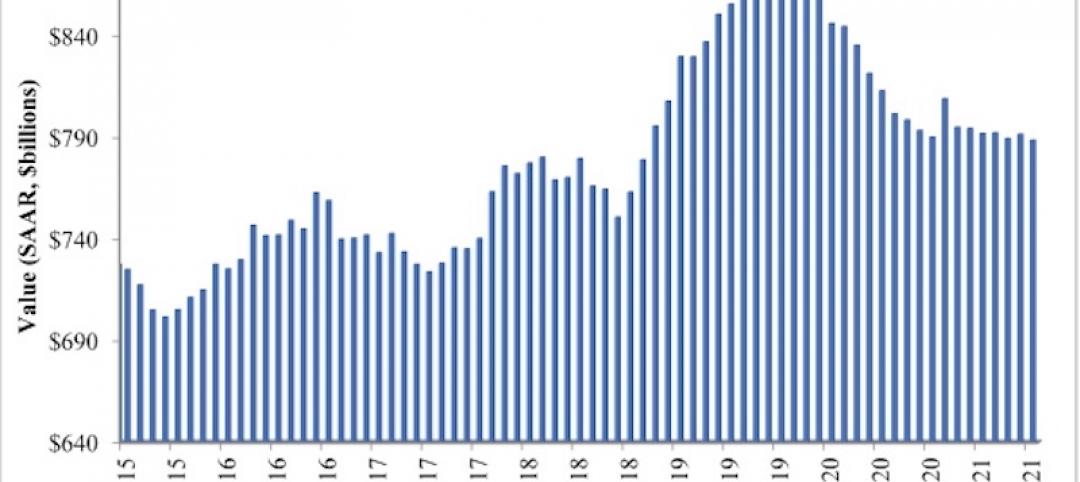

No decline in construction costs in sight

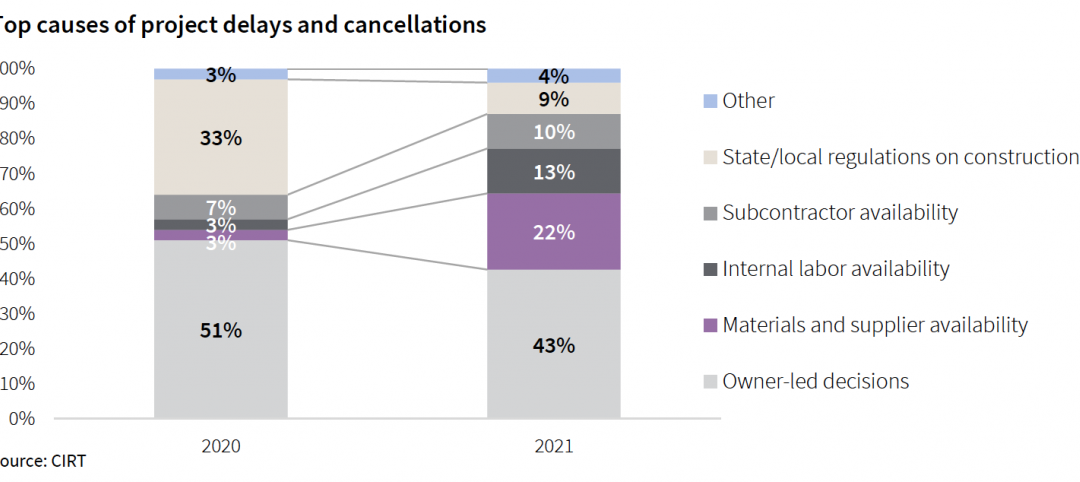

Construction cost gains are occurring at a time when nonresidential construction spending was down by 9.5 percent for the 12 months through July 2021.

Market Data | Oct 11, 2021

Nonresidential construction sector posts first job gain since March

Has yet to hit pre-pandemic levels amid supply chain disruptions and delays.

Market Data | Oct 4, 2021

Construction spending stalls between July and August

A decrease in nonresidential projects negates ongoing growth in residential work.

Market Data | Oct 1, 2021

Nonresidential construction spending dips in August

Spending declined on a monthly basis in 10 of the 16 nonresidential subcategories.

Market Data | Sep 29, 2021

One-third of metro areas lost construction jobs between August 2020 and 2021

Lawrence-Methuen Town-Salem, Mass. and San Diego-Carlsbad, Calif. top lists of metros with year-over-year employment increases.