Most economists say the U.S. is slowly emerging from the Great Recession, a view that was confirmed to some extent by an exclusive survey of 498 BD+C subscribers whose views we sought on the commercial construction industry’s outlook on business prospects for 2013.

The majority (52.2%) of respondents—architects, engineers, contractors, buildings owners, and others in the commercial, industrial, and institutional field—said their firms were in at least “good” financial health, compared to 49.7% last year.

But a markedly strong showing (86.4%) said their firms would be up in revenues or would at least hold steady in 2013, versus 80.2% last year—an increase that may be not only statistically significant but also most certainly welcome for an industry that could use a bit of cheering.

As was the case last year, more than three-fourths of respondents (75.7%) rated “general economic conditions (i.e., recession)” as the most important concern their firms will face in 2013—roughly comparable to the 78.4% who responded that way last year.

Economy Remains Top Concern for ’13

2013 2012

General economic conditions 75.7% 78.4%

Competition from other firms 44.9% 40.1%

Managing cash flow 37.6% 33.7%

Insufficient capital funding for projects 29.7% 34.5%

Softness in fees/bids 29.7% 28.0%

Government regulations/restrictions 26.6% 23.0%

Price increases (e.g., materials, services)15.7% 18.1%

Avoiding layoffs 16.4% 14.3%

Keeping staff motivated 14.3% 14.3%

Avoiding benefit reductions 11.9% 12.5%

Other factors were largely within the same range as last year, given the margin of error (about 3.5-4%). Competition from other firms (44.9%) went up slightly (from 40.1% in 2011), while having insufficient capital funding for projects declined a bit, to 29.7%, from 34.5% the year before. For both years, nearly three in four (73.4% this year, 74.8% in 2011) described the current business situation for their firms as “very” to “intensely” competitive—further evidence that AEC firms are still struggling for every dollar.

HEALTHCARE, DATA CENTERS LOOK PROMISING FOR ’13

Respondents were asked to rate their firms’ prospects in specific construction sectors on a five-point scale from “excellent” to “very weak.” (Respondents who checked “Not applicable/No opinion/Don’t know” are not counted here.) Among the findings:

- Healthcare continued to be the most highly rated sector, with nearly three-fifths of respondents (58.8%, vs. 54.6% last year) giving it a “good” to “excellent” rating.

- Data centers and mission-critical facilities were also up, with the majority of respondents (52.1%) in the good/excellent category, compared to 45.2% last year

- Senior and assisted-living facilities made a big jump, from last year’s 37.8% of respondents in the good/excellent category, to a majority this year, at 50.5%.

- Government and military work was rated good to excellent by 36.1% of respondents, down slightly from last year’s 41.1%.

- University/college facilities were rated good to excellent by 37.8% of respondents, versus 32.3% in 2011.

- Retail commercial construction got a slight vote of confidence, with nearly one-fifth of respondents (19.9%) stating they thought their firms would have a good to excellent year, nearly double last year’s 11.1%.

- Industrial and warehouse facilities might be staging a comeback: One-fourth (25.5%) of respondents whose firms engaged in that sector said they expect a good to excellent year in 2013; on the other hand, 35.8% said it would be weak or very weak.

Reconstruction—including historic preservation and renovations—accounted for at least 25% of work for more than a third (34.6%) of respondents’ firms, roughly the same as last year (36.3%). Office interiors and fitouts were down, with only 35.7% of this year’s respondents saying this sector would be good to excellent, compared to 42.7% last year.

The prospects for office buildings looked bleak, however, with only 15.6% saying that market would be good to excellent. The majority (55.2%) predicted office buildings would be “weak” or “very weak,” but that’s an improvement from 2011’s 67.3%.

The K-12 sector looked basically flat, with good/excellent responses from 22.9% of respondents this year, compared to 23.2% last year.

As for the use of building information modeling, one-fifth (20.2%) said their firm did not use BIM, about the same as in 2011 (20.6%). Of those who said their firms used BIM, a healthy 26.8% said BIM was used in the majority of projects, based on dollar value—precisely the same as last year. Only a few saw the use of BIM declining in the coming year. Nearly two-fifths (39.0%) of respondents said their companies would be beefing up their investments in technology.

On the communications front, nearly a third of respondents (32.9%) said they did not use social media. Of those who said they did, LinkedIn was the clear choice, at 85.1%, with Facebook in second place (49.5%) and Twitter bringing up the rear (21.1%).

Note: Of the 428 who gave their professional description, 42.1% were architects; 18.7%, engineers; 23.8%, contractors; 5.6% building owners, developers, or facility/property managers; and 9.8%, consultants or “other.” +

Related Stories

| Nov 3, 2010

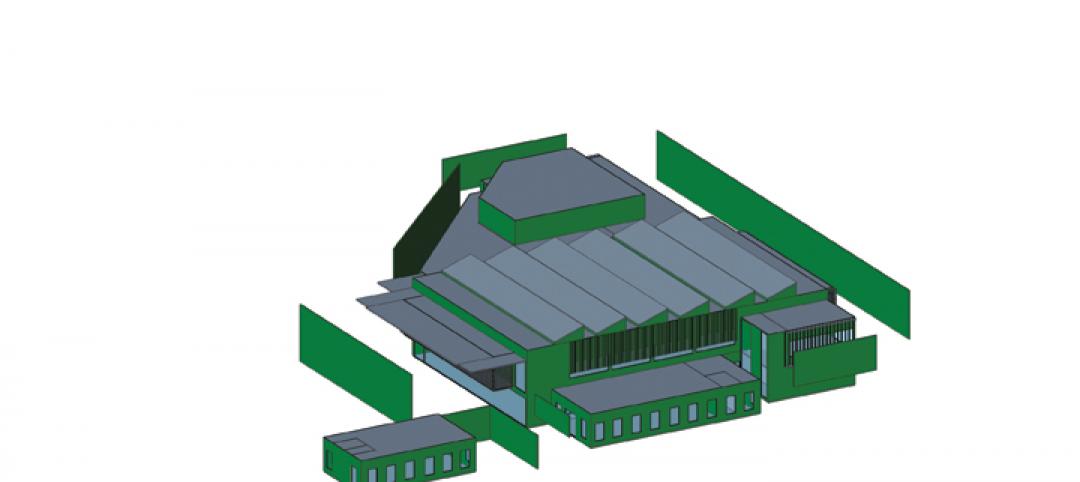

Dining center cooks up LEED Platinum rating

Students at Bowling Green State University in Ohio will be eating in a new LEED Platinum multiuse dining center next fall. The 30,000-sf McDonald Dining Center will have a 700-seat main dining room, a quick-service restaurant, retail space, and multiple areas for students to gather inside and out, including a fire pit and several patios—one of them on the rooftop.

| Nov 2, 2010

11 Tips for Breathing New Life into Old Office Spaces

A slowdown in new construction has firms focusing on office reconstruction and interior renovations. Three experts from Hixson Architecture Engineering Interiors offer 11 tips for office renovation success. Tip #1: Check the landscaping.

| Nov 2, 2010

Cypress Siding Helps Nature Center Look its Part

The Trinity River Audubon Center, which sits within a 6,000-acre forest just outside Dallas, utilizes sustainable materials that help the $12.5 million nature center fit its wooded setting and put it on a path to earning LEED Gold.

| Nov 2, 2010

A Look Back at the Navy’s First LEED Gold

Building Design+Construction takes a retrospective tour of a pace-setting LEED project.

| Nov 2, 2010

Wind Power, Windy City-style

Building-integrated wind turbines lend a futuristic look to a parking structure in Chicago’s trendy River North neighborhood. Only time will tell how much power the wind devices will generate.

| Nov 2, 2010

Energy Analysis No Longer a Luxury

Back in the halcyon days of 2006, energy analysis of building design and performance was a luxury. Sure, many forward-thinking AEC firms ran their designs through services such as Autodesk’s Green Building Studio and IES’s Virtual Environment, and some facility managers used Honeywell’s Energy Manager and other monitoring software. Today, however, knowing exactly how much energy your building will produce and use is survival of the fittest as energy costs and green design requirements demand precision.

| Nov 2, 2010

Yudelson: ‘If It Doesn’t Perform, It Can’t Be Green’

Jerry Yudelson, prolific author and veteran green building expert, challenges Building Teams to think big when it comes to controlling energy use and reducing carbon emissions in buildings.

| Nov 2, 2010

Historic changes to commercial building energy codes drive energy efficiency, emissions reductions

Revisions to the commercial section of the 2012 International Energy Conservation Code (IECC) represent the largest single-step efficiency increase in the history of the national, model energy. The changes mean that new and renovated buildings constructed in jurisdictions that follow the 2012 IECC will use 30% less energy than those built to current standards.

| Nov 1, 2010

Sustainable, mixed-income housing to revitalize community

The $41 million Arlington Grove mixed-use development in St. Louis is viewed as a major step in revitalizing the community. Developed by McCormack Baron Salazar with KAI Design & Build (architect, MEP, GC), the project will add 112 new and renovated mixed-income rental units (market rate, low-income, and public housing) totaling 162,000 sf, plus 5,000 sf of commercial/retail space.

| Nov 1, 2010

John Pearce: First thing I tell designers: Do your homework!

John Pearce, FAIA, University Architect at Duke University, Durham, N.C., tells BD+C’s Robert Cassidy about the school’s construction plans and sustainability efforts, how to land work at Duke, and why he’s proceeding with caution when it comes to BIM.