Proposal activity for architecture, engineering and construction (A/E/C) firms increased significantly in the 1st Quarter of 2023, according to PSMJ’s Quarterly Market Forecast (QMF) survey. The predictive measure of the industry’s health rebounded to a net plus/minus index (NPMI) of 32.8 in the first three months of the year. This followed the 8.0 NPMI in the 4th Quarter of 2022, which marked the lowest level since the final quarter of 2020 and the second-lowest NPMI recorded in the last 10 years.

PSMJ President Greg Hart noted that the 1st quarter results are a pleasant surprise, especially since data was collected after the Silicon Valley Bank collapse and amid continuing interest rate hikes and recession predictions. “I don’t think anybody expected this kind of recovery,” he said. “But inflation is cooling and there are some positive signs in the housing market, so maybe we’ve found the bottom.”

First quarter results have historically been the strongest throughout the history of the QMF survey, which may play some part in the jump in project opportunities. In the last 10 years, the first quarter NPMI averaged 45.2, with the results weakening in subsequent quarters. The average NPMI for the 2nd quarter since 2013 is 36.5, with the third and fourth quarters averaging 29.0 and 25.7, respectively. Year-over-year, the NPMI for the first three months of 2023 was down substantially from a near-record NPMI of 60.2 reported in the first quarter of 2022.

PSMJ’s proprietary NPMI is the difference between the percentage of respondents who say that proposal opportunities are growing and those reporting a decrease. In addition to overall activity, the QMF surveys A/E/C firm leaders about their proposal activity experience in 12 major markets and 58 submarkets.

Private Sector Construction Markets Struggle, Publics Thrive

Firms working in private-sector markets continue to report historically low levels of proposal activity, while those in the public sector perform better, as the chart below indicates. Environmental topped all 12 major markets with an NPMI of 71.4, followed by Water/Wastewater at 70.8. Transportation continues to thrive, aided by the Infrastructure Investment and Jobs Act (IIJA), with an NPMI of 65.5. Energy/Utilities remains solid, repeating its fourth-place finish from the prior quarter and a near-exact NPMI of 55.1 (down from 55.2).

Since the 1st quarter of 2019, the Energy/Utilities market has been out of the top five only once (the 2nd quarter of 2021), and the Water/Wastewater market has missed the top five just twice.

The biggest surprise of the 1st Quarter may be that Education was the fifth-strongest among the major markets with an NPMI of 42.2. This is the first time that Education hit the top five since the 2nd quarter of 2018. The Higher Education (NPMI of 45.3) and K-12 (42.3) submarkets drove the resurgence.

Related Stories

Market Data | Apr 23, 2020

5 must reads for the AEC industry today: April 23, 2020

The death of the department store and how to return to work when the time comes.

Market Data | Apr 22, 2020

6 must reads for the AEC industry today: April 22, 2020

Repurposed containers can be used as rapid response airborne infection isolation rooms and virtual site visits help control infection on project sites.

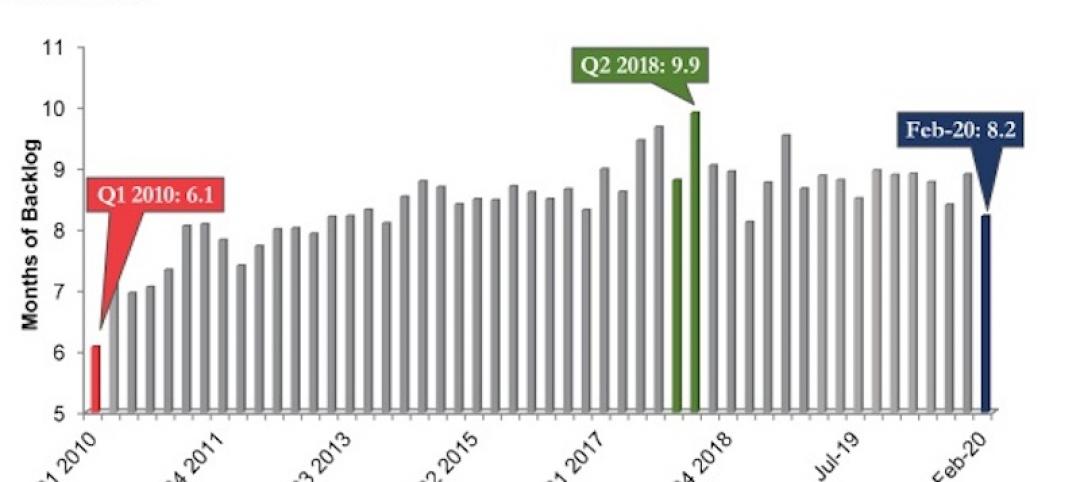

Market Data | Apr 21, 2020

ABC's Construction Backlog Indicator down in February

Backlog for firms working in the infrastructure segment rose by 1.3 months in February while backlog for commercial and institutional and heavy industrial firms declined by 0.6 months and 0.7 months, respectively.

Market Data | Apr 21, 2020

5 must reads for the AEC industry today: April 21, 2020

IoT system helps contractors keep their distance and the multifamily market flattens.

Market Data | Apr 20, 2020

6 must reads for the AEC industry today: April 20, 2020

The continent's tallest living wall and NMHC survey shows significant delays in apartment construction.

Market Data | Apr 17, 2020

Construction employment declines in 20 states and D.C. in March, in line with industry survey showing growing job losses for the sector

New monthly job loss data foreshadows more layoffs amid project cancellations and state cutbacks in road projects as association calls for more small business relief and immediate aid for highway funding.

Market Data | Apr 17, 2020

5 must reads for the AEC industry today: April 17, 2020

Meet the 'AEC outsiders' pushing the industry forward and the world's largest Living Building.

Market Data | Apr 16, 2020

5 must reads for the AEC industry today: April 16, 2020

The SMPS Foundation and Building Design+Construction are studying the impact of the coronavirus pandemic on the ability to attain and retain clients and conduct projects and Saks Fifth Avenue plans a sanitized post-coronavirus opening.

Market Data | Apr 15, 2020

5 must reads for the AEC industry today: April 15, 2020

Buildings as "open source platforms" and 3D printing finds its grove producing face shields.

Market Data | Apr 14, 2020

6 must reads for the AEC industry today: April 14, 2020

A robot dog conducts site inspections and going to the library with little kids just got easier.