Construction Backlog Indicator rose to 7.9 months in May, an increase of less than 0.1 months from April’s reading. Furthermore, based on an ABC member survey conducted May 20-June 3, results indicate that confidence among U.S. construction industry leaders continued to rebound from the historically low levels observed in the March survey.

Nonresidential construction backlog is down 0.8 months compared to May 2019 and declined year over year in every industry, classification and region. Backlog in the heavy industrial category, however, increased by nearly one month in May after reaching its lowest level in the history of the series in April.

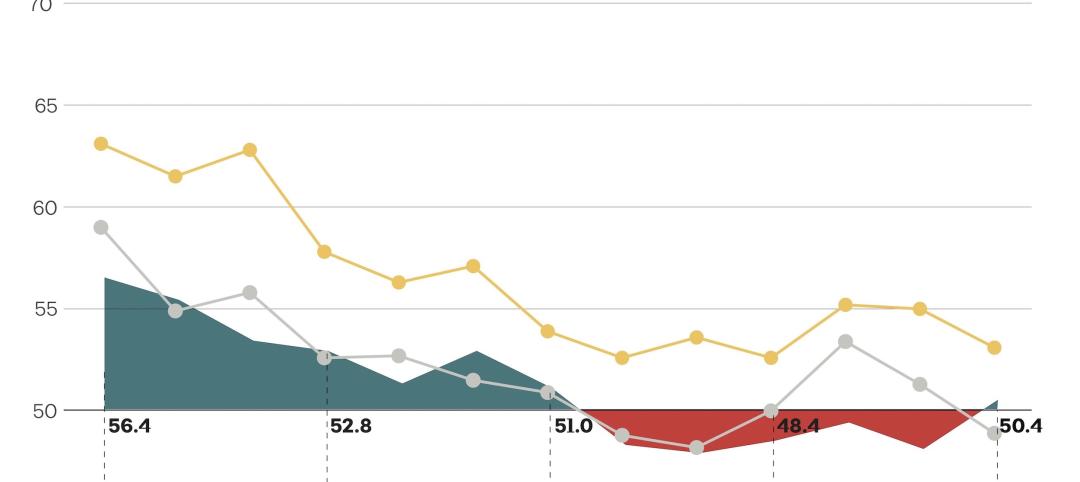

ABC’s Construction Confidence Index readings for sales, profit margins and staffing levels expectations all increased in May, although sales and profit margin expectations remain below the threshold of 50, indicating ongoing anticipation of contraction. The staffing level index remained above that threshold, with more than 38% of contractors expecting to expand their staff during the next six months.

More than 45% of contractors expect their sales to decline during the next six months while 35% expect sales to increase. More than 48% of contractors expect their profit margins to decrease over the next two quarters.

- The CCI for sales expectations increased from 41.1 to 44.9 in May.

- The CCI for profit margin expectations increased from 39.8 to 41.7.

- The CCI for staffing levels increased from 51.4 to 53.

“Given the depth of the economic downturn and myriad other issues facing America today, backlog and contractor confidence data have held up better than one might have anticipated,” said ABC Chief Economist Anirban Basu. “But the marketplace is still tilted toward pessimism. For instance, more contractors expect sales and profit margins to decline than increase over the next six months, which is consistent with anecdotal information suggesting that many project owners are considering postponing projects and possibly rebidding them.

“After falling meaningfully in April, backlog remained relatively unchanged in May, hinting at a stable nonresidential construction marketplace,” said Basu. “However, the underlying survey received fewer responses compared to earlier months in the COVID-19 crisis, perhaps suggesting that some contractors are no longer operating at previous capacity, inducing available work to move toward better-positioned contractors. To the extent that these stronger contractors are reflected in the survey, this would tend to bolster average backlog even in the context of a subdued marketplace.

“Contractors still expect to boost staffing levels over the next six months,” said Basu. “But this may simply be a function of jobsites reopening as construction shutdowns end. Almost 70% of respondents had jobsites shut down due to government mandates and other reasons, and with labor shortages in place before the pandemic, contractors may have residual staffing needs. It remains to be seen whether expected employment growth going forward coincides with speedy recovery in overall contractor confidence and backlog.”

Note: The reference months for the Construction Backlog Indicator and Construction Confidence Index data series were revised on May 12 to better reflect the survey period. CBI quantifies the previous month’s work under contract based on the latest financials available, while CCI measures contractors’ outlook for the next six months.

Related Stories

Industry Research | Apr 25, 2023

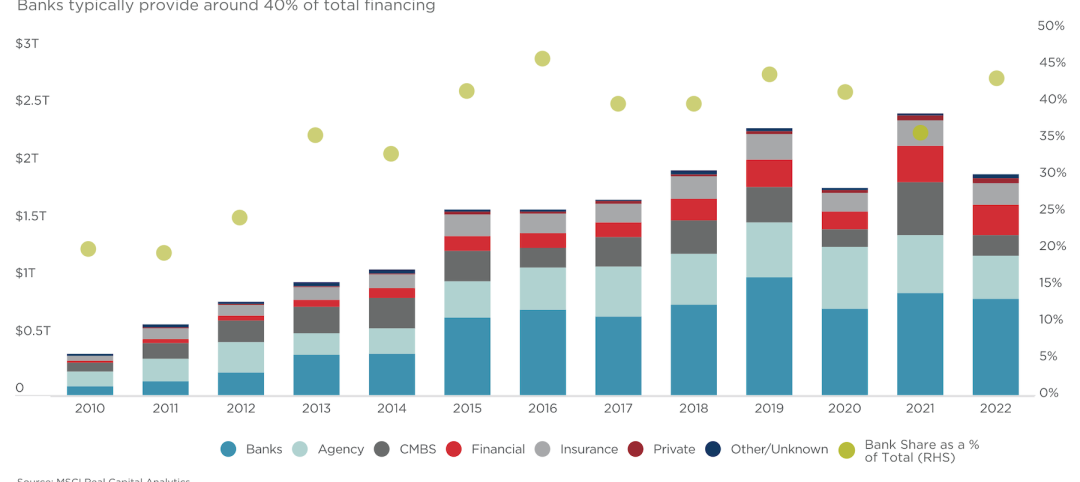

The commercial real estate sector shouldn’t panic (yet) about recent bank failures

A new Cushman & Wakefield report depicts a “well capitalized” banking industry that is responding assertively to isolated weaknesses, but is also tightening its lending.

Architects | Apr 21, 2023

Architecture billings improve slightly in March

Architecture firms reported a modest increase in March billings. This positive news was tempered by a slight decrease in new design contracts according to a new report released today from The American Institute of Architects (AIA). March was the first time since last September in which billings improved.

Contractors | Apr 19, 2023

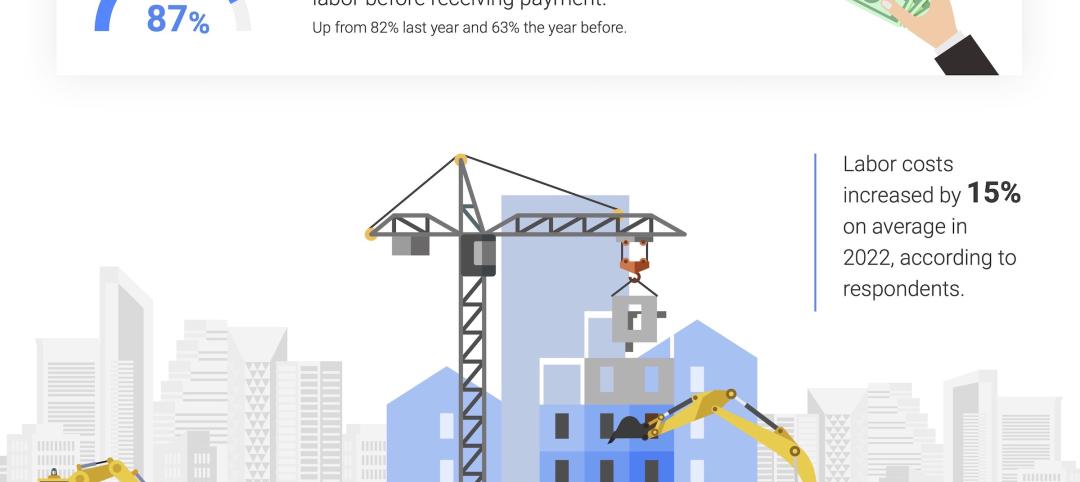

Rising labor, material prices cost subcontractors $97 billion in unplanned expenses

Subcontractors continue to bear the brunt of rising input costs for materials and labor, according to a survey of nearly 900 commercial construction professionals.

Data Centers | Apr 14, 2023

JLL's data center outlook: Cloud computing, AI driving exponential growth for data center industry

According to JLL’s new Global Data Center Outlook, the mass adoption of cloud computing and artificial intelligence (AI) is driving exponential growth for the data center industry, with hyperscale and edge computing leading investor demand.

Healthcare Facilities | Apr 13, 2023

Healthcare construction costs for 2023

Data from Gordian breaks down the average cost per square foot for a three-story hospital across 10 U.S. cities.

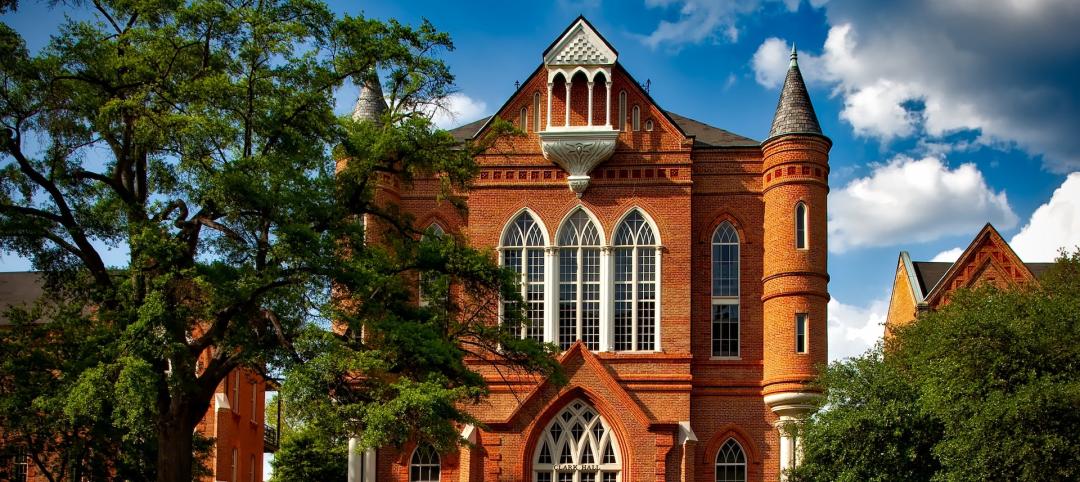

Higher Education | Apr 13, 2023

Higher education construction costs for 2023

Fresh data from Gordian breaks down the average cost per square foot for a two-story college classroom building across 10 U.S. cities.

Market Data | Apr 13, 2023

Construction input prices down year-over-year for first time since August 2020

Construction input prices increased 0.2% in March, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics Producer Price Index data released today. Nonresidential construction input prices rose 0.4% for the month.

Market Data | Apr 11, 2023

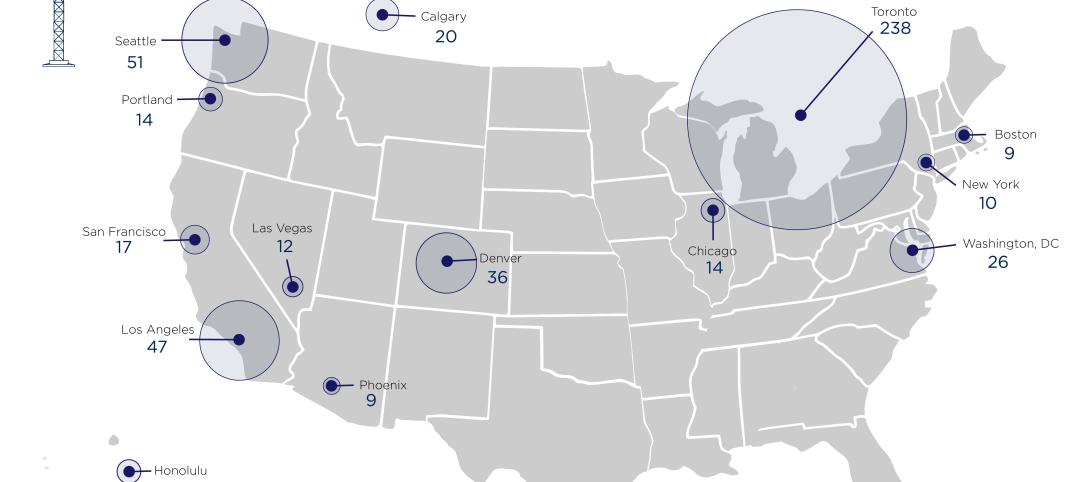

Construction crane count reaches all-time high in Q1 2023

Toronto, Seattle, Los Angeles, and Denver top the list of U.S/Canadian cities with the greatest number of fixed cranes on construction sites, according to Rider Levett Bucknall's RLB Crane Index for North America for Q1 2023.

Contractors | Apr 11, 2023

The average U.S. contractor has 8.7 months worth of construction work in the pipeline, as of March 2023

Associated Builders and Contractors reported that its Construction Backlog Indicator declined to 8.7 months in March, according to an ABC member survey conducted March 20 to April 3. The reading is 0.4 months higher than in March 2022.

Market Data | Apr 6, 2023

JLL’s 2023 Construction Outlook foresees growth tempered by cost increases

The easing of supply chain snags for some product categories, and the dispensing with global COVID measures, have returned the North American construction sector to a sense of normal. However, that return is proving to be complicated, with the construction industry remaining exceptionally busy at a time when labor and materials cost inflation continues to put pricing pressure on projects, leading to caution in anticipation of a possible downturn. That’s the prognosis of JLL’s just-released 2023 U.S. and Canada Construction Outlook.