Construction backlog fell by 4 percent during the last quarter of 2016, according to the latest Construction Backlog Indicator (CBI) released today by Associated Builders and Contractors (ABC). Contractors in each segment surveyed—commercial/institutional, infrastructure and heavy industrial—all saw lower backlog during the fourth quarter, with firms in the heavy industrial segment experiencing the largest drop, down 16.8 percent to an average backlog of 5.5 months.

Overall, backlog—the amount of work under contract but yet to be performed—fell to 8.3 months during the fourth quarter. CBI rose a modest 0.4 months or 4.5 percent on a year-over-year basis.

“Many factors contributed to the dip in contractors’ backlog, but none is more important than the lack of public construction spending momentum,” said ABC Chief Economist Anirban Basu. “Indeed, backlog among firms specializing in infrastructure has declined from 12.2 months during the final three months of 2015 to 10.6 months one year later.

“CBI is intended to be a predictive tool and has accurately predicted declining public spending for several quarters,” said Basu. “Recent construction spending data supplied by the U.S. Census Bureau confirm these declines. For instance, between January 2016 and January 2017, construction spending in the nation’s highway and street segment declined by more than 10 percent. In the water supply, public safety and transportation components, the level of construction spending declined by closer to 11 percent. In the sewage and waste disposal category, construction spending declined by a whopping 28 percent.

“A still fragile global economy, strong U.S. dollar, and stubbornly low energy prices have helped to translate into declining heavy industrial backlog,” said Basu. “The only category experiencing construction spending stability is the commercial segment. Over the past year, construction spending in office, lodging and relative categories has surged. During that same period, the CBI reading in the commercial/institutional category has remained stable.”

Regional Highlights

- Backlog declined in all major regions of the nation during 2016’s final quarter with the exception of the Northeast. A surge in financial activity and foreign investment in commercial real estate helped buoy construction in the New York metropolitan area, according to available CBI survey data. Boston continues to be propelled by its large and expanding technology sector. Stable economies in both Washington and Baltimore have also helped to drive Northeast CBI higher.

- Middle States backlog sits at roughly 7.8 months. Though this represents a decline on a quarterly basis, backlog is still more than a month higher than it was a year ago. Stable-to-rising industrial production in a number of Middle States communities has helped.

- Backlog in the West declined during the fourth quarter and is now at its lowest level since the first quarter of 2015. The region’s backlog has now fallen in four of the previous five quarters, largely due to dynamics among large construction firms. The technology boom in many communities, including in Silicon Valley and Seattle, has led to massive construction projects in recent years. It was expected that this level of technology-generated construction would slow a bit, and this appears to be what has transpired.

- Backlog in the South fell during 2016’s final quarter, ending a prolonged period of growth that began during the third quarter of 2015. Despite this setback, backlog in the southern region remains elevated due to the volume of construction in several of the region’s most economically dynamic major metropolitan areas, including Dallas, Atlanta, Orlando and Miami.

Highlights by Industry

- Foreign and domestic equity capital, searching for a satisfactory combination of safety and yield, has continued to flow into U.S. commercial real estate.

- Average backlog in the heavy industrial category fell to 5.5 months during the fourth quarter, a decrease of more than 1 month. Backlog in the segment has reverted to early-2014 levels, almost 2 months later than its peak in the second quarter of 2016.

- Backlog in the infrastructure category contracted in the fourth quarter but remains well above its post-recession trough. Despite falling 13.2 percent from the same time last year, backlog in the sector is up 49.8 percent from the fourth quarter of 2013.

- Commercial/institutional backlog fell to end 2016, but the sector remains remarkably stable. The category’s backlog reading has hovered between 8 months and 8.3 months for the past two years.

Company Size Trends

- Backlog for firms with annual revenues above $100 million fell dramatically to end 2016 with contractors shedding nearly three months of backlog on average, dropping from 13.7 months to 10.8 months. The CBI reading for this group is now at its lowest level since the second quarter of 2015.

- Backlog for the smallest firms surveyed—those with annual revenues less than $30 million—remains stable. Many of these companies are subcontractors that continue to toil on privately-financed, commercial construction projects.

- Firms with annual revenues between $30 million and $50 million per annum were in the only category that collectively reported rising backlog. These firms are often advantageously positioned to take on large components of commercial or institutional work, and backlog for this group now stands at a still-healthy 8.3 months.

- Backlog among firms with between $50 million and $100 million in annual revenue fell fractionally during the final quarter, not enough for statistical significance. Though backlog has declined relative to the peak achieved in mid-2013, in part due to the loss of public infrastructure spending momentum, average backlog remains above 9 months.

Click here to view additional charts and graphs.

Related Stories

Market Data | Sep 27, 2019

The global hotel construction pipeline ascends to new record highs

With the exception of Latin America, all regions of the globe either continued to set record high pipeline counts or have already settled into topping-out formations amidst concerns of a worldwide economic slowdown.

Market Data | Sep 25, 2019

Senate introduces The School Safety Clearinghouse Act

Legislation would create a federally funded and housed informational resource on safer school designs.

Market Data | Sep 18, 2019

Substantial decline in Architecture Billings

August report suggests greatest weakness in design activity in several years.

Market Data | Sep 17, 2019

ABC’s Construction Backlog Indicator inches lower in July

Backlog in the heavy industrial category increased by 2.3 months and now stands at its highest level in the history of the CBI series.

Market Data | Sep 13, 2019

Spending on megaprojects, already on the rise, could spike hard in the coming years

A new FMI report anticipates that megaprojects will account for one-fifth of annual construction spending within the next decade.

Architects | Sep 11, 2019

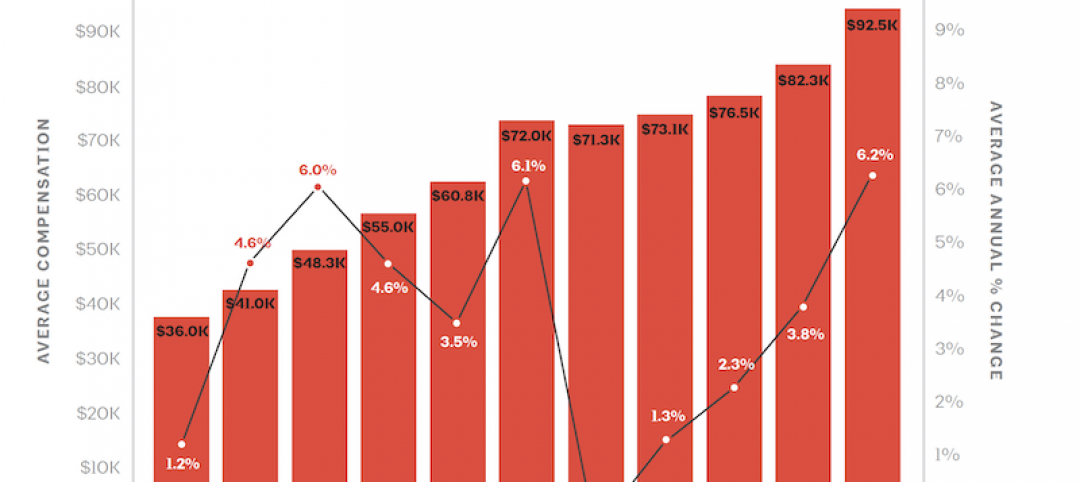

Buoyed by construction activity, architect compensation continues to see healthy gains

The latest AIA report breaks down its survey data by 44 positions and 28 metros.

Market Data | Sep 11, 2019

New 2030 Commitment report findings emphasize need for climate action

Profession must double down on efforts to meet 2030 targets.

Market Data | Sep 10, 2019

Apartment buildings and their residents contribute $3.4 trillion to the national economy

New data show how different aspects of the apartment industry positively impact national, state and local economies.

Market Data | Sep 3, 2019

Nonresidential construction spending slips in July 2019, but still surpasses $776 billion

Construction spending declined 0.3% in July, totaling $776 billion on a seasonally adjusted annualized basis.

Industry Research | Aug 29, 2019

Construction firms expect labor shortages to worsen over the next year

A new AGC-Autodesk survey finds more companies turning to technology to support their jobsites.