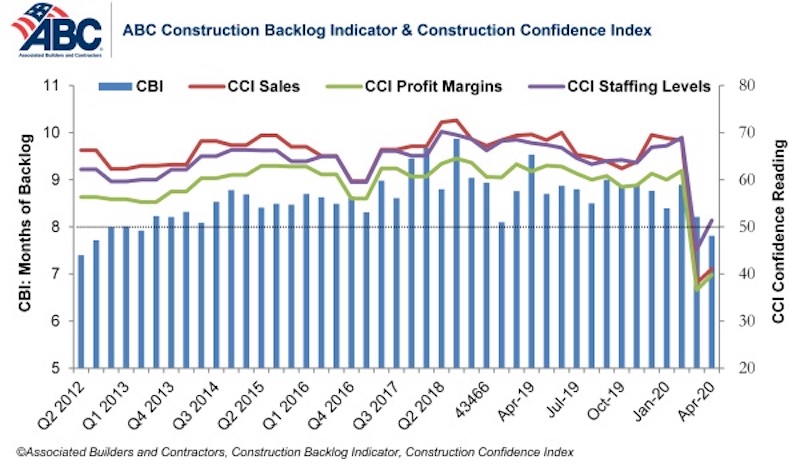

Associated Builders and Contractors reported today that its Construction Backlog Indicator fell to 7.8 months in April, the series’ lowest reading since the third quarter of 2012. Based on an ABC member survey conducted April 20-May 4, the results indicate that confidence among U.S. construction industry leaders inched higher last month compared to the historically low levels observed in the March survey.

Nonresidential construction backlog is down 0.4 months compared to the March 2020 ABC survey and 1.7 months from April 2019. Backlog has declined year-over-year in every industry classification, region and company size. Backlog in the infrastructure category has been stable, however, and reached its highest level since December 2019.

ABC’s Construction Confidence Index readings for sales, profit margins and staffing levels expectations all increased from the historically low levels reported in the March 2020 survey, although sales and profit margin expectations remain below the threshold of 50, indicating ongoing expectations of contraction. The staffing level index rose to 51.4 in April, however, indicating positive hiring expectations over the next six months.

More than 55% of contractors expect their sales to decline over the next six months compared to just 34% who expect them to increase. Only 27% of contractors expect to increase their profit margins over the next two quarters. More than half expect to experience diminished margins.

- The CCI for sales expectations increased from 38.1 to 41.1 in April.

- The CCI for profit margin expectations increased from 36.6 to 39.8.

- The CCI for staffing levels increased from 45.2 to 51.4.

“Backlog has not been quite the protective shield that it normally is during the early stages of an economic downturn,” said ABC Chief Economist Anirban Basu. “These survey data indicate that only 30% of nonresidential contractors have enjoyed uninterrupted work flows recently. Roughly two in five contractors indicate that their work has been interrupted by government mandate. Other sources of interruption to construction projects include labor force issues as well as a lack of personal protective equipment and/or key construction inputs.

“Given the large quantity of businesses that will likely not survive the public health and economic crisis, demand for construction services could be suppressed for quite some time,” said Basu. “Vacant storefronts, empty office suites and shattered state and local government finances do not serve as a solid foundation for robust demand for construction services. For construction activity to rebound briskly, the federal government is going to have to step forward and provide substantial assistance to state and local governments, including to finance infrastructure improvements.”

Note: The reference months for the Construction Backlog Indicator and Construction Confidence Index data series were revised on May 12 to better reflect the survey period. CBI quantifies the previous month’s work under contract based on the latest financials available, while CCI measures contractors’ outlook for the next six months.

Related Stories

Market Data | Aug 2, 2021

Nonresidential construction spending falls again in June

The fall was driven by a big drop in funding for highway and street construction and other public work.

Market Data | Jul 29, 2021

Outlook for construction spending improves with the upturn in the economy

The strongest design sector performers for the remainder of this year are expected to be health care facilities.

Market Data | Jul 29, 2021

Construction employment lags or matches pre-pandemic level in 101 metro areas despite housing boom

Eighty metro areas had lower construction employment in June 2021 than February 2020.

Market Data | Jul 28, 2021

Marriott has the largest construction pipeline of U.S. franchise companies in Q2‘21

472 new hotels with 59,034 rooms opened across the United States during the first half of 2021.

Market Data | Jul 27, 2021

New York leads the U.S. hotel construction pipeline at the close of Q2‘21

Many hotel owners, developers, and management groups have used the operational downtime, caused by COVID-19’s impact on operating performance, as an opportunity to upgrade and renovate their hotels and/or redefine their hotels with a brand conversion.

Market Data | Jul 26, 2021

U.S. construction pipeline continues along the road to recovery

During the first and second quarters of 2021, the U.S. opened 472 new hotels with 59,034 rooms.

Market Data | Jul 21, 2021

Architecture Billings Index robust growth continues

AIA’s Architecture Billings Index (ABI) score for June remained at an elevated level of 57.1.

Market Data | Jul 20, 2021

Multifamily proposal activity maintains sizzling pace in Q2

Condos hit record high as all multifamily properties benefit from recovery.

Market Data | Jul 19, 2021

Construction employment trails pre-pandemic level in 39 states

Supply chain challenges, rising materials prices undermine demand.

Market Data | Jul 15, 2021

Producer prices for construction materials and services soar 26% over 12 months

Contractors cope with supply hitches, weak demand.