Real gross domestic product (GDP) expanded by just 0.7% (seasonally adjusted annual rate) during the fourth quarter of 2015, according to an analysis of Bureau of Economic Analysis data released by Associated Builders and Contractors (ABC). This paltry growth follows a 2% increase during the year's third quarter and a 3.9% increase during the second quarter. For the year, GDP expanded by 2.4%, matching the rate of growth seen in 2014.

Nonresidential fixed investment shrank by 1.8% in the fourth quarter, the first time the segment has contracted since the third quarter of 2012. For the year, nonresidential fixed investment expanded by 2.9% after growing by 6.2% in 2014 and 3% in 2013.

"The economy did not end the year well," ABC Chief Economist Anirban Basu said. "Today's GDP data adds weight to the argument that the U.S. is in a corporate profits recession, an industrial recession, and was experiencing a softening of investments. With the exception of the residential building sector, business capital outlays have declined as corporations deal with a combination of sagging exports, competitive imports, declining energy related investments, rising wage pressures and healthcare costs.

"Recent turbulence in financial markets suggest that capital availability may continue to soften," Basu said. "While residential construction is likely to continue to recover given the combination of low interest rates and accelerating household formation, nonresidential construction spending growth may begin to sputter a bit as those who deploy capital become more defensive. This is not to suggest that nonresidential construction spending is set to decline. Many contractors continue to report significant and growing backlog. However, the current situation suggests that the growth in backlog and ultimately in spending may not be quite as rapid as it was earlier in 2015."

Six key input prices rose or remained unchanged in October on a monthly basis, while one remained unchanged:

- Personal consumption expenditures expanded 2.2% in the fourth quarter after growing by 3% in the third quarter.

- Spending on goods grew 2.4% in the fourth quarter after expanding 5% in the third quarter and 5.5% in the second quarter.

- Real final sales of domestically produced output increased 1.2% for the fourth quarter after a 2.7% increase in the third quarter.

- Federal government spending increased 2.7% in the fourth quarter, the segment's largest increase since the third quarter of 2014.

- Nondefense spending increased 1.4% in the fourth quarter after expanding 2.8% in the previous quarter.

- National defense spending expanded by 3.6% in the fourth quarter after contracting by 1.4% during the third.

- State and local government spending contracted by 0.6% in the fourth quarter after increasing by 2.8% in the third quarter.

Related Stories

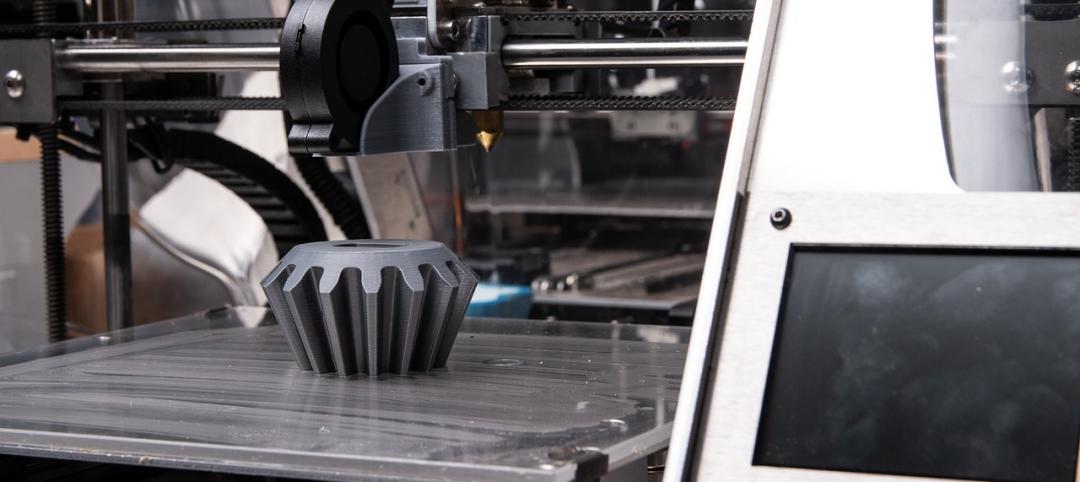

3D Printing | Sep 17, 2019

Additive manufacturing goes mainstream in the industrial sector

More manufacturers now include this production process in their factories.

Codes and Standards | Sep 12, 2019

Illinois law sets maximum retainage on private projects

The change is expected to give contractors bigger checks earlier in project timeline.

Multifamily Housing | Sep 12, 2019

Meet the masters of offsite construction

Prescient combines 5D software, clever engineering, and advanced robotics to create prefabricated assemblies for apartment buildings and student housing.

Giants 400 | Sep 11, 2019

Top 95 Industrial Sector Contractors for 2019

Fluor, Clayco, Jacobs, ARCO, and Gray Construction top the rankings of the nation's largest industrial sector contractors and construction management firms, as reported in Building Design+Construction's 2019 Giants 300 Report.

Multifamily Housing | Sep 10, 2019

Carbon-neutral apartment building sets the pace for scalable affordable housing

Project Open has no carbon footprint, but the six-story, solar-powered building is already leaving its imprint on Salt Lake City’s multifamily landscape.

Giants 400 | Sep 9, 2019

2019 Industrial Sector Giants Report: Managing last mile delivery

This and more industrial building sector trends from Building Design+Construction's 2019 Giants 300 Report.

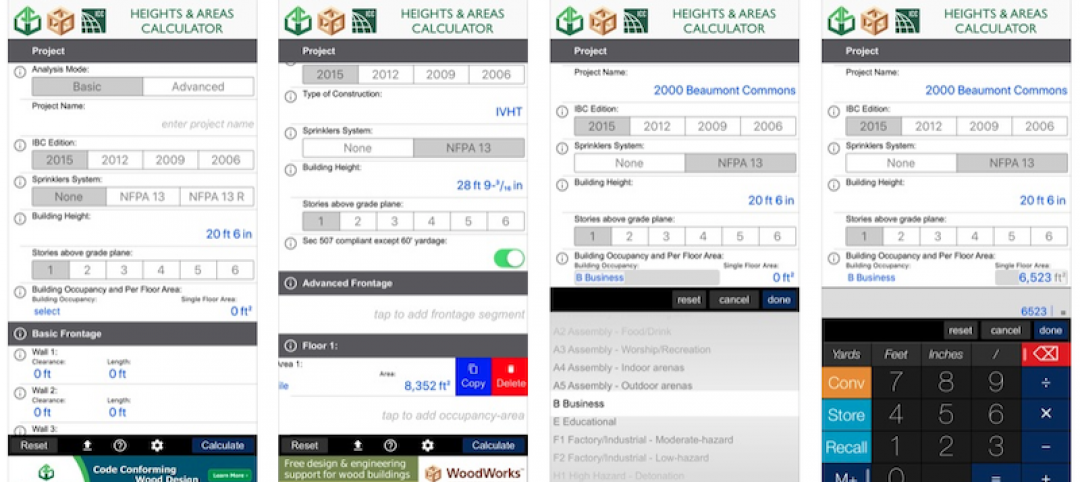

Codes and Standards | Sep 9, 2019

Free app calculates maximum allowable heights and areas for buildings

A free app that calculates the maximum allowable heights and areas for buildings of various occupancy classifications and types of construction has been released.

Retail Centers | Sep 6, 2019

Another well-known retailer files for bankruptcy: Here's the solution to more empty anchor stores

Where can you find the future of retail? At the intersection of experience and instant gratification.

Giants 400 | Sep 5, 2019

Top 85 Hotel Sector Construction Firms for 2019

Suffolk, Yates Companies, AECOM, Swinerton, and Turner top the rankings of the nation's largest hotel sector contractors and construction management firms, as reported in Building Design+Construction's 2019 Giants 300 Report.

Contractors | Sep 5, 2019

Katerra adds two GCs to its stable

UEB Builders and Fortune-Johnson General Contractors specialize in multifamily and mixed-used developments.