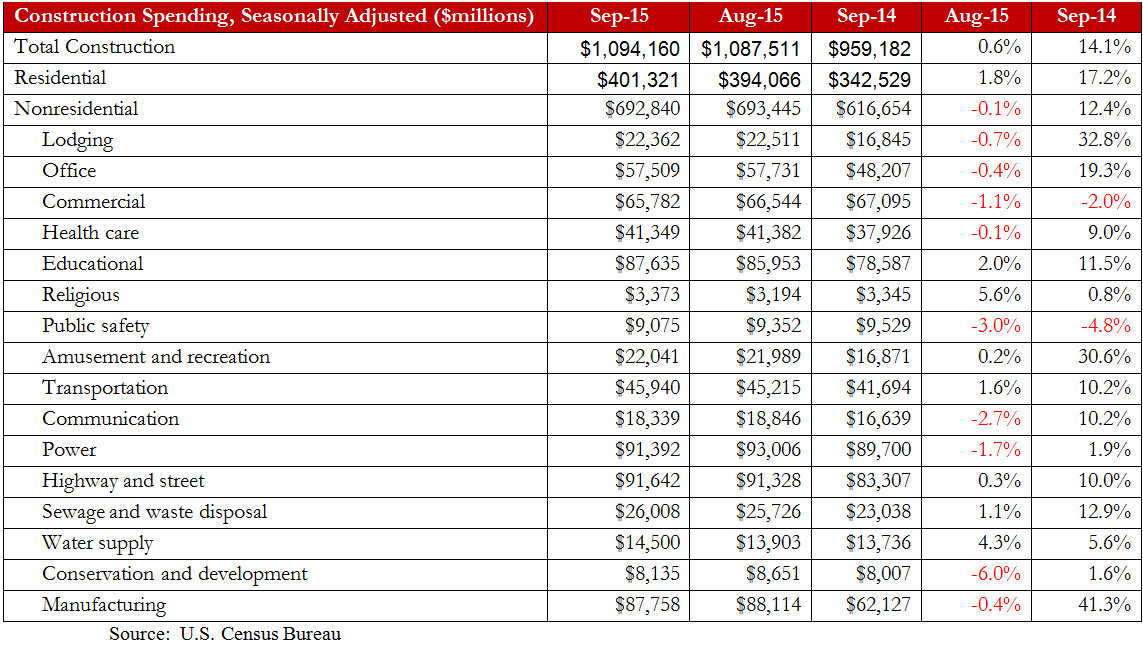

Nonresidential construction spending fell in September for the first time in eight months, the U.S. Census Bureau reported, but the monthly drop in spending is not a cause for concern according to analysis by Associated Builders and Contractors (ABC). Nonresidential construction spending fell by 0.1% from August, totaling $692.8 billion on a seasonally adjusted annualized basis.

September's year-over-year increase of 12.4% is the largest increase since April 2008. After falling in two consecutive months, public nonresidential construction spending grew by 0.7% in September while private sector construction spending fell by 0.7% for the month.

"The last several months have generally been associated with sizable increases in nonresidential construction," said ABC Chief Economist Anirban Basu. "Today's release, while not particularly upbeat, does not alter the fact that nonresidential construction spending continues to recover and that most contractors are busier than they were a year ago.

"Although there are many potential forces at work that resulted September's monthly construction spending decline, most are not alarming. With construction materials prices falling, contractors may be able to offer somewhat lower prices for their services, helping to suppress growth in construction value put in place. It is also conceivable that some construction work is being slowed by an ongoing lack of available skilled personnel. This factor has certainly helped to slow residential construction, and it seems reasonable to presume that some nonresidential contractors would face similar issues.

Seven nonresidential construction sectors experienced spending increases in September on a monthly basis:

- Educational-related spending expanded by 2% for the month and 11.5% for the year.

- Spending in the religious category grew by 5.6% on a monthly basis and 0.8% year-over-year.

- Amusement and transportation-related spending rose by 0.2% from August and 30.6% from September of last year.

- Transportation-related spending expanded by 1.6% from a month ago and 10.2% from a year ago.

- Highway and street-related construction spending inched 0.3% higher for the month and is up 10% from the same time last year.

- Sewage and waste disposal-related spending rose by 1.1% from August and 12.9% from September of last year.

- Spending in the water supply category gained 4.3% from the previous month and 5.6% on a year-ago basis.

Spending in nine nonresidential construction subsectors fell in September on a monthly basis:

- Spending in the lodging category fell by 0.7% for the month but is up 32.8% from September 2014.

- Office-related spending dipped 0.4% from August but is 19.3% higher than at the same time last year.

- Spending in the commercial category fell by 1.1% on a monthly basis and by 2% on a yearly basis.

- Health care-related spending inched 0.1% lower for the month but is up 9% on a year-ago basis.

- Public safety-related spending fell 3% month-over-month and 4.8% year-over-year.

- Spending in the communication-category declined 2.7% from August but is up 10.2% from the same time last year.

- Power-related construction spending fell 1.7% on a monthly basis but expanded 1.9% over the previous twelve months.

- Conservation and development-related spending lost 6% for the month but is still 1.6% higher than at the same time last year.

- Manufacturing related spending fell 0.4% for the month but is still up 41.3% from September 2014.

To view the previous spending report, click here.

Related Stories

Giants 400 | Oct 2, 2023

Top 50 Data Center Construction Firms for 2023

Turner Construction, Holder Construction, HITT Contracting, DPR Construction, and Fortis Construction top BD+C's ranking of the nation's largest data center sector contractors and construction management firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Market Data | Oct 2, 2023

Nonresidential construction spending rises 0.4% in August 2023, led by manufacturing and public works sectors

National nonresidential construction spending increased 0.4% in August, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.09 trillion.

Giants 400 | Sep 28, 2023

Top 100 University Building Construction Firms for 2023

Turner Construction, Whiting-Turner Contracting Co., STO Building Group, Suffolk Construction, and Skanska USA top BD+C's ranking of the nation's largest university sector contractors and construction management firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report. Note: This ranking includes revenue for all university/college-related buildings except student residence halls, sports/recreation facilities, laboratories, S+T-related buildings, parking facilities, and performing arts centers (revenue for those buildings are reported in their respective Giants 400 ranking).

Construction Costs | Sep 28, 2023

U.S. construction market moves toward building material price stabilization

The newly released Quarterly Construction Cost Insights Report for Q3 2023 from Gordian reveals material costs remain high compared to prior years, but there is a move towards price stabilization for building and construction materials after years of significant fluctuations. In this report, top industry experts from Gordian, as well as from Gilbane, McCarthy Building Companies, and DPR Construction weigh in on the overall trends seen for construction material costs, and offer innovative solutions to navigate this terrain.

Contractors | Sep 25, 2023

Balfour Beatty expands its operations in Tampa Bay, Fla.

Balfour Beatty is expanding its leading construction operations into the Tampa Bay area offering specialized and expert services to deliver premier projects along Florida’s Gulf Coast.

Resiliency | Sep 25, 2023

National Institute of Building Sciences, Fannie Mae release roadmap for resilience

The National Institute of Building Sciences and Fannie Mae have released the Resilience Incentivization Roadmap 2.0. The document is intended to guide mitigation investment to prepare for and respond to natural disasters.

Codes and Standards | Sep 25, 2023

Lendlease launches new protocol for Scope 3 carbon reduction

Lendlease unveiled a new protocol to monitor, measure, and disclose Scope 3 carbon emissions and called on built environment industry leaders to tackle this challenge.

Data Centers | Sep 21, 2023

North American data center construction rises 25% to record high in first half of 2023, driven by growth of artificial intelligence

CBRE’s latest North American Data Center Trends Report found there is 2,287.6 megawatts (MW) of data center supply currently under construction in primary markets, reaching a new all-time high with more than 70% already preleased.

Giants 400 | Sep 20, 2023

Top 80 Hospitality Facility Construction Firms for 2023

Suffolk Construction, The Yates Companies, STO Building Group, and PCL Construction Enterprises top BD+C's ranking of the nation's largest hospitality facilities sector contractors and construction management (CM) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report. Note: This ranking includes revenue for all hospitality facilities work, including casinos, hotels, and resorts.

Giants 400 | Sep 18, 2023

Top 120 Office Building Construction Firms for 2023

Turner Construction, STO Building Group, AECOM, and DPR Construction top BD+C's ranking of the nation's largest office building sector contractors and construction management (CM) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report. Note: This ranking includes revenue for all office building work, including core and shell projects and workplace/interior fitouts.