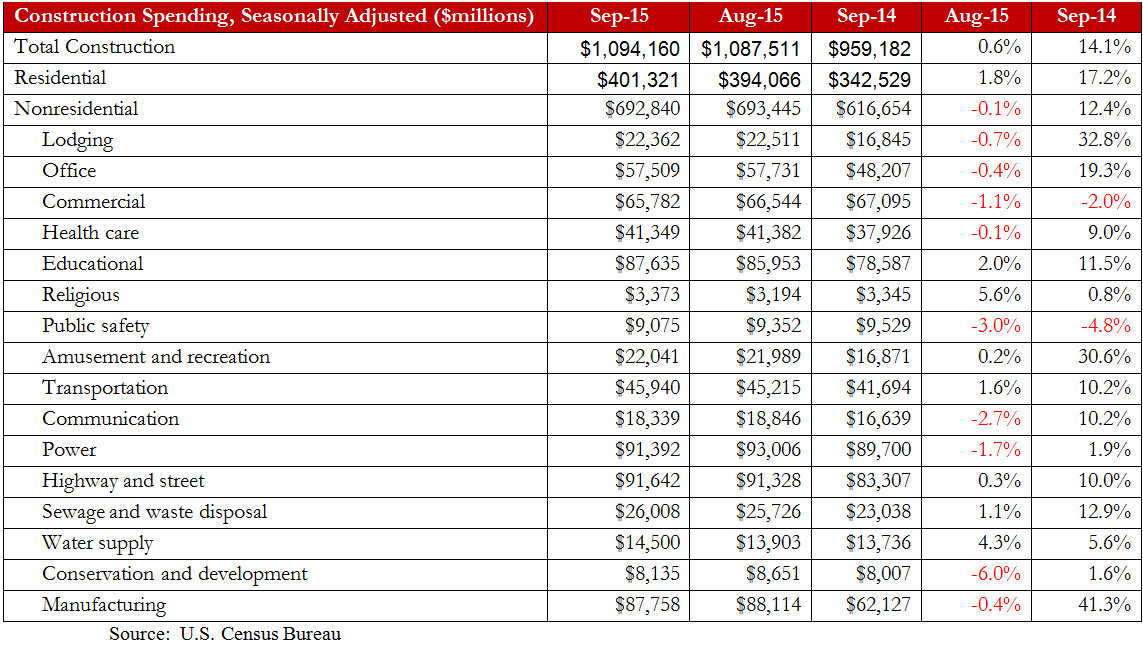

Nonresidential construction spending fell in September for the first time in eight months, the U.S. Census Bureau reported, but the monthly drop in spending is not a cause for concern according to analysis by Associated Builders and Contractors (ABC). Nonresidential construction spending fell by 0.1% from August, totaling $692.8 billion on a seasonally adjusted annualized basis.

September's year-over-year increase of 12.4% is the largest increase since April 2008. After falling in two consecutive months, public nonresidential construction spending grew by 0.7% in September while private sector construction spending fell by 0.7% for the month.

"The last several months have generally been associated with sizable increases in nonresidential construction," said ABC Chief Economist Anirban Basu. "Today's release, while not particularly upbeat, does not alter the fact that nonresidential construction spending continues to recover and that most contractors are busier than they were a year ago.

"Although there are many potential forces at work that resulted September's monthly construction spending decline, most are not alarming. With construction materials prices falling, contractors may be able to offer somewhat lower prices for their services, helping to suppress growth in construction value put in place. It is also conceivable that some construction work is being slowed by an ongoing lack of available skilled personnel. This factor has certainly helped to slow residential construction, and it seems reasonable to presume that some nonresidential contractors would face similar issues.

Seven nonresidential construction sectors experienced spending increases in September on a monthly basis:

- Educational-related spending expanded by 2% for the month and 11.5% for the year.

- Spending in the religious category grew by 5.6% on a monthly basis and 0.8% year-over-year.

- Amusement and transportation-related spending rose by 0.2% from August and 30.6% from September of last year.

- Transportation-related spending expanded by 1.6% from a month ago and 10.2% from a year ago.

- Highway and street-related construction spending inched 0.3% higher for the month and is up 10% from the same time last year.

- Sewage and waste disposal-related spending rose by 1.1% from August and 12.9% from September of last year.

- Spending in the water supply category gained 4.3% from the previous month and 5.6% on a year-ago basis.

Spending in nine nonresidential construction subsectors fell in September on a monthly basis:

- Spending in the lodging category fell by 0.7% for the month but is up 32.8% from September 2014.

- Office-related spending dipped 0.4% from August but is 19.3% higher than at the same time last year.

- Spending in the commercial category fell by 1.1% on a monthly basis and by 2% on a yearly basis.

- Health care-related spending inched 0.1% lower for the month but is up 9% on a year-ago basis.

- Public safety-related spending fell 3% month-over-month and 4.8% year-over-year.

- Spending in the communication-category declined 2.7% from August but is up 10.2% from the same time last year.

- Power-related construction spending fell 1.7% on a monthly basis but expanded 1.9% over the previous twelve months.

- Conservation and development-related spending lost 6% for the month but is still 1.6% higher than at the same time last year.

- Manufacturing related spending fell 0.4% for the month but is still up 41.3% from September 2014.

To view the previous spending report, click here.

Related Stories

Contractors | Mar 27, 2018

Shawmut Design and Construction’s burgeoning L.A. office looks to hospitality and interiors for future growth

A new division also taps the luxury homes market.

Contractors | Mar 9, 2018

Undoing 5 myths of IPD and Lean construction

The Lean Construction Institute, one of this year’s Movers+Shapers, has been sponsoring valuable research recently.

Contractors | Mar 6, 2018

Skender revolutionizes how the industry builds, integrates design, construction, and manufacturing

Envisioning a radically more efficient future for the building industry, Skender announces its expansion beyond construction, becoming a vertically integrated company including construction, design and building component manufacturing functions. The expansion includes significant investment in the launch of a new Chicago-based advanced manufacturing subsidiary and the acquisition of the boutique design firm Ingenious Architecture.

Multifamily Housing | Mar 4, 2018

Katerra, a tech-driven GC, plots ambitious expansion

Investors flock to this vertically integrated startup, which automates its design and construction processes.

Office Buildings | Feb 13, 2018

Office market vacancy rate at 10-year low

Cautious development and healthy absorption across major markets contributed to the decline in vacancy, according to a new Transwestern report.

Contractors | Feb 2, 2018

Construction employers add 36,000 jobs in January and 226,000 over the year

Industry employment is most since August 2008 As unemployment rate falls sharply.

Healthcare Facilities | Feb 1, 2018

Early supplier engagement provides exceptional project outcomes

Efficient supply chains enable companies to be more competitive in the marketplace.

Industry Research | Jan 30, 2018

AIA’s Kermit Baker: Five signs of an impending upturn in construction spending

Tax reform implications and rebuilding from natural disasters are among the reasons AIA’s Chief Economist is optimistic for 2018 and 2019.

Market Data | Jan 30, 2018

AIA Consensus Forecast: 4.0% growth for nonresidential construction spending in 2018

The commercial office and retail sectors will lead the way in 2018, with a strong bounce back for education and healthcare.

Architects | Jan 29, 2018

14 marketing resolutions AEC firms should make in 2018

As we close out the first month of the New Year, AEC firms have made (and are still making) plans for where and how to spend their marketing time and budgets in 2018.