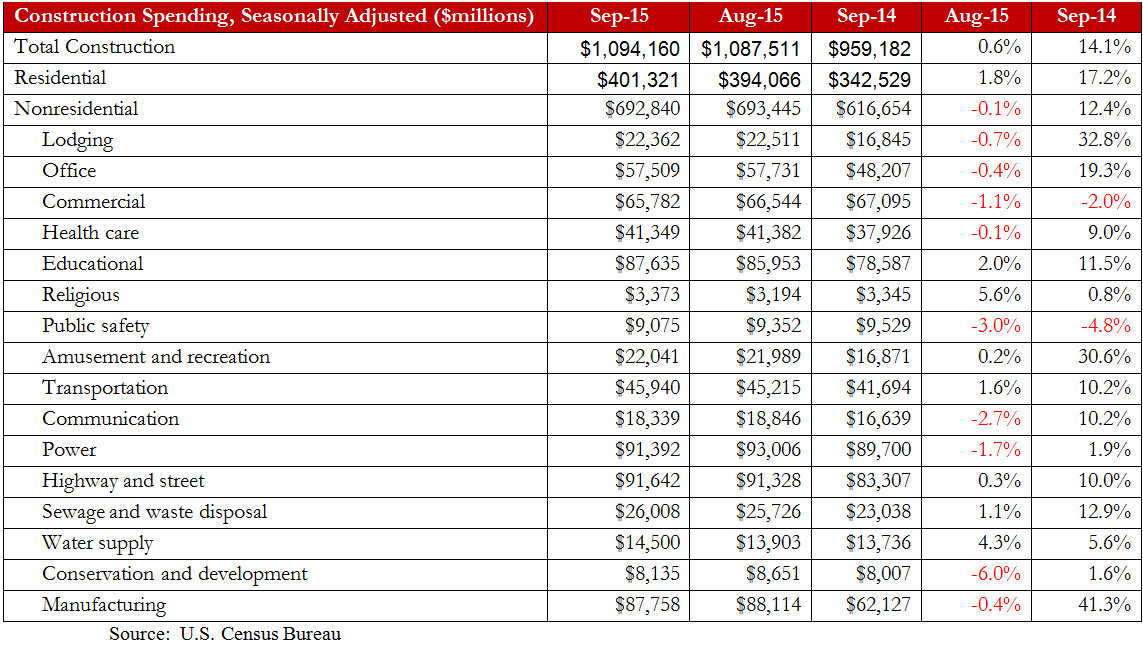

Nonresidential construction spending fell in September for the first time in eight months, the U.S. Census Bureau reported, but the monthly drop in spending is not a cause for concern according to analysis by Associated Builders and Contractors (ABC). Nonresidential construction spending fell by 0.1% from August, totaling $692.8 billion on a seasonally adjusted annualized basis.

September's year-over-year increase of 12.4% is the largest increase since April 2008. After falling in two consecutive months, public nonresidential construction spending grew by 0.7% in September while private sector construction spending fell by 0.7% for the month.

"The last several months have generally been associated with sizable increases in nonresidential construction," said ABC Chief Economist Anirban Basu. "Today's release, while not particularly upbeat, does not alter the fact that nonresidential construction spending continues to recover and that most contractors are busier than they were a year ago.

"Although there are many potential forces at work that resulted September's monthly construction spending decline, most are not alarming. With construction materials prices falling, contractors may be able to offer somewhat lower prices for their services, helping to suppress growth in construction value put in place. It is also conceivable that some construction work is being slowed by an ongoing lack of available skilled personnel. This factor has certainly helped to slow residential construction, and it seems reasonable to presume that some nonresidential contractors would face similar issues.

Seven nonresidential construction sectors experienced spending increases in September on a monthly basis:

- Educational-related spending expanded by 2% for the month and 11.5% for the year.

- Spending in the religious category grew by 5.6% on a monthly basis and 0.8% year-over-year.

- Amusement and transportation-related spending rose by 0.2% from August and 30.6% from September of last year.

- Transportation-related spending expanded by 1.6% from a month ago and 10.2% from a year ago.

- Highway and street-related construction spending inched 0.3% higher for the month and is up 10% from the same time last year.

- Sewage and waste disposal-related spending rose by 1.1% from August and 12.9% from September of last year.

- Spending in the water supply category gained 4.3% from the previous month and 5.6% on a year-ago basis.

Spending in nine nonresidential construction subsectors fell in September on a monthly basis:

- Spending in the lodging category fell by 0.7% for the month but is up 32.8% from September 2014.

- Office-related spending dipped 0.4% from August but is 19.3% higher than at the same time last year.

- Spending in the commercial category fell by 1.1% on a monthly basis and by 2% on a yearly basis.

- Health care-related spending inched 0.1% lower for the month but is up 9% on a year-ago basis.

- Public safety-related spending fell 3% month-over-month and 4.8% year-over-year.

- Spending in the communication-category declined 2.7% from August but is up 10.2% from the same time last year.

- Power-related construction spending fell 1.7% on a monthly basis but expanded 1.9% over the previous twelve months.

- Conservation and development-related spending lost 6% for the month but is still 1.6% higher than at the same time last year.

- Manufacturing related spending fell 0.4% for the month but is still up 41.3% from September 2014.

To view the previous spending report, click here.

Related Stories

Market Data | Jan 26, 2022

2022 construction forecast: Healthcare, retail, industrial sectors to lead ‘healthy rebound’ for nonresidential construction

A panel of construction industry economists forecasts 5.4 percent growth for the nonresidential building sector in 2022, and a 6.1 percent bump in 2023.

Sponsored | Steel Buildings | Jan 25, 2022

Structural Game Changer: Winning solution for curved-wall gymnasium design

Sponsored | Steel Buildings | Jan 25, 2022

Multifamily + Hospitality: Benefits of building in long-span composite floor systems

Long-span composite floor systems provide unique advantages in the construction of multi-family and hospitality facilities. This introductory course explains what composite deck is, how it works, what typical composite deck profiles look like and provides guidelines for using composite floor systems. This is a nano unit course.

Sponsored | Reconstruction & Renovation | Jan 25, 2022

Concrete buildings: Effective solutions for restorations and major repairs

Architectural concrete as we know it today was invented in the 19th century. It reached new heights in the U.S. after World War II when mid-century modernism was in vogue, following in the footsteps of a European aesthetic that expressed structure and permanent surfaces through this exposed material. Concrete was treated as a monolithic miracle, waterproof and structurally and visually versatile.

Urban Planning | Jan 25, 2022

Retooling innovation districts for medium-sized cities

This type of development isn’t just about innovation or lab space; and it’s not just universities or research institutions that are driving this change.

Sponsored | Resiliency | Jan 24, 2022

Norshield Products Fortify Critical NYC Infrastructure

New York City has two very large buildings dedicated to answering the 911 calls of its five boroughs. With more than 11 million emergency calls annually, it makes perfect sense. The second of these buildings, the Public Safety Answering Center II (PSAC II) is located on a nine-acre parcel of land in the Bronx. It’s an imposing 450,000 square-foot structure—a 240-foot-wide by 240-foot-tall cube. The gleaming aluminum cube risesthe equivalent of 24 stories from behind a grassy berm, projecting the unlikely impression that it might actually be floating. Like most visually striking structures, the building has drawn as much scorn as it has admiration.

Sponsored | Resiliency | Jan 24, 2022

Blast Hazard Mitigation: Building Openings for Greater Safety and Security

Coronavirus | Jan 20, 2022

Advances and challenges in improving indoor air quality in commercial buildings

Michael Dreidger, CEO of IAQ tech startup Airsset speaks with BD+C's John Caulfield about how building owners and property managers can improve their buildings' air quality.

3D Printing | Jan 12, 2022

Using 3D-printed molds to create unitized window forms

COOKFOX designer Pam Campbell and Gate Precast's Mo Wright discuss the use of 3D-printed molds from Oak Ridge National Lab to create unitized window panels for One South First, a residential-commercial high-rise in Brooklyn, N.Y.

Engineers | Jan 12, 2022

Private equity: An increasingly attractive alternative for AEC firm sellers

Private equity firms active in the AEC sector work quietly in the background to partner with management, hold for longer periods, and build a win-win for investors and the firm. At a minimum, AEC firms contemplating ownership transition should consider private equity as a viable option. Here is why.