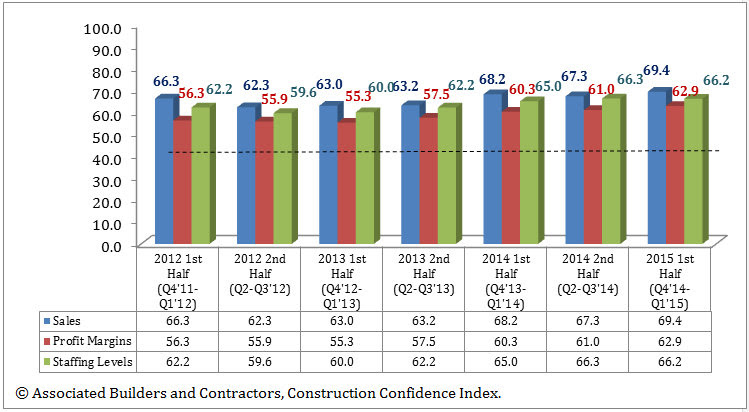

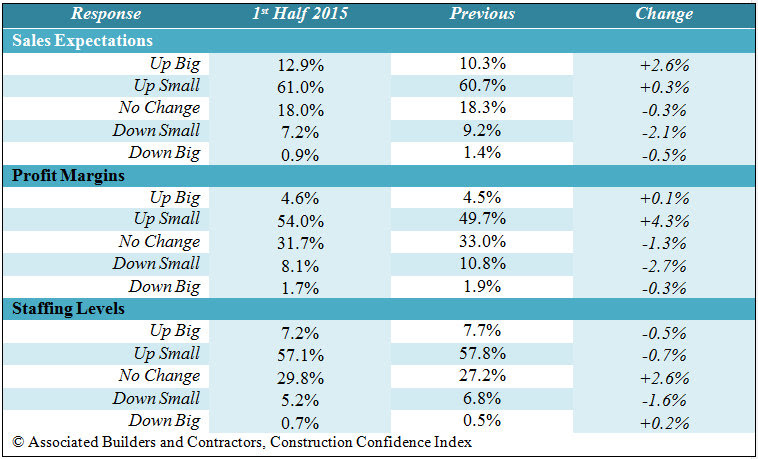

Associated Builders and Contractors' (ABC) Construction Confidence Index (CCI) indicates that contractor confidence will continue to rise in the first half of 2015. The diffusion index measures forward-looking construction industry expectations in sales, profit margins and staffing levels with readings above 50 indicating growth.

In summary, first half index readings are as follows:

- Sales expectations rose from 67.3 to 69.4;

- Profit margin expectations were up from 61.0 to 62.9;

- Staffing level intentions dipped slightly from 66.3 to 66.2.

Most expect that sales will continue to expand and profit margins will widen further. ABC's weighted diffusion index for profit margins is now approaching the highest reading in the index's three-year history. The sales expectation reading is even more optimistic with nearly three in four respondents expecting an increase in sales. While the rate of new hires will continue to be brisk, the pace of hiring is not expected to accelerate over the next six months due in large part to a lack of available skilled labor.

"The recovery continues and is now in its seventh year, but there is plenty of reason for concern with respect to the U.S. economy," said ABC Chief Economist Anirban Basu. "Financial markets have been jittery, the global economy has been slowing and Federal Reserve policy has become less predictable and more confusing. While U.S. economic expansion continues to be led by growth in consumer outlays, in part due to extraordinarily low interest rates, nonresidential construction spending growth has become an important supporting actor. Nonresidential spending, including on factories, hotels, office buildings and distribution centers, has continued to climb in the face of more readily available financing, lower retail and office vacancy rates and rising hotel occupancy rates.

"Though the U.S. economy refuses to boom, the pace of growth has been enough to allow the average contractor to secure more work at higher margins," said Basu. "Interestingly, the pace of hiring is not set to accelerate, which may be a partial reflection of the lack of appropriately skilled construction workers available for hire. The expectation is for construction compensation costs to continue to rise given expanding skills shortages, but apparently not by enough to preclude steadily expanding margins."

"While the decline in commodity prices has helped to slow construction in parts of the country, including in portions of Texas, Oklahoma and North Dakota, low fuel prices have induced faster investment elsewhere, including in the U.S. auto industry," said Basu. "The result appears to be that the average construction decision maker is more confident than six months ago when commodity prices were higher. A stronger U.S. dollar has served to suppress U.S. export growth, however, and business investment growth remains mediocre by historic standards. The implication is that the U.S. economy is not poised to break out anytime soon, and that stakeholders can continue to expect frustratingly unexceptional growth close to 2 to 2.5%."

To read more about the latest CCI, click here.

Related Stories

Digital Twin | May 24, 2021

Digital twin’s value propositions for the built environment, explained

Ernst & Young’s white paper makes its cases for the technology’s myriad benefits.

Contractors | May 20, 2021

Balfour Beatty’s outreach to veterans pays dividends in leadership and growth

Contracts for work it’s done for the San Diego Unified School District have extended to several disabled vet-owned businesses.

Senior Living Design | May 19, 2021

Senior living design: Post-COVID trends and innovations

Two senior living design experts discuss the latest trends and innovations in the senior living building sector.

Multifamily Housing | May 18, 2021

Multifamily housing sector sees near record proposal activity in early 2021

The multifamily sector led all housing submarkets, and was third among all 58 submarkets tracked by PSMJ in the first quarter of 2021.

Wood | May 14, 2021

What's next for mass timber design?

An architect who has worked on some of the nation's largest and most significant mass timber construction projects shares his thoughts on the latest design trends and innovations in mass timber.

Healthcare Facilities | Apr 30, 2021

Registration and waiting: Weak points and an enduring strength

Changing how patients register and wait for appointments will enhance the healthcare industry’s ability to respond to crises.

University Buildings | Apr 29, 2021

The Weekly Show, April 29, 2021: COVID-19's impact on campus planning, and bird management strategies

This week on The Weekly show, BD+C Senior Editor John Caulfield interviews a duo of industry experts on 1) how campus planning has changed during the pandemic and 2) managing bird infestations on construction sites and completed buildings.

Multifamily Housing | Apr 22, 2021

The Weekly Show, Apr 22, 2021: COVID-19's impact on multifamily amenities

This week on The Weekly show, BD+C's Robert Cassidy speaks with three multifamily design experts about the impact of COVID-19 on apartment and condo amenities, based on the 2021 Multifamily Amenities Survey.