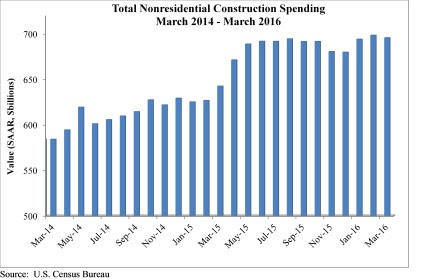

Nonresidential construction spending fell 0.4% on a monthly basis in March, according to analysis of U.S. Census Bureau data released today by Associated Builders and Contractors (ABC), but it was up 8.3% on a year-over-year basis to $695.7 billion. Eight of 16 nonresidential construction subsectors experienced monthly spending growth in March and twelve are up on a year-ago basis.

March would have recorded a monthly spending gain were it not for an upward revision to February's data (from $690.3 to $698.4 billion).

"Viewed optimistically, one can conclude that nonresidential construction has stabilized at a high level," said ABC Chief Economist Anirban Basu. "While the last several months have failed to deliver significant spending growth, many contractors indicate that they remain busy and that backlog levels are satisfactory. Still, one might have expected better spending growth performance given the combination of steady job growth nationally, large sums of capital coming from abroad and invested in the U.S. and surprisingly low interest rates.

"Based on recent trends, one concludes that many U.S. corporations remain reluctant to invest in large-scale projects," said Basu. "Nonresidential fixed investment has generally been soft over recent quarters, and has subtracted from GDP growth recently. America has been experiencing a corporate profits recession recently and slow growth. GDP expanded less than 2% on an annualized basis during last year's final quarter and less than 1% during this year's first. Combine that with hesitant government agencies, and one lacks a recipe for healthy nonresidential construction spending growth."

Spending has increased in 12 of the 16 construction subsectors over the past year. Three of the four sectors registering spending declines over that time — water supply, conservation and development, and public safety — rank among the four smallest subsectors. Each of these subsectors is also heavily influenced by public sector capital budgets.

Eight of 16 nonresidential construction sectors experienced spending increases in March on a monthly basis:

- Lodging-related spending was up 1% from February 2016 and is up 27.7% from March 2015;

- Health care-related spending expanded 1.6% month-over-month and is up 4.1% year-over-year;

- Commercial-related construction spending rose 1.2% for the month and 14.5% over the last year;

- Conservation and development-related spending was 1.6% higher on a monthly basis, but is 3.3% lower on a year-over-year basis.

- Spending in the religious category grew 5.2% for the month and is up 6.4% from March 2015.

- Manufacturing-related spending gained 2% on a monthly basis, but is down 2.1% on a year-over-year basis.

- Communication-related spending grew 3.7% month-over-month and has expanded 10.4% year-over-year.

- Spending in the highway and street category expanded 0.5% from February and is 18.8 higher than one year ago.

Spending in eight of the nonresidential construction subsectors fell in March on a monthly basis:

- Spending in the amusement and recreation category fell 1% from February, but is up 9.6% from the same month one year ago.

- Education-related construction spending fell 0.6% on a monthly basis, but has expanded 11.8% on a yearly basis.

- Sewage and waste disposal-related spending fell 4.2% for the month, but is up 3.8% from the same time one year ago.

- Spending in the power category was down 3.2% from February, but is up 0.8% from a year ago.

- Water supply-related spending fell 1.6% on a monthly basis and has declined 6.1% on a yearly basis.

- Spending in the office category declined 1.3% from February, but is up 19.5% on a year-ago basis.

- Transportation-related spending fell 2.1% month-over-month and has expanded 1.2% year-over-year.

- Public safety-related spending is down 7.8% for the month and 12.3% from March 2015.

Related Stories

| Feb 14, 2013

Firestone projects recognized for roofing excellence

Firestone Building Products has been awarded the 2012 RoofPoint Excellence in Design Award in two categories: Global Leadership and Advancing Sustainable Roofing.

Smart Buildings | Feb 14, 2013

Minneapolis joins energy benchmarking trend for commercial buildings

Minneapolis is the latest major metro to require large commercial buildings to benchmark and disclose their energy and water use.

| Feb 8, 2013

Modest growth predicted for engineering, construction mergers

Small and mid-market deals and construction materials drive activity; U.S. is the most active individual nation.

| Feb 8, 2013

FMI/CURT 2012 Owner Study highlights construction industry challenges

Capital program owners grapple with concerns about project funding, staffing, regulations.

| Feb 6, 2013

RSMeans cost comparisons: office buildings and medical offices

RSMeans' February 2013 Cost Comparison Report breaks down the average construction costs per square foot for four types of office buildings across 25 metro markets.

| Feb 6, 2013

Arcadia (Calif.) High School opens $20 million performing arts center

A 60-year old wish for the community of Arcadia has finally come true with the opening of Arcadia Unified School District’s new $20 million Performing Arts Center.

| Jan 31, 2013

The Opus Group completes construction of corporate HQ for Church & Dwight Co.

The Opus Group announced today the completion of construction on a new 250,000-square-foot corporate headquarter campus for Church & Dwight Co., Inc., in Ewing Township, near Princeton, N.J.

| Jan 31, 2013

Map of U.S. illustrates planning times for commercial construction

Stephen Oliner, a UCLA professor doing research for the Federal Reserve Board, has made the first-ever estimate of planning times for commercial construction across the United States.