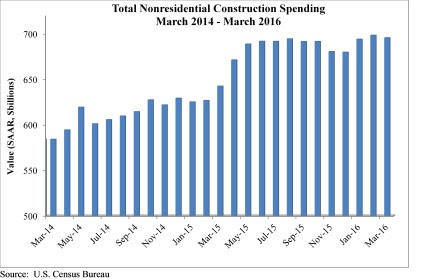

Nonresidential construction spending fell 0.4% on a monthly basis in March, according to analysis of U.S. Census Bureau data released today by Associated Builders and Contractors (ABC), but it was up 8.3% on a year-over-year basis to $695.7 billion. Eight of 16 nonresidential construction subsectors experienced monthly spending growth in March and twelve are up on a year-ago basis.

March would have recorded a monthly spending gain were it not for an upward revision to February's data (from $690.3 to $698.4 billion).

"Viewed optimistically, one can conclude that nonresidential construction has stabilized at a high level," said ABC Chief Economist Anirban Basu. "While the last several months have failed to deliver significant spending growth, many contractors indicate that they remain busy and that backlog levels are satisfactory. Still, one might have expected better spending growth performance given the combination of steady job growth nationally, large sums of capital coming from abroad and invested in the U.S. and surprisingly low interest rates.

"Based on recent trends, one concludes that many U.S. corporations remain reluctant to invest in large-scale projects," said Basu. "Nonresidential fixed investment has generally been soft over recent quarters, and has subtracted from GDP growth recently. America has been experiencing a corporate profits recession recently and slow growth. GDP expanded less than 2% on an annualized basis during last year's final quarter and less than 1% during this year's first. Combine that with hesitant government agencies, and one lacks a recipe for healthy nonresidential construction spending growth."

Spending has increased in 12 of the 16 construction subsectors over the past year. Three of the four sectors registering spending declines over that time — water supply, conservation and development, and public safety — rank among the four smallest subsectors. Each of these subsectors is also heavily influenced by public sector capital budgets.

Eight of 16 nonresidential construction sectors experienced spending increases in March on a monthly basis:

- Lodging-related spending was up 1% from February 2016 and is up 27.7% from March 2015;

- Health care-related spending expanded 1.6% month-over-month and is up 4.1% year-over-year;

- Commercial-related construction spending rose 1.2% for the month and 14.5% over the last year;

- Conservation and development-related spending was 1.6% higher on a monthly basis, but is 3.3% lower on a year-over-year basis.

- Spending in the religious category grew 5.2% for the month and is up 6.4% from March 2015.

- Manufacturing-related spending gained 2% on a monthly basis, but is down 2.1% on a year-over-year basis.

- Communication-related spending grew 3.7% month-over-month and has expanded 10.4% year-over-year.

- Spending in the highway and street category expanded 0.5% from February and is 18.8 higher than one year ago.

Spending in eight of the nonresidential construction subsectors fell in March on a monthly basis:

- Spending in the amusement and recreation category fell 1% from February, but is up 9.6% from the same month one year ago.

- Education-related construction spending fell 0.6% on a monthly basis, but has expanded 11.8% on a yearly basis.

- Sewage and waste disposal-related spending fell 4.2% for the month, but is up 3.8% from the same time one year ago.

- Spending in the power category was down 3.2% from February, but is up 0.8% from a year ago.

- Water supply-related spending fell 1.6% on a monthly basis and has declined 6.1% on a yearly basis.

- Spending in the office category declined 1.3% from February, but is up 19.5% on a year-ago basis.

- Transportation-related spending fell 2.1% month-over-month and has expanded 1.2% year-over-year.

- Public safety-related spending is down 7.8% for the month and 12.3% from March 2015.

Related Stories

Contractors | Oct 13, 2016

Contractors’ financial performance improved in 2015

The Construction Financial Management Association’s latest survey found gains across the board, but notable variances by the size of the companies.

| Sep 26, 2016

RELIGIOUS FACILITY GIANTS: A ranking of the nation’s top religious sector design and construction firms

Gensler, Leo A Daly, Brasfield & Gorrie, Layton Construction, and AECOM top Building Design+Construction’s annual ranking of the nation’s largest religious facility AEC firms, as reported in the 2016 Giants 300 Report.

| Sep 16, 2016

U.S. construction companies not embracing technology: KPMG survey

U.S. construction companies are not embracing technological advancements, such as drone aircrafts, robotics, RFID equipment and materials tracking, and data analytics, according to KPMG International’s Global Construction Survey 2016, “Building a technology advantage.

Architects | Sep 15, 2016

Implicit bias: How the unconscious mind drives business decisions

Companies are tapping into the latest research in psychology and sociology to advance their diversity and inclusion efforts when it comes to hiring, promoting, compensation, and high-performance teaming, writes BD+C's David Barista.

AEC Tech | Sep 6, 2016

Innovation intervention: How AEC firms are driving growth through R&D programs

AEC firms are taking a page from the tech industry, by infusing a deep commitment to innovation and disruption into their cultural DNA.

Sponsored | Contractors | Sep 5, 2016

Rental vs. purchase: How to minimize job site costs

Smart business decisions can mean the difference between being ‘on budget’ and going ‘way over’ budget.

| Sep 1, 2016

TRANSIT GIANTS: A ranking of the nation's top transit sector design and construction firms

Skidmore, Owings & Merrill, Perkins+Will, Skanska USA, Webcor Builders, Jacobs, and STV top Building Design+Construction’s annual ranking of the nation’s largest transit sector AEC firms, as reported in the 2016 Giants 300 Report.

| Sep 1, 2016

INDUSTRIAL GIANTS: A ranking of the nation's top industrial design and construction firms

Stantec, BRPH, Fluor Corp., Walbridge, Jacobs, and AECOM top Building Design+Construction’s annual ranking of the nation’s largest industrial sector AEC firms, as reported in the 2016 Giants 300 Report.

| Sep 1, 2016

HOTEL SECTOR GIANTS: A ranking of the nation's top hotel sector design and construction firms

Gensler, HKS, Turner Construction Co., The Whiting-Turner Contracting Co., Jacobs, and JBA Consulting Engineers top Building Design+Construction’s annual ranking of the nation’s largest hotel sector AEC firms, as reported in the 2016 Giants 300 Report.

| Sep 1, 2016

CULTURAL SECTOR GIANTS: A ranking of the nation's top cultural sector design and construction firms

Gensler, Perkins+Will, PCL Construction Enterprises, Turner Construction Co., AECOM, and WSP | Parsons Brinckerhoff top Building Design+Construction’s annual ranking of the nation’s largest cultural sector AEC firms, as reported in the 2016 Giants 300 Report.