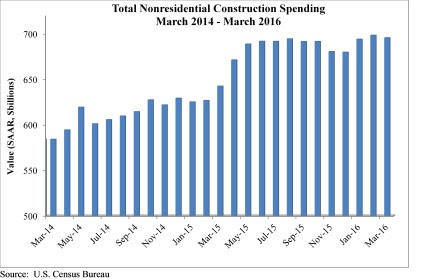

Nonresidential construction spending fell 0.4% on a monthly basis in March, according to analysis of U.S. Census Bureau data released today by Associated Builders and Contractors (ABC), but it was up 8.3% on a year-over-year basis to $695.7 billion. Eight of 16 nonresidential construction subsectors experienced monthly spending growth in March and twelve are up on a year-ago basis.

March would have recorded a monthly spending gain were it not for an upward revision to February's data (from $690.3 to $698.4 billion).

"Viewed optimistically, one can conclude that nonresidential construction has stabilized at a high level," said ABC Chief Economist Anirban Basu. "While the last several months have failed to deliver significant spending growth, many contractors indicate that they remain busy and that backlog levels are satisfactory. Still, one might have expected better spending growth performance given the combination of steady job growth nationally, large sums of capital coming from abroad and invested in the U.S. and surprisingly low interest rates.

"Based on recent trends, one concludes that many U.S. corporations remain reluctant to invest in large-scale projects," said Basu. "Nonresidential fixed investment has generally been soft over recent quarters, and has subtracted from GDP growth recently. America has been experiencing a corporate profits recession recently and slow growth. GDP expanded less than 2% on an annualized basis during last year's final quarter and less than 1% during this year's first. Combine that with hesitant government agencies, and one lacks a recipe for healthy nonresidential construction spending growth."

Spending has increased in 12 of the 16 construction subsectors over the past year. Three of the four sectors registering spending declines over that time — water supply, conservation and development, and public safety — rank among the four smallest subsectors. Each of these subsectors is also heavily influenced by public sector capital budgets.

Eight of 16 nonresidential construction sectors experienced spending increases in March on a monthly basis:

- Lodging-related spending was up 1% from February 2016 and is up 27.7% from March 2015;

- Health care-related spending expanded 1.6% month-over-month and is up 4.1% year-over-year;

- Commercial-related construction spending rose 1.2% for the month and 14.5% over the last year;

- Conservation and development-related spending was 1.6% higher on a monthly basis, but is 3.3% lower on a year-over-year basis.

- Spending in the religious category grew 5.2% for the month and is up 6.4% from March 2015.

- Manufacturing-related spending gained 2% on a monthly basis, but is down 2.1% on a year-over-year basis.

- Communication-related spending grew 3.7% month-over-month and has expanded 10.4% year-over-year.

- Spending in the highway and street category expanded 0.5% from February and is 18.8 higher than one year ago.

Spending in eight of the nonresidential construction subsectors fell in March on a monthly basis:

- Spending in the amusement and recreation category fell 1% from February, but is up 9.6% from the same month one year ago.

- Education-related construction spending fell 0.6% on a monthly basis, but has expanded 11.8% on a yearly basis.

- Sewage and waste disposal-related spending fell 4.2% for the month, but is up 3.8% from the same time one year ago.

- Spending in the power category was down 3.2% from February, but is up 0.8% from a year ago.

- Water supply-related spending fell 1.6% on a monthly basis and has declined 6.1% on a yearly basis.

- Spending in the office category declined 1.3% from February, but is up 19.5% on a year-ago basis.

- Transportation-related spending fell 2.1% month-over-month and has expanded 1.2% year-over-year.

- Public safety-related spending is down 7.8% for the month and 12.3% from March 2015.

Related Stories

Contractors | Oct 26, 2018

How three contractors expanded thin profit margins

If there’s one issue that every contractor is familiar with, it’s the challenge of finishing the job on time and on budget.

Contractors | Oct 26, 2018

Three ways construction leaders harness digital transformation

The construction industry is lagging behind others when it comes to digital transformation. Some construction firms “are still using paper-based processes that can only be described as archaic,” according to a 2016 report by PricewaterhouseCoopers LLP’s Strategy1.

Contractors | Oct 24, 2018

How seasoned construction pros handle the cost of scaling up

Here’s how seasoned operators meet the new demand for homes, offices and new locations without drowning in new expenses.

Contractors | Oct 2, 2018

Nonresidential spending reaches new high in August

Total nonresidential spending stood at $762.7 billion in August, an increase of 8.4% compared to one year ago.

Contractors | Oct 2, 2018

Katerra adds a Denver-area GC to its growing stable

Bristlecone Construction brings self-performing expertise in concrete and framing.

Architects | Sep 14, 2018

We’ve entered the golden age of brain science. What does it mean for AEC firms?

New research from the SMPS Foundation explores the known principles and most recent research surrounding the human brain and behavioral science. The goal: to discover connections between the science and the AEC business.

Contractors | Sep 5, 2018

Lean, tech, talent training highlight contractor innovations

From 5D estimating tools to interactive punch lists, the nation’s largest construction and construction management firms continue to push technology to gain an edge.

Modular Building | Aug 6, 2018

More contractors are turning to offsite production for speed and quality

Skender launches an advanced manufacturing division. Katerra ups its bet on modular. Prefabrication comes to the rescue on multiple projects.

Architects | Aug 1, 2018

Client experience as competitive advantage for AEC firms

Clients are looking for solutions to their business problems from collaborative advisors. They’ve come to expect a higher level of service and detail than what was provided in the past.

Codes and Standards | Jul 31, 2018

Workers allegedly held in captivity by construction subcontractor in San Jose pay theft case

Contractor pays $250,000 in back wages in Dept. of Labor enforcement action.