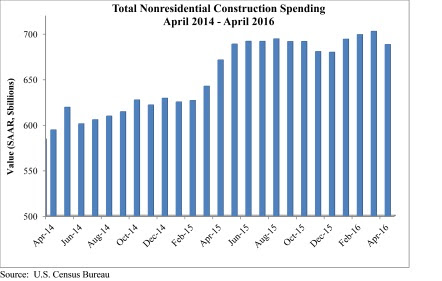

Nonresidential construction spending fell 2.1% in April according to analysis of U.S. Census Bureau data released by Associated Builders and Contractors (ABC). Nonresidential spending totaled $688.2 billion on a seasonally adjusted, annualized rate.

Much like last month, the sting of a disappointing headline number was mitigated by upward revisions to the previous two months of data. March's estimate was revised from $695.7 billion to $702.6 billion, while February's estimate saw a 0.1% increase. March represents the first month in which spending exceeded $700 billion since March 2009.

"Nonresidential construction spending growth continues to struggle to maintain momentum," said ABC Chief Economist Anirban Basu. "The amount of nonresidential construction value put in place has expanded by just 2.5% over the past year, with private spending up 3.4% and public spending up just 1.4%. While many will primarily attribute this to a sluggish U.S. economy, one that has expanded by less than 1.5% during each of the last two completed calendar quarters, there are other factors at work.

"Lower materials prices are embodied in the value of completed work," said Basu. "Though commodity prices have been firming recently, commodity prices had been in decline for more than a year. Moreover, in some communities, nonresidential construction is facing severe constraints given an insufficient number of qualified workers. Both factors would tend to constrain the level of observed growth in nonresidential construction spending.

"There may also be growing skittishness among private developers, who have become increasingly concerned by possible overbuilding in commercial, office and lodging markets," warned Basu. "Both lodging and commercial construction spending dipped in April. This hesitancy is reflected in many ways, including in the Architectural Billings Index, which has struggled to consistently stand meaningfully above its threshold value of 50. Public spending also remains lackluster as many states deal with underfunded pensions and ballooning Medicaid costs."

Only five of 16 nonresidential construction sectors experienced spending increases in April on a monthly basis:

- Religious-related spending expanded 9.6% from March 2016 and 7.3% from April 2015.

- Spending in the public safety category grew 5.2% on a monthly basis but fell 6.2% on a yearly basis.

- Office-related spending expanded 1.6% for the month and 20.3% for the year.

- Amusement and recreation-related spending expanded 0.8% month-over-month and 8.3% year-over-year.

- Spending in the power category rose by 0.3% for the month and 0.6% from April 2015.

Spending in 11 of the nonresidential construction subsectors fell in April on a monthly basis:

- Spending in the communication category fell 7.7% from March 2016 and is down 16.4% from April 2015.

- Highway and street-related spending fell 6.5% on a monthly basis but is up 4% on a yearly basis.

- Commercial-related spending dipped 3.7% for the month but is up 6.8% from April 2015.

- Spending in the health care category fell 3% from March 2016 and is down 0.6% from the same month one year ago.

- Educational-related spending dropped 2.4% month-over-month but is up 5.4% year-over-year.

- Spending in the lodging category fell 2% on a monthly basis but is up 24.6% on a yearly basis.

- Transportation-related spending fell 1.7% since March 2016 and is down 1% from April 2015.

- Sewage and waste disposal-related spending fell 1.4% for the month but is up 1% from April 2015.

- Manufacturing-related spending fell 1.4% month-over-month and 9.8% year-over-year.

- Spending in the conservation and development category dipped 1.2% for the month and 6.5% year-over-year.

- Water supply-related spending fell 0.5% on a monthly basis and 6.5% on a yearly basis.

Related Stories

Giants 400 | Dec 1, 2022

Top 40 Parking Structure Contractors + CM Firms for 2022

PCL Construction, Balfour Beatty, McCarthy Holdings, and Level 10 Construction top the ranking of the nation's largest parking structure contractors and construction management (CM) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report.

Contractors | Nov 30, 2022

Construction industry’s death rate hasn’t improved in 10 years

Fatal accidents in the construction industry have not improved over the past decade, “raising important questions about the effectiveness of OSHA and what it would take to save more lives,” according to an analysis by Construction Dive.

75 Top Building Products | Nov 30, 2022

75 top building products for 2022

Each year, the Building Design+Construction editorial team evaluates the vast universe of new and updated products, materials, and systems for the U.S. building design and construction market. The best-of-the-best products make up our annual 75 Top Products report.

K-12 Schools | Nov 30, 2022

School districts are prioritizing federal funds for air filtration, HVAC upgrades

U.S. school districts are widely planning to use funds from last year’s American Rescue Plan (ARP) to upgrade or improve air filtration and heating/cooling systems, according to a report from the Center for Green Schools at the U.S. Green Building Council. The report, “School Facilities Funding in the Pandemic,” says air filtration and HVAC upgrades are the top facility improvement choice for the 5,004 school districts included in the analysis.

Retail Centers | Nov 29, 2022

'Social' tenants play a vital role in the health of the retail center market

After a long Covid-induced period when the public avoided large gatherings, owners of malls and retail lifestyle centers are increasingly focused on attracting tenants that provide opportunities for socialization. Pent-up demand for experiences involving gatherings of people is fueling renovations and redesigns of large retail developments.

Giants 400 | Nov 28, 2022

Top 130 Office Sector Contractors and CM Firms for 2022

Turner Construction, STO Building Group, Gilbane, and CBRE top the ranking of the nation's largest office sector contractors and construction management (CM) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report.

Legislation | Nov 23, 2022

7 ways the Inflation Reduction Act will impact the building sector

HOK’s Anica Landreneau and Stephanie Miller and Smart Surfaces Coalition’s Greg Kats reveal multiple ways the IRA will benefit the built environment.

Multifamily Housing | Nov 22, 2022

10 compelling multifamily developments debut in 2022

A smart home tech-focused apartment complex in North Phoenix, Ariz., and a factory conversion to lofts in St. Louis highlight the notable multifamily developments to debut recently.

Industrial Facilities | Nov 16, 2022

Industrial building sector construction, while healthy, might also be flattening

For all the hoopla about the ecommerce boom and “last mile” order fulfillment driving demand for more warehouse and manufacturing space, construction of industrial buildings actually declined over the past five years, albeit marginally by 2.1% to $27.3 billion in 2022, according to estimates by IBIS World. Still, construction in this sector remains buzzy.

Wood | Nov 16, 2022

5 steps to using mass timber in multifamily housing

A design-assist approach can provide the most effective delivery method for multifamily housing projects using mass timber as the primary building element.