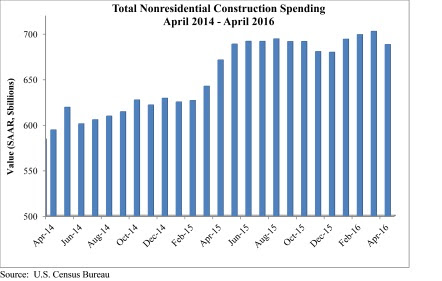

Nonresidential construction spending fell 2.1% in April according to analysis of U.S. Census Bureau data released by Associated Builders and Contractors (ABC). Nonresidential spending totaled $688.2 billion on a seasonally adjusted, annualized rate.

Much like last month, the sting of a disappointing headline number was mitigated by upward revisions to the previous two months of data. March's estimate was revised from $695.7 billion to $702.6 billion, while February's estimate saw a 0.1% increase. March represents the first month in which spending exceeded $700 billion since March 2009.

"Nonresidential construction spending growth continues to struggle to maintain momentum," said ABC Chief Economist Anirban Basu. "The amount of nonresidential construction value put in place has expanded by just 2.5% over the past year, with private spending up 3.4% and public spending up just 1.4%. While many will primarily attribute this to a sluggish U.S. economy, one that has expanded by less than 1.5% during each of the last two completed calendar quarters, there are other factors at work.

"Lower materials prices are embodied in the value of completed work," said Basu. "Though commodity prices have been firming recently, commodity prices had been in decline for more than a year. Moreover, in some communities, nonresidential construction is facing severe constraints given an insufficient number of qualified workers. Both factors would tend to constrain the level of observed growth in nonresidential construction spending.

"There may also be growing skittishness among private developers, who have become increasingly concerned by possible overbuilding in commercial, office and lodging markets," warned Basu. "Both lodging and commercial construction spending dipped in April. This hesitancy is reflected in many ways, including in the Architectural Billings Index, which has struggled to consistently stand meaningfully above its threshold value of 50. Public spending also remains lackluster as many states deal with underfunded pensions and ballooning Medicaid costs."

Only five of 16 nonresidential construction sectors experienced spending increases in April on a monthly basis:

- Religious-related spending expanded 9.6% from March 2016 and 7.3% from April 2015.

- Spending in the public safety category grew 5.2% on a monthly basis but fell 6.2% on a yearly basis.

- Office-related spending expanded 1.6% for the month and 20.3% for the year.

- Amusement and recreation-related spending expanded 0.8% month-over-month and 8.3% year-over-year.

- Spending in the power category rose by 0.3% for the month and 0.6% from April 2015.

Spending in 11 of the nonresidential construction subsectors fell in April on a monthly basis:

- Spending in the communication category fell 7.7% from March 2016 and is down 16.4% from April 2015.

- Highway and street-related spending fell 6.5% on a monthly basis but is up 4% on a yearly basis.

- Commercial-related spending dipped 3.7% for the month but is up 6.8% from April 2015.

- Spending in the health care category fell 3% from March 2016 and is down 0.6% from the same month one year ago.

- Educational-related spending dropped 2.4% month-over-month but is up 5.4% year-over-year.

- Spending in the lodging category fell 2% on a monthly basis but is up 24.6% on a yearly basis.

- Transportation-related spending fell 1.7% since March 2016 and is down 1% from April 2015.

- Sewage and waste disposal-related spending fell 1.4% for the month but is up 1% from April 2015.

- Manufacturing-related spending fell 1.4% month-over-month and 9.8% year-over-year.

- Spending in the conservation and development category dipped 1.2% for the month and 6.5% year-over-year.

- Water supply-related spending fell 0.5% on a monthly basis and 6.5% on a yearly basis.

Related Stories

Market Data | Apr 23, 2020

Construction Contractor Confidence plummets in February

As of February 2020, fewer than 30% of contractors expected their sales to increase over the next six months.

Market Data | Apr 23, 2020

5 must reads for the AEC industry today: April 23, 2020

The death of the department store and how to return to work when the time comes.

Market Data | Apr 22, 2020

6 must reads for the AEC industry today: April 22, 2020

Repurposed containers can be used as rapid response airborne infection isolation rooms and virtual site visits help control infection on project sites.

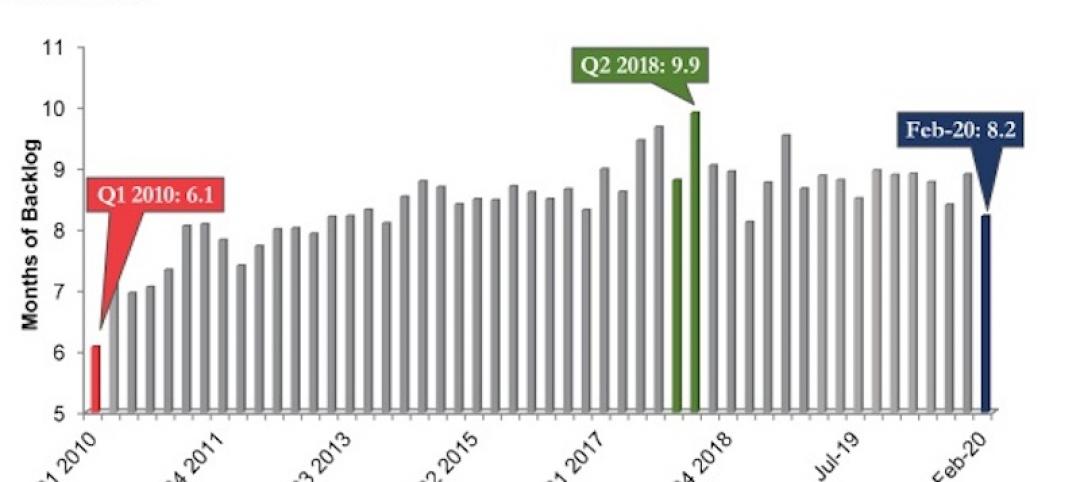

Market Data | Apr 21, 2020

ABC's Construction Backlog Indicator down in February

Backlog for firms working in the infrastructure segment rose by 1.3 months in February while backlog for commercial and institutional and heavy industrial firms declined by 0.6 months and 0.7 months, respectively.

Market Data | Apr 21, 2020

5 must reads for the AEC industry today: April 21, 2020

IoT system helps contractors keep their distance and the multifamily market flattens.

Market Data | Apr 20, 2020

6 must reads for the AEC industry today: April 20, 2020

The continent's tallest living wall and NMHC survey shows significant delays in apartment construction.

Market Data | Apr 17, 2020

Construction employment declines in 20 states and D.C. in March, in line with industry survey showing growing job losses for the sector

New monthly job loss data foreshadows more layoffs amid project cancellations and state cutbacks in road projects as association calls for more small business relief and immediate aid for highway funding.

Market Data | Apr 17, 2020

5 must reads for the AEC industry today: April 17, 2020

Meet the 'AEC outsiders' pushing the industry forward and the world's largest Living Building.

Market Data | Apr 16, 2020

5 must reads for the AEC industry today: April 16, 2020

The SMPS Foundation and Building Design+Construction are studying the impact of the coronavirus pandemic on the ability to attain and retain clients and conduct projects and Saks Fifth Avenue plans a sanitized post-coronavirus opening.

Market Data | Apr 15, 2020

5 must reads for the AEC industry today: April 15, 2020

Buildings as "open source platforms" and 3D printing finds its grove producing face shields.