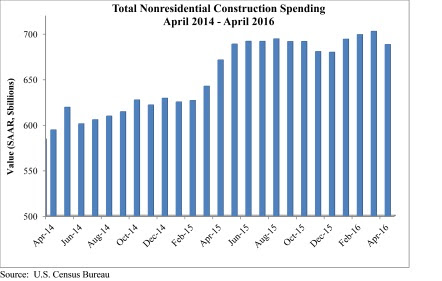

Nonresidential construction spending fell 2.1% in April according to analysis of U.S. Census Bureau data released by Associated Builders and Contractors (ABC). Nonresidential spending totaled $688.2 billion on a seasonally adjusted, annualized rate.

Much like last month, the sting of a disappointing headline number was mitigated by upward revisions to the previous two months of data. March's estimate was revised from $695.7 billion to $702.6 billion, while February's estimate saw a 0.1% increase. March represents the first month in which spending exceeded $700 billion since March 2009.

"Nonresidential construction spending growth continues to struggle to maintain momentum," said ABC Chief Economist Anirban Basu. "The amount of nonresidential construction value put in place has expanded by just 2.5% over the past year, with private spending up 3.4% and public spending up just 1.4%. While many will primarily attribute this to a sluggish U.S. economy, one that has expanded by less than 1.5% during each of the last two completed calendar quarters, there are other factors at work.

"Lower materials prices are embodied in the value of completed work," said Basu. "Though commodity prices have been firming recently, commodity prices had been in decline for more than a year. Moreover, in some communities, nonresidential construction is facing severe constraints given an insufficient number of qualified workers. Both factors would tend to constrain the level of observed growth in nonresidential construction spending.

"There may also be growing skittishness among private developers, who have become increasingly concerned by possible overbuilding in commercial, office and lodging markets," warned Basu. "Both lodging and commercial construction spending dipped in April. This hesitancy is reflected in many ways, including in the Architectural Billings Index, which has struggled to consistently stand meaningfully above its threshold value of 50. Public spending also remains lackluster as many states deal with underfunded pensions and ballooning Medicaid costs."

Only five of 16 nonresidential construction sectors experienced spending increases in April on a monthly basis:

- Religious-related spending expanded 9.6% from March 2016 and 7.3% from April 2015.

- Spending in the public safety category grew 5.2% on a monthly basis but fell 6.2% on a yearly basis.

- Office-related spending expanded 1.6% for the month and 20.3% for the year.

- Amusement and recreation-related spending expanded 0.8% month-over-month and 8.3% year-over-year.

- Spending in the power category rose by 0.3% for the month and 0.6% from April 2015.

Spending in 11 of the nonresidential construction subsectors fell in April on a monthly basis:

- Spending in the communication category fell 7.7% from March 2016 and is down 16.4% from April 2015.

- Highway and street-related spending fell 6.5% on a monthly basis but is up 4% on a yearly basis.

- Commercial-related spending dipped 3.7% for the month but is up 6.8% from April 2015.

- Spending in the health care category fell 3% from March 2016 and is down 0.6% from the same month one year ago.

- Educational-related spending dropped 2.4% month-over-month but is up 5.4% year-over-year.

- Spending in the lodging category fell 2% on a monthly basis but is up 24.6% on a yearly basis.

- Transportation-related spending fell 1.7% since March 2016 and is down 1% from April 2015.

- Sewage and waste disposal-related spending fell 1.4% for the month but is up 1% from April 2015.

- Manufacturing-related spending fell 1.4% month-over-month and 9.8% year-over-year.

- Spending in the conservation and development category dipped 1.2% for the month and 6.5% year-over-year.

- Water supply-related spending fell 0.5% on a monthly basis and 6.5% on a yearly basis.

Related Stories

Market Data | Feb 9, 2021

Construction Backlog and contractor optimism rise to start 2021, according to ABC member survey

Despite the monthly uptick, backlog is 0.9 months lower than in January 2020.

Market Data | Feb 9, 2021

USGBC top 10 states for LEED in 2020

The Top 10 States for LEED green building is based on gross square feet of certified space per person using 2010 U.S. Census data and includes commercial and institutional projects certified in 2020.

Market Data | Feb 8, 2021

Construction employment stalls in January with unemployment rate of 9.4%

New measures threaten to undermine recovery.

Market Data | Feb 4, 2021

Construction employment declined in 2020 in majority of metro areas

Houston-The Woodlands-Sugar Land and Brockton-Bridgewater-Easton, Mass. have worst 2020 losses, while Indianapolis-Carmel-Anderson, Ind. and Walla Walla, Wash. register largest gains in industry jobs.

Market Data | Feb 3, 2021

Construction spending diverges in December with slump in private nonresidential sector, mixed public work, and boom in homebuilding

Demand for nonresidential construction and public works will decline amid ongoing pandemic concerns.

Market Data | Feb 1, 2021

The New York City market is back on top and leads the U.S. hotel construction pipeline

New York City has the greatest number of projects under construction with 108 projects/19,439 rooms.

Market Data | Jan 29, 2021

Multifamily housing construction outlook soars in late 2020

Exceeds pre-COVID levels, reaching highest mark since 1st quarter 2018.

Market Data | Jan 29, 2021

The U.S. hotel construction pipeline stands at 5,216 projects/650,222 rooms at year-end 2020

At the end of Q4 ‘20, projects currently under construction stand at 1,487 projects/199,700 rooms.

Multifamily Housing | Jan 27, 2021

2021 multifamily housing outlook: Dallas, Miami, D.C., will lead apartment completions

In its latest outlook report for the multifamily rental market, Yardi Matrix outlined several reasons for hope for a solid recovery for the multifamily housing sector in 2021, especially during the second half of the year.

Market Data | Jan 26, 2021

Construction employment in December trails pre-pandemic levels in 34 states

Texas and Vermont have worst February-December losses while Virginia and Alabama add the most.