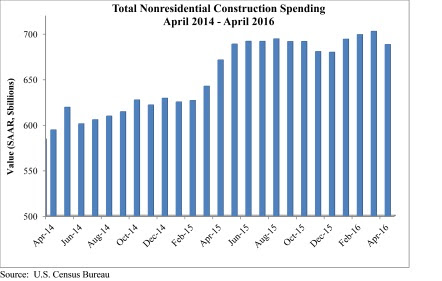

Nonresidential construction spending fell 2.1% in April according to analysis of U.S. Census Bureau data released by Associated Builders and Contractors (ABC). Nonresidential spending totaled $688.2 billion on a seasonally adjusted, annualized rate.

Much like last month, the sting of a disappointing headline number was mitigated by upward revisions to the previous two months of data. March's estimate was revised from $695.7 billion to $702.6 billion, while February's estimate saw a 0.1% increase. March represents the first month in which spending exceeded $700 billion since March 2009.

"Nonresidential construction spending growth continues to struggle to maintain momentum," said ABC Chief Economist Anirban Basu. "The amount of nonresidential construction value put in place has expanded by just 2.5% over the past year, with private spending up 3.4% and public spending up just 1.4%. While many will primarily attribute this to a sluggish U.S. economy, one that has expanded by less than 1.5% during each of the last two completed calendar quarters, there are other factors at work.

"Lower materials prices are embodied in the value of completed work," said Basu. "Though commodity prices have been firming recently, commodity prices had been in decline for more than a year. Moreover, in some communities, nonresidential construction is facing severe constraints given an insufficient number of qualified workers. Both factors would tend to constrain the level of observed growth in nonresidential construction spending.

"There may also be growing skittishness among private developers, who have become increasingly concerned by possible overbuilding in commercial, office and lodging markets," warned Basu. "Both lodging and commercial construction spending dipped in April. This hesitancy is reflected in many ways, including in the Architectural Billings Index, which has struggled to consistently stand meaningfully above its threshold value of 50. Public spending also remains lackluster as many states deal with underfunded pensions and ballooning Medicaid costs."

Only five of 16 nonresidential construction sectors experienced spending increases in April on a monthly basis:

- Religious-related spending expanded 9.6% from March 2016 and 7.3% from April 2015.

- Spending in the public safety category grew 5.2% on a monthly basis but fell 6.2% on a yearly basis.

- Office-related spending expanded 1.6% for the month and 20.3% for the year.

- Amusement and recreation-related spending expanded 0.8% month-over-month and 8.3% year-over-year.

- Spending in the power category rose by 0.3% for the month and 0.6% from April 2015.

Spending in 11 of the nonresidential construction subsectors fell in April on a monthly basis:

- Spending in the communication category fell 7.7% from March 2016 and is down 16.4% from April 2015.

- Highway and street-related spending fell 6.5% on a monthly basis but is up 4% on a yearly basis.

- Commercial-related spending dipped 3.7% for the month but is up 6.8% from April 2015.

- Spending in the health care category fell 3% from March 2016 and is down 0.6% from the same month one year ago.

- Educational-related spending dropped 2.4% month-over-month but is up 5.4% year-over-year.

- Spending in the lodging category fell 2% on a monthly basis but is up 24.6% on a yearly basis.

- Transportation-related spending fell 1.7% since March 2016 and is down 1% from April 2015.

- Sewage and waste disposal-related spending fell 1.4% for the month but is up 1% from April 2015.

- Manufacturing-related spending fell 1.4% month-over-month and 9.8% year-over-year.

- Spending in the conservation and development category dipped 1.2% for the month and 6.5% year-over-year.

- Water supply-related spending fell 0.5% on a monthly basis and 6.5% on a yearly basis.

Related Stories

Market Data | Aug 2, 2021

Nonresidential construction spending falls again in June

The fall was driven by a big drop in funding for highway and street construction and other public work.

Market Data | Jul 29, 2021

Outlook for construction spending improves with the upturn in the economy

The strongest design sector performers for the remainder of this year are expected to be health care facilities.

Market Data | Jul 29, 2021

Construction employment lags or matches pre-pandemic level in 101 metro areas despite housing boom

Eighty metro areas had lower construction employment in June 2021 than February 2020.

Market Data | Jul 28, 2021

Marriott has the largest construction pipeline of U.S. franchise companies in Q2‘21

472 new hotels with 59,034 rooms opened across the United States during the first half of 2021.

Market Data | Jul 27, 2021

New York leads the U.S. hotel construction pipeline at the close of Q2‘21

Many hotel owners, developers, and management groups have used the operational downtime, caused by COVID-19’s impact on operating performance, as an opportunity to upgrade and renovate their hotels and/or redefine their hotels with a brand conversion.

Market Data | Jul 26, 2021

U.S. construction pipeline continues along the road to recovery

During the first and second quarters of 2021, the U.S. opened 472 new hotels with 59,034 rooms.

Market Data | Jul 21, 2021

Architecture Billings Index robust growth continues

AIA’s Architecture Billings Index (ABI) score for June remained at an elevated level of 57.1.

Market Data | Jul 20, 2021

Multifamily proposal activity maintains sizzling pace in Q2

Condos hit record high as all multifamily properties benefit from recovery.

Market Data | Jul 19, 2021

Construction employment trails pre-pandemic level in 39 states

Supply chain challenges, rising materials prices undermine demand.

Market Data | Jul 15, 2021

Producer prices for construction materials and services soar 26% over 12 months

Contractors cope with supply hitches, weak demand.