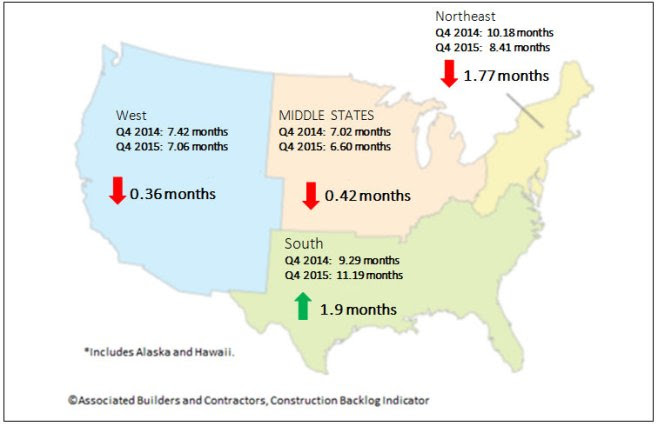

The South posted the highest backlog in the history of the Construction Backlog Indicator (CBI) in the fourth quarter of 2015, according to Associated Builders and Contractors (ABC).

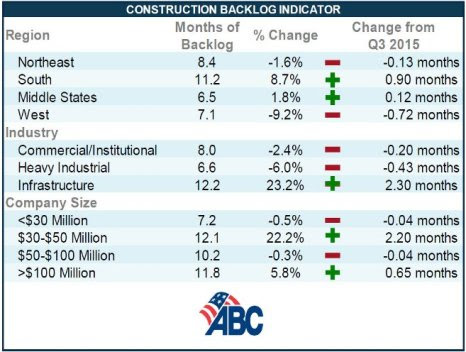

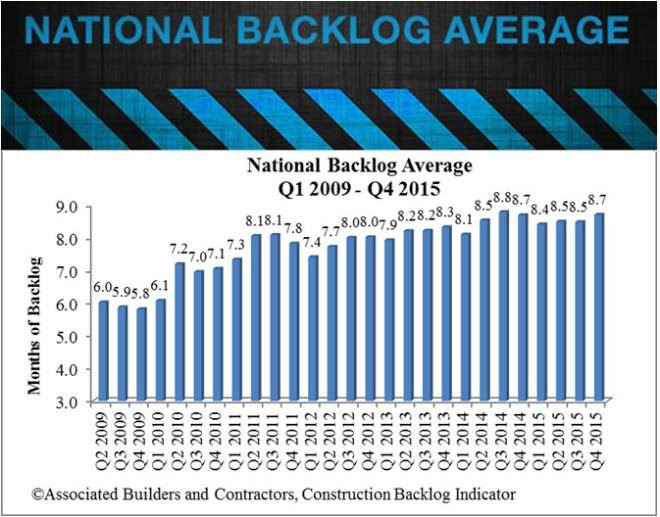

Nationally, backlog expanded by 2.7% to 8.7 months in the last three months of the year, with the South expanding on its previous record high reading by 8.7% to 11.19 months. In addition, infrastructure-related backlog expanded by 23.2% in the fourth quarter to 12.2 months.

"For the first time in years, some contractors are reporting that they are turning away work," ABC Chief Economist Anirban Basu said. "Skill-worker shortages are a frequently cited reason. The recent uptick in backlog suggests that demand for construction workers will remain elevated going forward, which will translate into faster wage growth, but also potentially rising costs and extended timelines.

"The nonresidential construction recovery remains very much in place," Basu said. "Despite disappointing news regarding global growth and corporate earnings, most contractors reported steady to rising backlog during 2015's final weeks. That's important to contractors, of course, but also to other economic stakeholders, since nonresidential construction spending growth has emerged as one of the nation's leading economic drivers.

"Nonresidential construction spending growth in January of 2016 was fully 12.3% its year-ago level," Basu said. "However, there were a number of months during the latter half of 2015 during which construction spending growth was soft. Accordingly, backlog expanded less rapidly during that period, including during the quarters that precede the fourth quarter's expansion."

For additional analysis click here.

Regional Highlights

- After a lull in backlog growth in Louisiana, several Louisiana contractors are reporting significant surges in backlog more recently. Louisiana is one of the nation's leading oil and natural gas suppliers. Some analysts have indicated that the state has been at risk of recession. But the ongoing expansion of the petrochemical sector as helped to rebuild backlog. Commercial activity has also begun to rebound in many communities.

- Backlog remains steady in the Northeast. The region has benefitted from stabilized federal government outlays, improving fiscal conditions in a handful of states and brisk commercial activity that is often linked to multifamily construction.

- Backlog in the West slipped during the year's initial quarter. There has been much speculation regarding excessively high technology company valuations. Many tech companies have expanded their physical capacity in recent years, and evidence suggests that this pace of expansion may have slowed somewhat. Still, backlog in the West remains above its level in the first half of 2015.

See Charts and Graphs.

Industry Highlights

- Backlog in the infrastructure category has reached an all-time high of 12.2 months. During the fourth quarter, backlog in this category increased by 2.3 months, a remarkable result and indicative of the quick impact of the newly passed federal highway spending bill – the first such bill to be passed in many years.

- Backlog in the heavy industrial category stands at 6.64 months, 6% lower than during the third quarter of 2015. This comes as little surprise as the nation's manufacturing sector sustained a 6% dip in exports last year. Additionally, the strong U.S. dollar has rendered imports more price competitive, suppressing domestic profit margins and construction.

- Backlog in the commercial/institutional category stands at more than 8 months. Backlog in this segment has stood at 8 months or better for 14 consecutive months, a reflection of the ongoing gradual economic recovery.

See Charts and Graphs.

Highlights by Company Size

- Backlog in the $30 million to $50 million annual revenue category now exceeds 12 months, the highest level in the history of this series. By contrast, average backlog during the fourth quarter of 2009 (six years ago) stood at 5.5 months.

- Backlog among the largest construction firms in the survey (+$100 million) expanded to 11.8 months during 2015's final quarter, the second highest level in the history of the series.

- Backlog in the $50 million to $100 million annual revenue category remains above 10 months and has been above that threshold during 12 of the last 14 quarters.

- Backlog among the smallest firms in the survey (>$30million) stood at 7.2 months during the four quarter, roughly the same as during the prior quarter. Backlog among this group of firms hardly changed over the course of 2015, though backlog presently is not as elevated on average as it was during in mid-2014.

See Charts and Graphs.

Related Stories

| Jan 7, 2011

How Building Teams Choose Roofing Systems

A roofing survey emailed to a representative sample of BD+C’s subscriber list revealed such key findings as: Respondents named metal (56%) and EPDM (50%) as the roofing systems they (or their firms) employed most in projects. Also, new construction and retrofits were fairly evenly split among respondents’ roofing-related projects over the last couple of years.

| Jan 7, 2011

Total construction to rise 5.1% in 2011

Total U.S. construction spending will increase 5.1% in 2011. The gain from the end of 2010 to the end of 2011 will be 10%. The biggest annual gain in 2011 will be 10% for new residential construction, far above the 2-3% gains in all other construction sectors.

| Jan 7, 2011

Mixed-Use on Steroids

Mixed-use development has been one of the few bright spots in real estate in the last few years. Successful mixed-use projects are almost always located in dense urban or suburban areas, usually close to public transportation. It’s a sign of the times that the residential component tends to be rental rather than for-sale.

| Jan 4, 2011

Product of the Week: Zinc cladding helps border crossing blend in with surroundings

Zinc panels provide natural-looking, durable cladding for an administrative building and toll canopies at the newly expanded Queenstown Plaza U.S.-Canada border crossing at the Niagara Gorge. Toronto’s Moriyama & Teshima Architects chose the zinc alloy panels for their ability to blend with the structures’ scenic surroundings, as well as for their low maintenance and sustainable qualities. The structures incorporate 14,000 sf of Rheinzink’s branded Angled Standing Seam and Reveal Panels in graphite gray.

| Jan 4, 2011

6 green building trends to watch in 2011

According to a report by New York-based JWT Intelligence, there are six key green building trends to watch in 2011, including: 3D printing, biomimicry, and more transparent and accurate green claims.

| Jan 4, 2011

LEED 2012: 10 changes you should know about

The USGBC is beginning its review and planning for the next version of LEED—LEED 2012. The draft version of LEED 2012 is currently in the first of at least two public comment periods, and it’s important to take a look at proposed changes to see the direction USGBC is taking, the plans they have for LEED, and—most importantly—how they affect you.

| Jan 4, 2011

California buildings: now even more efficient

New buildings in California must now be more sustainable under the state’s Green Building Standards Code, which took effect with the new year. CALGreen, the first statewide green building code in the country, requires new buildings to be more energy efficient, use less water, and emit fewer pollutants, among many other requirements. And they have the potential to affect LEED ratings.

| Jan 4, 2011

New Years resolutions for architects, urban planners, and real estate developers

Roger K. Lewis, an architect and a professor emeritus of architecture at the University of Maryland, writes in the Washington Post about New Years resolutions he proposes for anyone involved in influencing buildings and cities. Among his proposals: recycle and reuse aging or obsolete buildings instead of demolishing them; amend or eliminate out-of-date, obstructive, and overly complex zoning ordinances; and make all city and suburban streets safe for cyclists and pedestrians.

| Jan 4, 2011

An official bargain, White House loses $79 million in property value

One of the most famous office buildings in the world—and the official the residence of the President of the United States—is now worth only $251.6 million. At the top of the housing boom, the 132-room complex was valued at $331.5 million (still sounds like a bargain), according to Zillow, the online real estate marketplace. That reflects a decline in property value of about 24%.