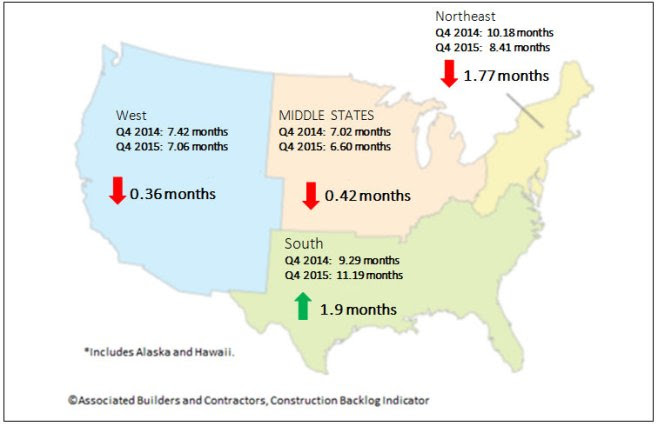

The South posted the highest backlog in the history of the Construction Backlog Indicator (CBI) in the fourth quarter of 2015, according to Associated Builders and Contractors (ABC).

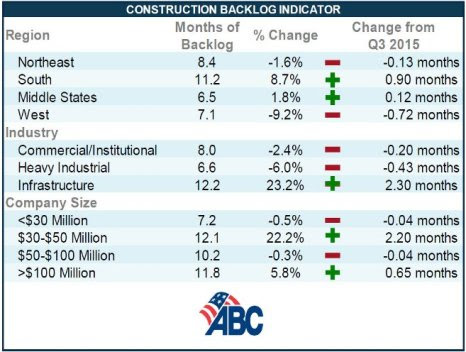

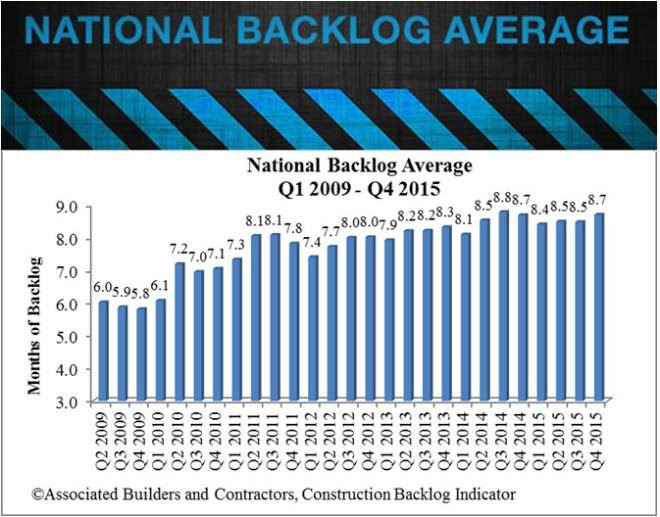

Nationally, backlog expanded by 2.7% to 8.7 months in the last three months of the year, with the South expanding on its previous record high reading by 8.7% to 11.19 months. In addition, infrastructure-related backlog expanded by 23.2% in the fourth quarter to 12.2 months.

"For the first time in years, some contractors are reporting that they are turning away work," ABC Chief Economist Anirban Basu said. "Skill-worker shortages are a frequently cited reason. The recent uptick in backlog suggests that demand for construction workers will remain elevated going forward, which will translate into faster wage growth, but also potentially rising costs and extended timelines.

"The nonresidential construction recovery remains very much in place," Basu said. "Despite disappointing news regarding global growth and corporate earnings, most contractors reported steady to rising backlog during 2015's final weeks. That's important to contractors, of course, but also to other economic stakeholders, since nonresidential construction spending growth has emerged as one of the nation's leading economic drivers.

"Nonresidential construction spending growth in January of 2016 was fully 12.3% its year-ago level," Basu said. "However, there were a number of months during the latter half of 2015 during which construction spending growth was soft. Accordingly, backlog expanded less rapidly during that period, including during the quarters that precede the fourth quarter's expansion."

For additional analysis click here.

Regional Highlights

- After a lull in backlog growth in Louisiana, several Louisiana contractors are reporting significant surges in backlog more recently. Louisiana is one of the nation's leading oil and natural gas suppliers. Some analysts have indicated that the state has been at risk of recession. But the ongoing expansion of the petrochemical sector as helped to rebuild backlog. Commercial activity has also begun to rebound in many communities.

- Backlog remains steady in the Northeast. The region has benefitted from stabilized federal government outlays, improving fiscal conditions in a handful of states and brisk commercial activity that is often linked to multifamily construction.

- Backlog in the West slipped during the year's initial quarter. There has been much speculation regarding excessively high technology company valuations. Many tech companies have expanded their physical capacity in recent years, and evidence suggests that this pace of expansion may have slowed somewhat. Still, backlog in the West remains above its level in the first half of 2015.

See Charts and Graphs.

Industry Highlights

- Backlog in the infrastructure category has reached an all-time high of 12.2 months. During the fourth quarter, backlog in this category increased by 2.3 months, a remarkable result and indicative of the quick impact of the newly passed federal highway spending bill – the first such bill to be passed in many years.

- Backlog in the heavy industrial category stands at 6.64 months, 6% lower than during the third quarter of 2015. This comes as little surprise as the nation's manufacturing sector sustained a 6% dip in exports last year. Additionally, the strong U.S. dollar has rendered imports more price competitive, suppressing domestic profit margins and construction.

- Backlog in the commercial/institutional category stands at more than 8 months. Backlog in this segment has stood at 8 months or better for 14 consecutive months, a reflection of the ongoing gradual economic recovery.

See Charts and Graphs.

Highlights by Company Size

- Backlog in the $30 million to $50 million annual revenue category now exceeds 12 months, the highest level in the history of this series. By contrast, average backlog during the fourth quarter of 2009 (six years ago) stood at 5.5 months.

- Backlog among the largest construction firms in the survey (+$100 million) expanded to 11.8 months during 2015's final quarter, the second highest level in the history of the series.

- Backlog in the $50 million to $100 million annual revenue category remains above 10 months and has been above that threshold during 12 of the last 14 quarters.

- Backlog among the smallest firms in the survey (>$30million) stood at 7.2 months during the four quarter, roughly the same as during the prior quarter. Backlog among this group of firms hardly changed over the course of 2015, though backlog presently is not as elevated on average as it was during in mid-2014.

See Charts and Graphs.

Related Stories

| Nov 29, 2011

Suffolk Construction breaks ground on Boston residential tower

Millennium Place III is a $220 million, 256-unit development that will occupy a full city block in Boston’s Downtown Crossing.

| Nov 29, 2011

Report finds credit crunch accounts for 20% of nation’s stalled projects

Persistent financing crunch continues to plague design and construction sector.

| Nov 29, 2011

SB Architects completes Mission Hills Volcanic Mineral Springs and Spa in China

Mission Hills Volcanic Mineral Springs and Spa is home to the largest natural springs reserve in the region, and measures 950,000 sf.

| Nov 29, 2011

Turner Construction establishes partnership with Clark Builders

Partnership advances growth in the Canadian marketplace.

| Nov 29, 2011

AIA launches stalled projects database

To populate this database with both stalled projects and investors interested in financing them, the AIA in the last week initiated a communications campaign to solicit information about stalled projects around the country from its members and allied professionals.

| Nov 28, 2011

Leo A Daly and McCarthy Building complete Casino Del Sol expansion in Tucson, Ariz.

Firms partner with Pascua Yaqui Tribe to bring new $130 million Hotel, Spa & Convention Center to the Tucson, Ariz., community.

| Nov 28, 2011

Armstrong acquires Simplex Ceilings

Simplex will become part of the Armstrong Building Products division.

| Nov 28, 2011

Nauset Construction completes addition for Franciscan Hospital for Children

The $6.5 million fast-track, urban design-build projectwas completed in just over 16 months in a highly sensitive, occupied and operational medical environment.

| Nov 23, 2011

Lord, Aeck & Sargent opens fourth U.S. office, acquiring architecture firm in Austin, Texas

Strategic move offers growth opportunity and strengthens the firm’s historic preservation portfolio.