The South posted the highest backlog in the history of the Construction Backlog Indicator (CBI) in the fourth quarter of 2015, according to Associated Builders and Contractors (ABC).

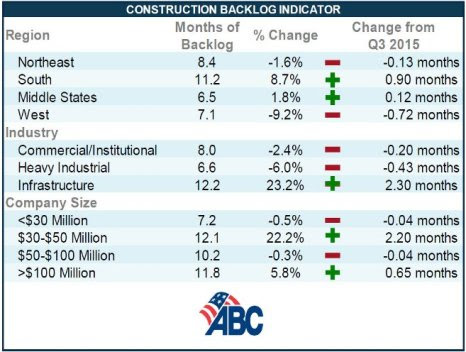

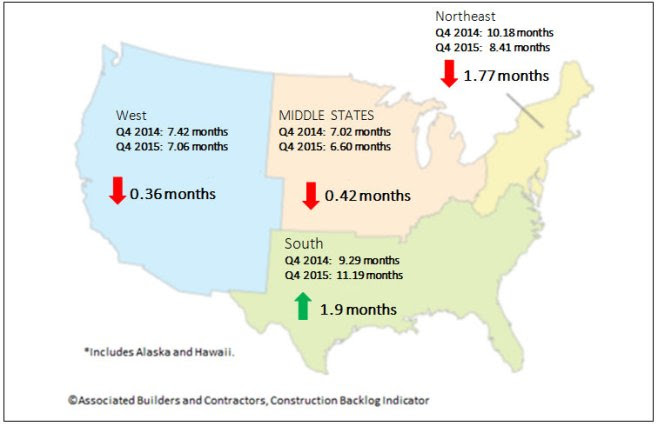

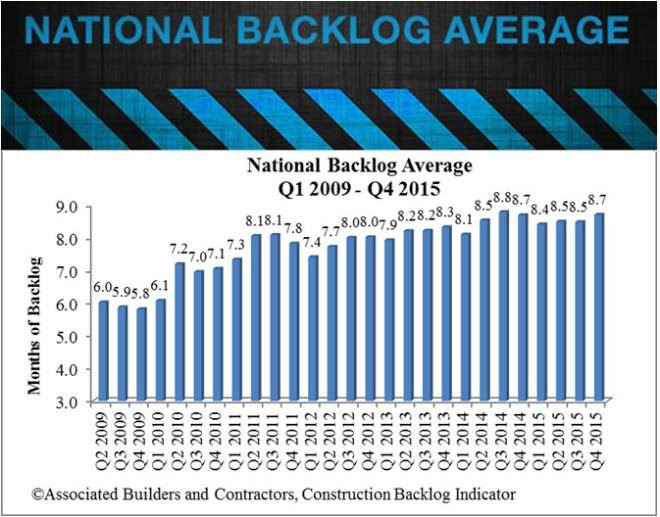

Nationally, backlog expanded by 2.7% to 8.7 months in the last three months of the year, with the South expanding on its previous record high reading by 8.7% to 11.19 months. In addition, infrastructure-related backlog expanded by 23.2% in the fourth quarter to 12.2 months.

"For the first time in years, some contractors are reporting that they are turning away work," ABC Chief Economist Anirban Basu said. "Skill-worker shortages are a frequently cited reason. The recent uptick in backlog suggests that demand for construction workers will remain elevated going forward, which will translate into faster wage growth, but also potentially rising costs and extended timelines.

"The nonresidential construction recovery remains very much in place," Basu said. "Despite disappointing news regarding global growth and corporate earnings, most contractors reported steady to rising backlog during 2015's final weeks. That's important to contractors, of course, but also to other economic stakeholders, since nonresidential construction spending growth has emerged as one of the nation's leading economic drivers.

"Nonresidential construction spending growth in January of 2016 was fully 12.3% its year-ago level," Basu said. "However, there were a number of months during the latter half of 2015 during which construction spending growth was soft. Accordingly, backlog expanded less rapidly during that period, including during the quarters that precede the fourth quarter's expansion."

For additional analysis click here.

Regional Highlights

- After a lull in backlog growth in Louisiana, several Louisiana contractors are reporting significant surges in backlog more recently. Louisiana is one of the nation's leading oil and natural gas suppliers. Some analysts have indicated that the state has been at risk of recession. But the ongoing expansion of the petrochemical sector as helped to rebuild backlog. Commercial activity has also begun to rebound in many communities.

- Backlog remains steady in the Northeast. The region has benefitted from stabilized federal government outlays, improving fiscal conditions in a handful of states and brisk commercial activity that is often linked to multifamily construction.

- Backlog in the West slipped during the year's initial quarter. There has been much speculation regarding excessively high technology company valuations. Many tech companies have expanded their physical capacity in recent years, and evidence suggests that this pace of expansion may have slowed somewhat. Still, backlog in the West remains above its level in the first half of 2015.

See Charts and Graphs.

Industry Highlights

- Backlog in the infrastructure category has reached an all-time high of 12.2 months. During the fourth quarter, backlog in this category increased by 2.3 months, a remarkable result and indicative of the quick impact of the newly passed federal highway spending bill – the first such bill to be passed in many years.

- Backlog in the heavy industrial category stands at 6.64 months, 6% lower than during the third quarter of 2015. This comes as little surprise as the nation's manufacturing sector sustained a 6% dip in exports last year. Additionally, the strong U.S. dollar has rendered imports more price competitive, suppressing domestic profit margins and construction.

- Backlog in the commercial/institutional category stands at more than 8 months. Backlog in this segment has stood at 8 months or better for 14 consecutive months, a reflection of the ongoing gradual economic recovery.

See Charts and Graphs.

Highlights by Company Size

- Backlog in the $30 million to $50 million annual revenue category now exceeds 12 months, the highest level in the history of this series. By contrast, average backlog during the fourth quarter of 2009 (six years ago) stood at 5.5 months.

- Backlog among the largest construction firms in the survey (+$100 million) expanded to 11.8 months during 2015's final quarter, the second highest level in the history of the series.

- Backlog in the $50 million to $100 million annual revenue category remains above 10 months and has been above that threshold during 12 of the last 14 quarters.

- Backlog among the smallest firms in the survey (>$30million) stood at 7.2 months during the four quarter, roughly the same as during the prior quarter. Backlog among this group of firms hardly changed over the course of 2015, though backlog presently is not as elevated on average as it was during in mid-2014.

See Charts and Graphs.

Related Stories

Codes and Standards | Mar 25, 2016

OSHA finalizes new silica dust regulations

Construction industry has until June 2017 to comply.

Market Data | Mar 1, 2016

ABC: Nonresidential spending regains momentum in January

Nonresidential construction spending expanded 2.5% on a monthly basis and 12.3% on a yearly basis, totaling $701.9 billion. Spending increased in January in 10 of 16 nonresidential construction sectors.

Market Data | Mar 1, 2016

Leopardo releases 2016 Construction Economics Report

This year’s report shows that spending in 2015 reached the highest level since the Great Recession. Total spending on U.S. construction grew 10.5% to $1.1 trillion, the largest year-over-year gain since 2007.

Market Data | Feb 26, 2016

JLL upbeat about construction through 2016

Its latest report cautions about ongoing cost increases related to finding skilled laborers.

Contractors | Feb 25, 2016

Huntsville’s Botanical Garden starts work on new Guest Welcome Center

The 30,000-sf facility will feature three rental spaces of varying sizes.

Architects | Feb 24, 2016

Is the booming freelance economy a threat to AEC firms?

By shifting the work (and revenue) to freelancers, “platform capitalism” startups have taken considerable market share from traditional businesses.

Religious Facilities | Feb 22, 2016

For the first time in Bulgaria, a temple’s construction raises a metal dome

The church is 2½ times larger than the basilica in Ukraine it references.

Market Data | Feb 10, 2016

Nonresidential building starts and spending should see solid gains in 2016: Gilbane report

But finding skilled workers continues to be a problem and could inflate a project's costs.

Contractors | Feb 2, 2016

ABC: Nonresidential spending falls again in December

For a second consecutive month, 12 of 16 nonresidential subsectors experienced spending decreases on a monthly basis.

Contractors | Feb 1, 2016

ABC: Tepid GDP growth a sign construction spending may sputter

Though the economy did not have a strong ending to 2015, the data does not suggest that nonresidential construction spending is set to decline.