Associated Builders and Contractors (ABC) Chief Economist Anirban Basu predicts stability for the construction industry’s economy and expanding nonresidential construction spending in 2018. While construction project backlog and contractor confidence remain high heading into the new year, Basu warns there are risks to the 2018 outlook as a number of potential cost increases could come into play.

“With wage pressures building, healthcare costs surging and fuel prices edging higher, inflation is becoming more apparent,” Basu said. “That could translate into some meaningful interest rate increases in 2018, which all things being equal is not good for construction spending. The stock market’s performance has been simply brilliant. But what goes up can go down.”

Basu added that asset prices might head in a different direction in 2018, including commercial real estate prices. Segments like hotels, office buildings and apartments have helped to fuel construction spending in recent years. If the value of properties begins to stagnate or worse, construction spending momentum will eventually wind down. The impact of this may not be felt in 2018, however, but in out years, Basu said.

“For now, there is plentiful momentum,” said Basu. “A recent reading of the Conference Board’s Index of Leading Economic Indicators suggests that the U.S. economy will enter 2018 with substantial momentum. Corporate earnings remain healthy. Global growth is accelerating. Consumers are upbeat. Tax cuts could fuel faster business spending. All of this suggests that the construction recovery that began in earnest in 2011 may have a few more birthdays ahead.”

Read Basu’s full 2018 construction economic forecast in Construction Executive magazine. You can also listen to Basu talk about his forecast in a recent webinar.

Visit ABC Construction Economics for the Construction Backlog Indicator, Construction Confidence Index and state unemployment reports, plus analysis of spending, employment, GDP and the Producer Price Index.

Related Stories

Building Team | Jun 17, 2022

Data analytics in design and construction: from confusion to clarity and the data-driven future

Data helps virtual design and construction (VDC) teams predict project risks and navigate change, which is especially vital in today’s fluctuating construction environment.

Market Data | Jun 15, 2022

ABC’s construction backlog rises in May; contractor confidence falters

Associated Builders and Contractors reports today that its Construction Backlog Indicator increased to nine months in May from 8.8 months in April, according to an ABC member survey conducted May 17 to June 3. The reading is up one month from May 2021.

Market Data | May 18, 2022

Architecture Billings Index moderates slightly, remains strong

For the fifteenth consecutive month architecture firms reported increasing demand for design services in April, according to a new report today from The American Institute of Architects (AIA).

Market Data | May 12, 2022

Monthly construction input prices increase in April

Construction input prices increased 0.8% in April compared to the previous month, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics’ Producer Price Index data released today.

Market Data | May 10, 2022

Hybrid work could result in 20% less demand for office space

Global office demand could drop by between 10% and 20% as companies continue to develop policies around hybrid work arrangements, a Barclays analyst recently stated on CNBC.

Market Data | May 6, 2022

Nonresidential construction spending down 1% in March

National nonresidential construction spending was down 0.8% in March, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau.

Market Data | Apr 29, 2022

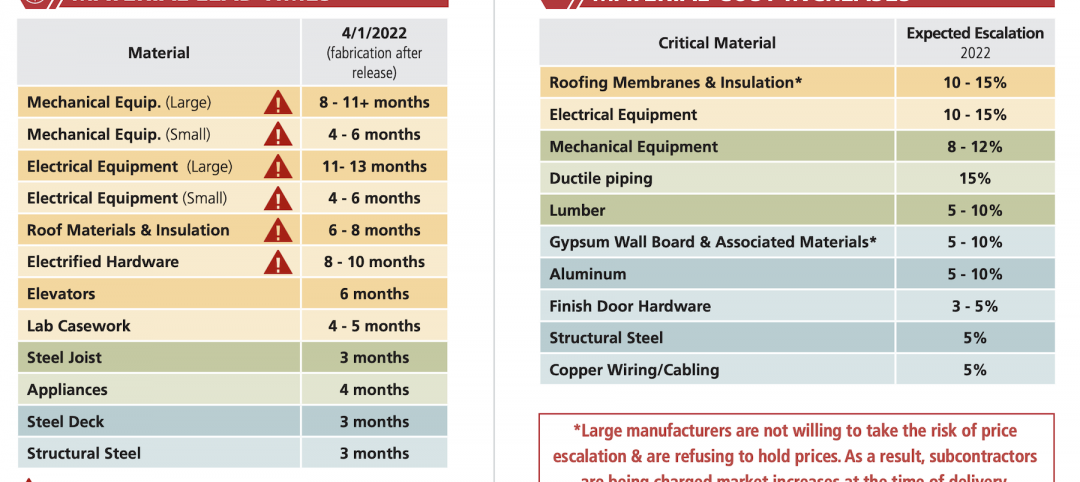

Global forces push construction prices higher

Consigli’s latest forecast predicts high single-digit increases for this year.

Market Data | Apr 29, 2022

U.S. economy contracts, investment in structures down, says ABC

The U.S. economy contracted at a 1.4% annualized rate during the first quarter of 2022.

Market Data | Apr 20, 2022

Pace of demand for design services rapidly accelerates

Demand for design services in March expanded sharply from February according to a new report today from The American Institute of Architects (AIA).

Market Data | Apr 14, 2022

FMI 2022 construction spending forecast: 7% growth despite economic turmoil

Growth will be offset by inflation, supply chain snarls, a shortage of workers, project delays, and economic turmoil caused by international events such as the Russia-Ukraine war.