7 key predictions for the 2024 multifamily rental housing market

The rental market has been on a roller coaster in recent years, with abrupt swings in demand and supply, changing preferences, and shifts in where renters choose to call home. As we head into 2024, the question on everyone's mind is: Where is this wild ride headed next?

In this report, the Apartment List Economics Team takes a look back at how the market evolved in 2023 and outlines the key trends that we expect to see in the year ahead.

2023 Lookback – The rental market takes a breather

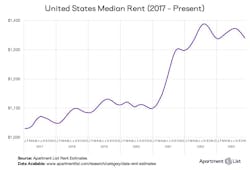

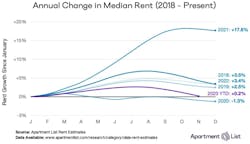

The once red-hot rental market has now definitively cooled. After rents rocketed up in 2021 and early 2022, the dominant theme of 2023 was a rental market cooldown: year-over-year rent growth nationally has plummeted from a peak of 18% to its current level of negative 1.1%, meaning the national median rent today is slightly lower than it was one year ago.

Year-over-year growth has now been in negative territory for the past six months, the first time that this metric has fallen below zero since the early pandemic. The recent dip has not come close to erasing the gains of prior years – the national median rent is still 20% higher than it was at the onset of the pandemic – but it does signal that the market is taking a breather.

What stalled the boom? Stagnating household formation in response to higher housing costs, inflation, and ongoing concerns about the economy. But weak rent growth has been equally rooted in the supply side of the market. We’re in the midst of a historic multifamily construction boom, and as softening demand collided with increasing supply, our national vacancy index continued to ease in 2023 and recently stabilized at 6.4%, slightly higher than the 2019 average. The key takeaway? The blistering rental surge has cooled for now thanks to easing demand and rising supply.

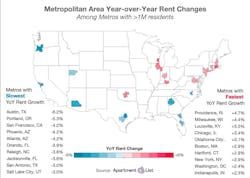

The 2023 rental market cooldown has spread far and wide: more than two-thirds of the nation’s 100 largest cities are currently logging negative year-over-year growth, and 83 of these cities experienced slower rent growth in 2023 than they did in 2022.

At the metro level, Austin saw the nation’s sharpest rent decline over the past 12 months (-6%), likely owing largely to new supply – the area has permitted the most new housing units per capita among large metros in recent years. The other metros where rents have fallen fastest largely consist of markets that saw some of the biggest booms in recent years, where the pendulum is now swinging back slightly in the other direction. One notable exception is San Francisco, where rents have yet to recover from sharp declines in 2020.

At the other end of the spectrum, Providence, R.I., logged the nation’s fastest rent growth in 2023 (+5%), likely driven by a surge of interest from renters looking for a more affordable alternative to nearby Boston. The continued prevalence of hybrid work arrangements is likely to continue driving interest to smaller and more affordable markets on the peripheries of major job centers. The other markets with the fastest rent growth are mostly scattered throughout the Northeast and Midwest. It’s worth noting, though, that even the fastest rent growth of 2023 has still been quite modest by the standards of recent years.

Here are 7 key predictions that we think will shape the 2024 multifamily rental sector

#1 - 2024 will bring the most new apartments in decades.

Construction data from the Census Bureau suggests that multifamily supply growth should remain strong through 2024. The number of new multifamily apartment units under construction hit one million for the first time ever in 2023, and completions are expected to peak in 2024. With so many units in the construction pipeline, 2024 should be the strongest year for new multifamily supply since the 1980s.

That said, the supply surge won’t be indefinite. Developers are already responding to the higher interest rate environment that we’re in now; new building permits have been falling for over a year and construction starts are following suit. But because of the lengthy development cycle of multifamily projects, this slowdown won’t be reflected in apartment completions until 2025. In 2024, multifamily operators should brace for swelling competition from new inventory, and renters should expect to find more options when searching for their next home.

#2 – Expect low single-digit rent growth in 2024.

2023 is set to have the second slowest rent growth of any year in the history of our estimates (going back to 2017), coming ahead of only 2020. Looking ahead to 2024, we expect demand to bounce back slightly, but remain on the soft side. The labor market remains fairly strong and there is likely some pent-up demand for new household formation. However, affordability continues to be a major concern and sentiment data shows that Americans still lack confidence in the economy.

Even in the most bullish scenario, it’s unlikely that demand will be strong enough to outstrip all of the new supply that we know is coming, likely resulting in our vacancy index rising modestly from its current level in 2024. We expect that rent growth will rise out of negative territory early next year, but that it won’t get above the low single digits in 2024.

#3 – The changing rent vs. buy math will create more long-term renters.

Multifamily demand likely won’t boom next year, but systemic barriers to homeownership will persist as a tailwind supporting rental demand. The combination of record-high prices and spiking mortgage rates has caused existing home sales to grind to a standstill. Few prospective buyers can afford to buy in today’s market, and current owners who are locked into low mortgage rates don’t want to sell. As a result, many families are remaining renters longer than they may have in the past.

Even those who can afford to buy in today’s market may find that renting now actually makes more financial sense. Although most Americans still aspire to own homes, more are now finding themselves renting later in life, and that trend is likely to continue. Consensus expectations are that mortgage rates will ease modestly next year, but likely not enough to significantly alter the prevailing dynamics of the for-sale market. As paths to homeownership fade for many, renting will increasingly be seen as the more practical housing option.

#4 – Hybrid work will cement itself as the new norm for office jobs.

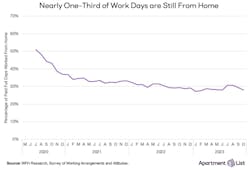

In 2023, the remote work narrative focused on return-to-office plans, but this focus obscures the fact the pendulum will never swing fully back to the pre-pandemic norm. According to the latest estimates, 28% of all work days are still from home, and that figure appears to be stabilizing at that level. 42% of American workers currently have some form of remote work flexibility, and hybrid arrangements are much more common than fully remote ones.

Hybrid workers present an opportunity for operators to meet new needs of high-earning and highly mobile renters. With many homes continuing to serve double duty as workplaces, renters will have an increasing demand for spare bedrooms and shared workspaces within multifamily communities. Communities that lie further from major job centers may also see growing demand, as renters are willing to bear longer commutes when those commutes are occurring less frequently. The data shows that hybrid work is here to stay, driving demand for rentals that provide spaces and amenities that blend work and home life for today's flexible workforce.

#5 – Sun Belt markets will see more renters, but not necessarily higher rents.

The nation’s fastest population growth in recent years has been taking place throughout the Sun Belt. Major markets in Texas and Florida in particular have seen their populations swell. In some cases, this has led to corresponding spikes in rent prices – the Miami, Tampa, and Orlando metros, for example, have all seen rents increase by 30% or more over the past three years. But in many cases, Sun Belt markets have also been among the most accommodating of growth, allowing for new housing development to meet the growing demand.

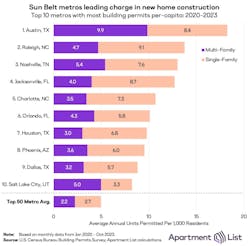

From 2020 to 2023, the Austin metro has permitted by far the most new housing units per-capita, and the top 10 is dominated by Sun Belt metros, especially those in Texas, Florida, and North Carolina. In 2024, many of the projects that were permitted in recent years will reach completion, adding significant new housing supply to these markets. We expect that these units will largely get absorbed. The Sun Belt region is poised to see ongoing strong demand, particularly as millennials continue to age into a phase of life where they seek out areas that offer more space and more accessible homeownership opportunities. But whereas in the past, rapid population growth has brought with it rising rents, the latter should be offset in 2024 by new supply. This has already started to play out in Austin, where rent prices are falling at the fastest pace in the nation even as the population continues to grow. The key takeaway: fast-growing Sun Belt markets will continue to be renter magnets, but rent growth should be kept in check thanks to lots multfamily development.

#6 – Presidential candidates will need to speak to housing concerns.

As we head into a presidential election year, the question of whether the economy is good or bad has proven to be surprisingly complicated. Most of the key indicators of economic health are looking quite strong, but economic sentiment surveys show that confidence and satisfaction in the economy remain weak. It’s likely that at least some of this disconnect is being driven by waning housing affordability. Even as inflation abates and wages rise, a growing share of renters are burdened by their housing costs, and homeownership – which has long been the primary engine of wealth creation for American households – feels increasingly out of reach.

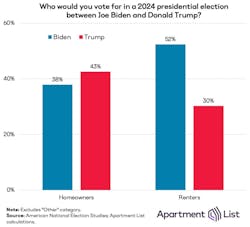

The Biden administration has responded to the growing housing affordability crisis by outlining a series of actions aimed at boosting housing supply and creating more affordable housing options. And YIMBY zoning reforms aimed at boosting housing supply have proven to be a rare example of a cause that has gained traction across the political spectrum. We’ve previously argued that renters have the potential to swing elections if candidates can effectively rally them by speaking to their unique economic needs. Historically, renters have strongly favored democrats, and in hypothetical 2024 rematch between President Biden and former President Trump, renters favored president Biden by a margin of 22 percentage points. As the election cycle continues to ramp up, candidates on both sides of the aisle will need to articulate housing plans and speak to what has become one of the most pressing concerns of the American electorate. 2024 could be the year where housing rises to the forefront of the political discourse.

#7 – More renters will use AI in their searches.

2023 will likely be remembered as the year when generative AI went mainstream, with ChatGPT and related technologies making ubiquitous headlines. In the rental market, these tools have already dramatically changed the way property managers operate, advertise, and communicate with renters. While these technologies will continue to develop, we expect 2024 to bring a new wave of AI-powered tools specifically for renters. It will soon become commonplace for renters to use AI in their apartment searches to search, compare, and coordinate actions. It will take time for these advancements to change macro market dynamics, but the next high-demand rental market cycle may look quite different with new power in renter’s pockets. And as adoption of AI-enabled rental search tools accelerates into 2024, both renters and property managers can seize opportunities from this new technological frontier.

Twists and turns coming in 2024

2024 is certain to bring twists and turns no model can predict, as the new year always does. But we hope that by forewarning of what’s foreseeable—from new supply waves to persistent homeownership headwinds bolstering rental demand—we can help you prepare for what is ahead.

ABOUT THE AUTHOR

Igor Popov is the Chief Economist at Apartment List.