The growth in demand for multifamily housing has been nothing short of astounding over the past several years. And that demand is expected to keep growing in line with shifting lifestyles throughout America.

But as the economy improves, will single-family homeownership once again regain its appeal, especially among younger, more mobile adults? And will pricing of luxury condos and apartments, which has been driving construction of late, reach a point of diminishing return sooner than later.

Byron Carlock, Jr., U.S. real estate practice leader for the consulting firm PwC, expects demand to remain steady, but to soften a bit for higher-priced products. In an interview with the National Real Estate Investor, Carlock, who is a member of the Urban Land Institute and a board member Emeritus at Harvard Business School, shares five predictions about where he thinks the multifamily sector is headed in 2015.

Here’s a look at those predictions, viewed within a larger context of related market factors.

1. Millennials will jump into the housing market, eventually. Student debt now exceeds $1.1 trillion. The Institute for College Access & Success released a report last November that found, in 2013, seven in 10 graduating seniors at public and private nonprofit colleges had student debt that averaged $28,400. Graduate school can tack on another $18,000 to $60,000 per year, depending on the specialty or discipline. So it’s not surprising that more than 31% of adults ages 18 through 34 were living with their parents in 2014, according to an analysis of Census data by the real estate website Trulia (www.trulia.com).

Carlock concedes these circumstances, along with a sluggish job market, have kept 29 million young adults from buying or renting a home. Nevertheless, he predicts, somewhat cautiously, that Millennials will move out and start their own households “over the coming years as the economy’s slow recovery continues.”

2. Affordability will continue to constrain household formation. Home prices keep rising. The median price for a new home increased in 2014 by 5.5% to $283,000. Last December, the median existing home price stood at $210,200, or 6.3% more than the same month a year earlier, according to Census Bureau and National Association of Realtor estimates. And for the fifth consecutive year, rents jumped in 2014, by 3.6% to an average monthly lease rate of $1,124.38, which represented the highest rate since Reis, the real estate research firm, started tracking rents in 1980. Vacancy rates, at 4.2% last year, were the lowest they’ve been since 2000.

Carlock foresees an ongoing shortage of affordable multifamily housing units, and he certainly isn’t alone in that assessment. The National Association of Home Builders recently predicted only a 1.7% increase in multifamily starts in 2015, and a 0.8% increase in 2016, in anticipation of the multifamily sector reaching its supply-demand equilibrium.

The vast majority of multifamily development and construction of late has been for rental apartments. And much of what’s being built targets affluent customers, many of them from outside the U.S. That leads to Carlock’s next prediction:

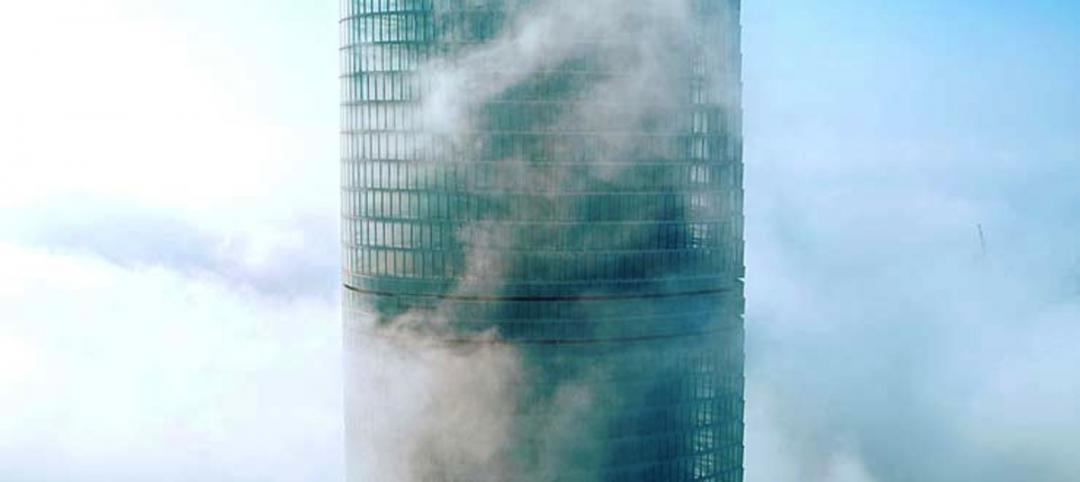

3. Foreign buyers can’t sustain the luxury market forever. The New York Times recently quoted Corcoran Sunshine Marketing Group, which estimates that twice as many new condominiums will be available in Manhattan—6,500 in 100 buildings—as there were in 2014, and the most since 2007. Half of those units will be in the middle luxury range, with prices between $1,700 and $2,300 per sf; about 500 new condos will be priced at $5,000 per sf or more.

In a recent column, CNBC’s real estate commentator Diane Olick points out that a 504-unit apartment building in Chicago that had sold for $328 million was renting apartment units for between $1,700 and $12,000 per month.

Carlock joins a host of market observers who say that selling price and rent appreciation at the luxury end of the multifamily spectrum is the result of wealthy foreign buyers who are making investments as much as purchasing living spaces. However, he cautions “questions are emerging as to the depth of that buying community.” Indeed, Bloomberg Businessweek reported in late January that luxury condos are sitting unsold much longer in New York, Chicago, and Los Angeles because a strengthening U.S. dollar is eroding foreigners’ purchasing power.

4. Multifamily will continue to offer lifestyle flexibility. It is well established that multifamily housing has two primary customer targets: Millennials and aging Baby Boomers, each with different preferences and needs. For Millennials, multifamily—especially smallish rental apartments—offers a way to live closer to their jobs in urban cores that is more financially feasible than owning a home (the downpayment for which they couldn’t afford, anyway). For older baby boomers, moving into multifamily housing is often part and parcel with downsizing after children move out of the nest, and seeking maintenance-free living.

The “walkability” factor unites these groups, as both like multifamily most when it’s near retail, restaurants, grocery, and entertainment. “Multifamily housing will continue to provide greater flexibility and mobility, and be deemed more convenient by those seeking to simply their lifestyle, downsize, or maintain locational flexibility due to job or family issues,” states Carlock. That comment blends naturally into another of his predictions:

5. Multifamily demand will continue to increase with urbanization trends. Eighty percent of the U.S. population now lives in urban areas. And Millennials currently live in urban areas at a higher rate than any other generation, according to Nielsen research. But it’s an open question as to whether urban living is simply expedient or a life-long preference for Millennials.

The Demand Institute recently polled 1,000 18- to 29-year-olds. Using their responses, the Institute extrapolates that this cohort would spend $1.6 trillion on home purchases and $600 billion on rent in the years 2014 through 2018. Over that period, many will marry and start families, which will be a key factor in where they decide to live. And 48% of those polled said their next home would be in the suburbs, and one-third expects to purchase a single-family home.

Related Stories

Multifamily Housing | May 30, 2015

Energy Department releases resources to assess building energy benchmarking policies, programs

The new handbook demonstrates methodologies using real data from New York City.

Multifamily Housing | May 28, 2015

Census Bureau: 10 U.S. cities now have one million people or more

California and Texas each have three of the one-million-plus cities.

Multifamily Housing | May 27, 2015

‘European’ living comes to The Woodlands with its first condo tower

Treviso at Waterway Square will offer a dynamic downtown setting with numerous live/work/play options.

Multifamily Housing | May 19, 2015

Zaha Hadid unveils 'interlocking lattice' design for luxury apartments in Monterrey, Mexico

Hadid's scheme was inspired by the Mexican tradition of interlocking lattice geometries.

Multifamily Housing | May 19, 2015

Study: Urban land use policies costs U.S. economy $1.6 trillion a year

The research contends that more affordable housing options can help cities generate significantly more income.

Multifamily Housing | May 17, 2015

New York City runs into affordable housing dilemma

New York City’s affordable housing policy has created attractive low-cost housing, but the price of success has been high.

Sponsored | Coatings | May 14, 2015

Prismatic coatings accent the new Altara Center

This multi-use campus will contain a university, sports facilities, medical center, and world-class shopping

High-rise Construction | May 6, 2015

Two new designs submitted for New York City Riverside Center

Both designs reference the cantilevers and other elements featured in architect Christian de Portzamparc’s original masterplan for the complex, which has now been scrapped.

High-rise Construction | May 6, 2015

Parks in the sky? Subterranean bike paths? Meet the livable city, designed in 3D

Today’s great cities must be resilient—and open—to many things, including the influx of humanity, writes Gensler co-CEO Andy Cohen.

Mixed-Use | May 5, 2015

Miami ‘innovation district’ will have 6.5 million sf of dense, walkable space

Designing a neighborhood from the ground-up, developers aim to create a dense, walkable district that fulfills what is lacking from Miami’s current auto-dependent layout.